Summary:

- Deutsche Bank is enhancing its wealth management services by consolidating units and expanding its market presence in Germany.

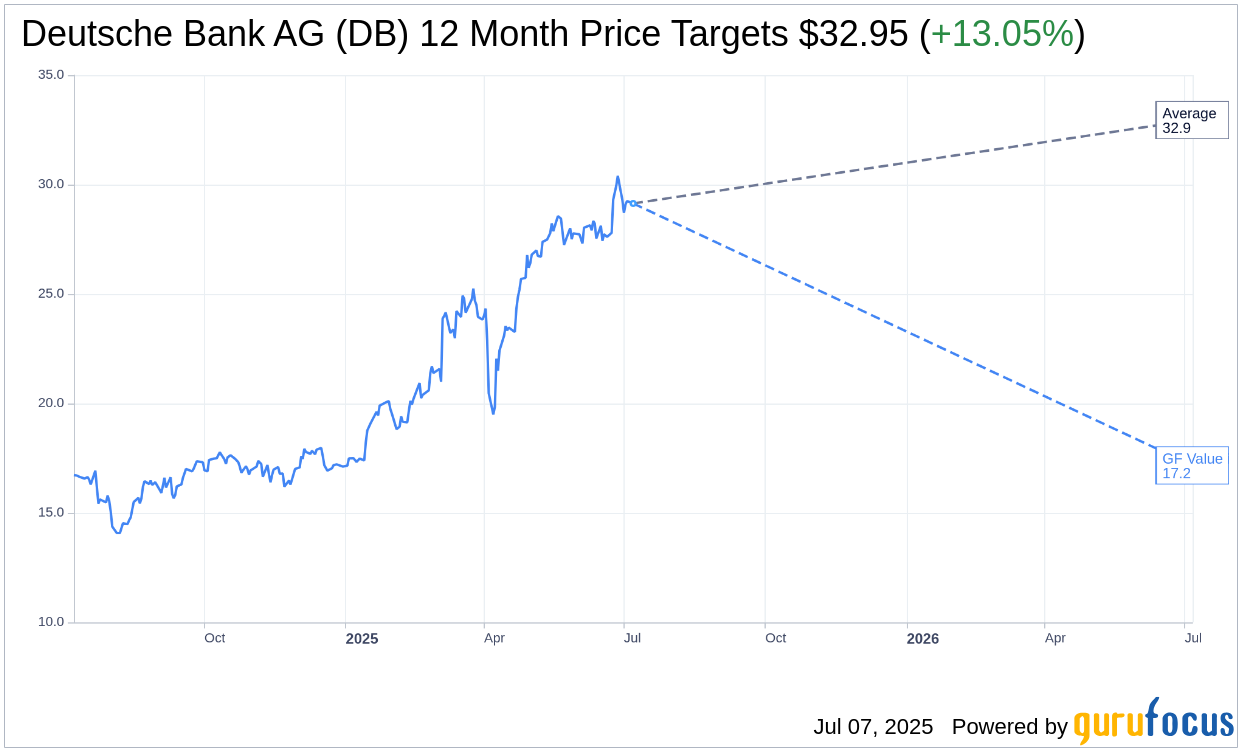

- Analysts foresee a potential 13.05% upside in Deutsche Bank's stock, while the GF Value suggests a possible downside.

- Current analyst ratings position Deutsche Bank as an "Outperform" investment opportunity.

Deutsche Bank (DB, Financial) is strategically consolidating its affluent and wealthy client services into a unified division, aiming to boost its wealth management operations in Germany. This restructuring involves appointing new leaders to spearhead innovative digital solutions and comprehensive wealth planning. With these efforts, Deutsche Bank seeks to significantly expand its market share within the region.

Wall Street Analysts Forecast

According to projections from a single analyst, Deutsche Bank AG (DB, Financial) has a one-year average target price of $32.95. This target aligns with both the high and low estimates, indicating a consensus. The projected average target hints at an upside potential of 13.05% from its current trading price of $29.15. For more in-depth estimates, please visit the Deutsche Bank AG (DB) Forecast page.

From the perspective of brokerage firm consensus, Deutsche Bank AG (DB, Financial) currently holds an average recommendation of 2.0, suggesting an "Outperform" status, as interpreted from a rating scale where 1 signifies a Strong Buy and 5 indicates a Sell.

The GF Value as estimated by GuruFocus for Deutsche Bank AG (DB, Financial) in the coming year is $17.17. This estimate implies a downside risk of 41.09% from the present price of $29.145. The GF Value represents GuruFocus' assessment of the fair trading value of the stock, derived from historical trading multiples, past business growth, and forward-looking business performance projections. For further detailed insights, explore the Deutsche Bank AG (DB) Summary page.