On July 3, 2025, Aeries Technology Inc (AERT, Financial) released its 8-K filing, detailing its fiscal year 2025 earnings. Aeries Technology Inc is a professional and management services partner that offers a range of management consultancy services for private equity sponsors and their portfolio companies. The company focuses on building and managing Global Capability Centers (GCCs) to optimize and transform business operations globally.

Performance and Challenges

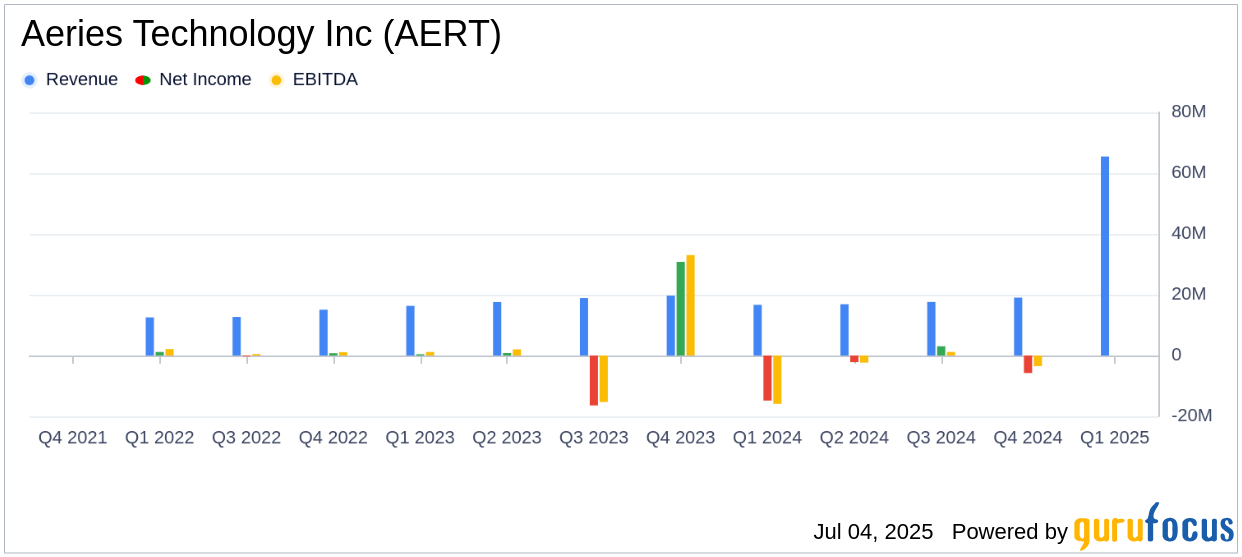

Aeries Technology Inc (AERT, Financial) reported a significant increase in North American revenue, which rose by 15% year-over-year to $65.5 million, now accounting for 93.3% of the total revenue mix. Despite this growth, the company faced challenges, including an operating loss of $(28.8) million and a net loss of $(21.6) million. These losses were primarily attributed to one-time line items that are not expected to recur in 2026, including a $12.0 million loss from non-core business activities and a $12.7 million stock-based compensation expense related to a one-time issuance from the deSPAC process.

Financial Achievements

A key highlight from the earnings report is the Core Adjusted EBITDA of $7.4 million, which exceeded the company's prior guidance range. This achievement underscores the company's strategic focus on its core business, which involves providing GCC services to private equity-backed companies, primarily in North America. This focus is crucial for Aeries Technology Inc (AERT, Financial) as it aims to generate the majority of its revenue from long-term, recurring contracts in its core business.

Key Financial Metrics

The company's Adjusted EBITDA was reported at $(4.7) million. The distinction between Adjusted EBITDA and Core Adjusted EBITDA is significant, as the latter excludes EBITDA from non-core business activities, which have been a drag on overall performance. These metrics are vital for evaluating the company's operating performance and making informed financial and strategic decisions.

“FY2025 was a pivotal year for Aeries,” said Chief Executive Officer Ajay Khare. “We made intentional decisions to sharpen our strategy and focus. That meant doubling down on our core business—helping Private Equity-backed companies with a presence in North America build and scale Global Capability Centers (GCCs)—and stepping away from lower-value, non-core geographies.”

Analysis and Outlook

Aeries Technology Inc (AERT, Financial) has reaffirmed its fiscal 2026 outlook, emphasizing its AI-Centric Global Capability Center strategy. The company has exited non-core geographies, such as the Middle East consulting markets, and completed all associated write-offs, significantly tightening its cost structure. This strategic shift is expected to enhance profitability and drive growth in the coming years.

“We believe 2026 is on track to be our best year yet. We’re seeing strong traction with new clients and our cost structure is now leaner. AI-led transformation is gaining pace, and our modular agents are already active in client environments,” added Chief Financial and Investment Officer Daniel Webb.

Overall, Aeries Technology Inc (AERT, Financial) is poised for a promising future as it continues to focus on its core business and leverage its expertise in building and scaling Global Capability Centers. The company's strategic decisions and financial achievements in fiscal year 2025 lay a solid foundation for future growth and value creation in the business services industry.

Explore the complete 8-K earnings release (here) from Aeries Technology Inc for further details.