On July 7th, 2025, Barclays analyst Alex Scott confirmed the financial institution's stance on Marsh & McLennan Cos (MMC, Financial) by maintaining an "Equal-Weight" rating on the stock. This decision indicates that MMC is expected to perform in line with the market or its sector.

In addition, Barclays made a notable adjustment to Marsh & McLennan's price target. The price target has been lowered from the previous mark of $249.00 to $233.00, reflecting a decrease of 6.43%. This adjustment suggests a recalibration of expectations concerning MMC's future stock performance.

Marsh & McLennan Cos, a leading professional services firm, continues to attract attention in the financial markets due to such analyst insights. Stakeholders and investors will likely follow these developments closely, as the revised price target offers new benchmarks for assessing future movements of MMC's stock.

Wall Street Analysts Forecast

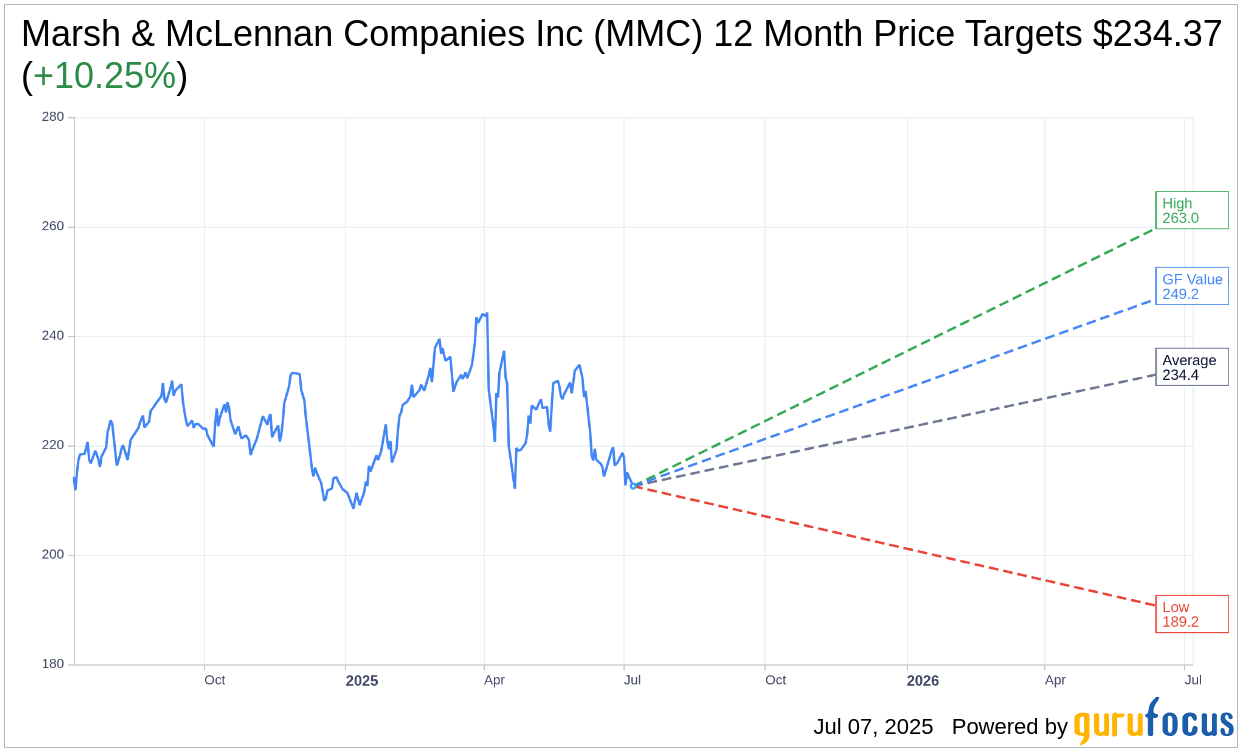

Based on the one-year price targets offered by 17 analysts, the average target price for Marsh & McLennan Companies Inc (MMC, Financial) is $234.37 with a high estimate of $263.00 and a low estimate of $189.21. The average target implies an upside of 10.25% from the current price of $212.57. More detailed estimate data can be found on the Marsh & McLennan Companies Inc (MMC) Forecast page.

Based on the consensus recommendation from 21 brokerage firms, Marsh & McLennan Companies Inc's (MMC, Financial) average brokerage recommendation is currently 2.9, indicating "Hold" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Marsh & McLennan Companies Inc (MMC, Financial) in one year is $249.15, suggesting a upside of 17.21% from the current price of $212.57. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Marsh & McLennan Companies Inc (MMC) Summary page.