On July 7, 2025, Oppenheimer analyst Suraj Kalia initiated coverage on PROCEPT BioRobotics, denoted by the stock ticker (PRCT, Financial). The analyst has provided a "Perform" rating for the company, indicating a neutral outlook.

No specific price target was assigned as part of this initiation. Investors may interpret the "Perform" rating as a suggestion that the stock could perform in line with the broader market benchmarks. This rating reflects the analyst's assessment of the company's current market position and potential future performance.

Keep an eye on PROCEPT BioRobotics (PRCT, Financial) as more information and analysis from Oppenheimer or other financial analysts could provide further insights into the company's performance and potential investment opportunities.

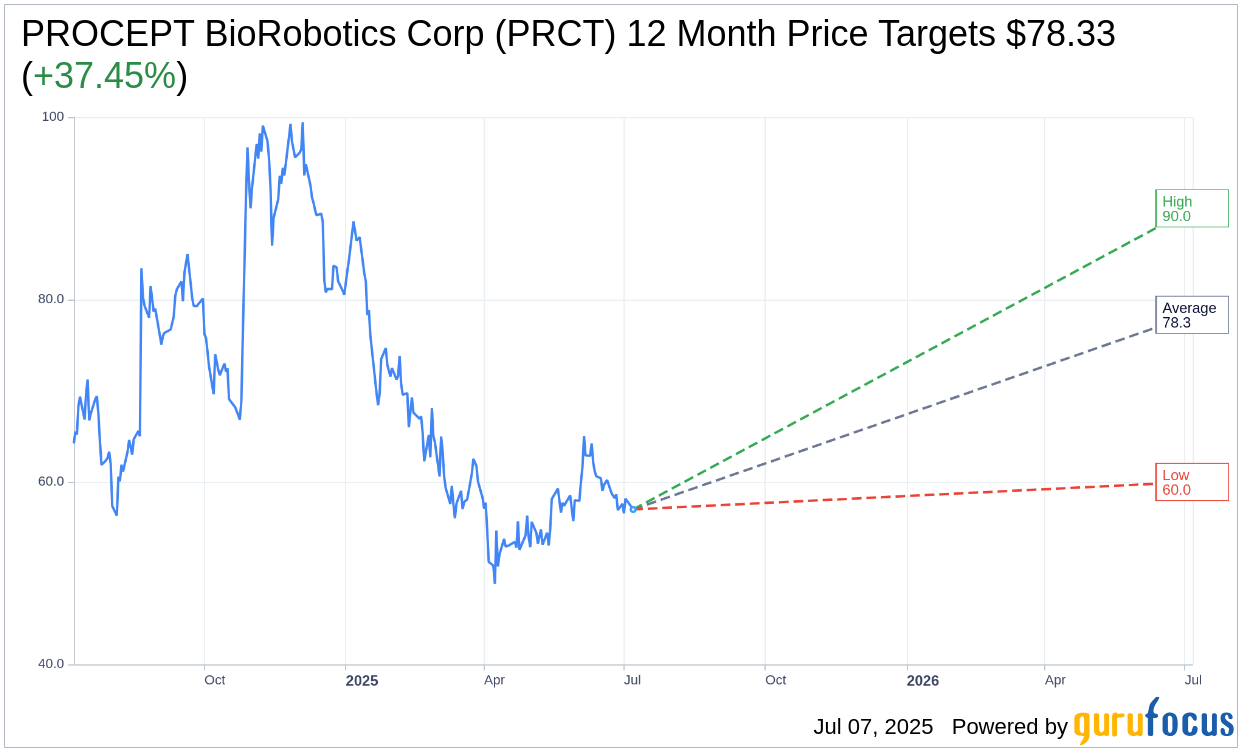

Wall Street Analysts Forecast

Based on the one-year price targets offered by 9 analysts, the average target price for PROCEPT BioRobotics Corp (PRCT, Financial) is $78.33 with a high estimate of $90.00 and a low estimate of $60.00. The average target implies an upside of 37.45% from the current price of $56.99. More detailed estimate data can be found on the PROCEPT BioRobotics Corp (PRCT) Forecast page.

Based on the consensus recommendation from 11 brokerage firms, PROCEPT BioRobotics Corp's (PRCT, Financial) average brokerage recommendation is currently 1.9, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for PROCEPT BioRobotics Corp (PRCT, Financial) in one year is $137.07, suggesting a upside of 140.52% from the current price of $56.99. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the PROCEPT BioRobotics Corp (PRCT) Summary page.