Summary:

- The Bancorp (TBBK, Financial) unveils a $500 million stock buyback program extension.

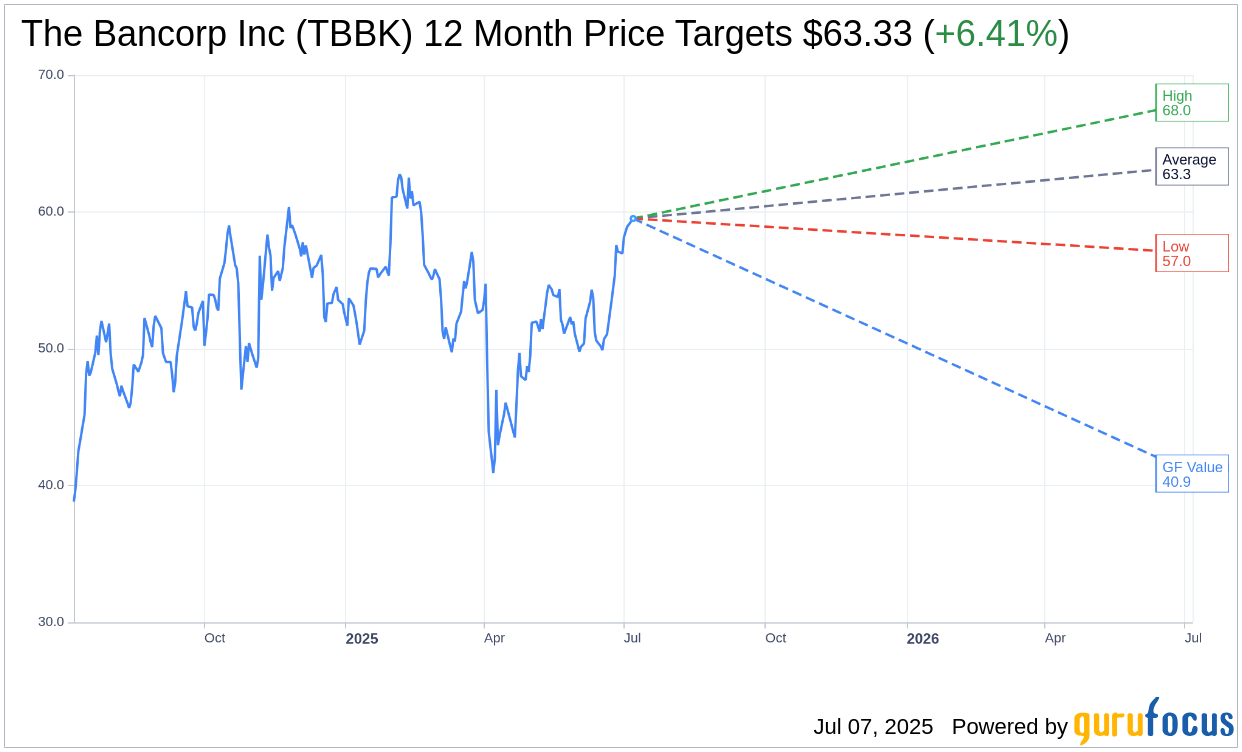

- Analysts suggest a potential 6.41% upside with a $63.33 average target price.

- GuruFocus estimates imply a 31.32% downside based on the GF Value metric.

The Bancorp's Strategic Expansion in Stock Buybacks

The Bancorp (NASDAQ: TBBK) has strategically amplified its stock repurchase program by an additional $500 million. This enhanced authorization includes $300 million earmarked for late 2025 and an additional $200 million slated for 2026. The Bancorp plans to finance these buybacks using its available cash reserves along with debt refinancing strategies, underscoring a commitment to returning value to shareholders.

Wall Street's Take: Analyst Price Targets and Recommendations

A review of one-year price targets from three seasoned analysts indicates that The Bancorp Inc (TBBK, Financial) has an average target price of $63.33. This encompasses a high target of $68.00 and a low of $57.00, suggesting a prospective upside of 6.41% from the current trading price of $59.52. For an in-depth look at these predictions, visit the The Bancorp Inc (TBBK) Forecast page.

The average brokerage recommendation, derived from three brokerage firms, positions The Bancorp Inc's stock at a 2.3 rating, suggesting an "Outperform" status. The rating scale ranges from 1, indicating a Strong Buy, to 5, which represents a Sell recommendation.

Evaluating The Bancorp's Value: GuruFocus GF Value Analysis

According to GuruFocus estimates, the projected GF Value for The Bancorp Inc (TBBK, Financial) in the coming year stands at $40.88. This suggests a potential downside of 31.32% from the current market price of $59.52. The GF Value is a unique GuruFocus valuation metric, reflecting the price at which the stock should ideally trade. It incorporates historical trading multiples, previous business growth patterns, and anticipated future performance estimates. For more comprehensive insights, explore the The Bancorp Inc (TBBK) Summary page.