Overview of MYDA Advisors LLC (Trades, Portfolio)'s Recent Transaction

On June 30, 2025, MYDA Advisors LLC (Trades, Portfolio) executed a significant transaction involving SmartKem Inc (SMTK, Financial). The firm reduced its holdings by 116,206 shares, trading at a price of $1.01 per share. This adjustment brought the total shares held by MYDA Advisors LLC (Trades, Portfolio) in SmartKem Inc to 217,127, representing 0.04% of the firm's portfolio. The transaction resulted in a -0.02% impact on the firm's overall portfolio, reflecting a strategic decision to recalibrate its investment in the semiconductor company.

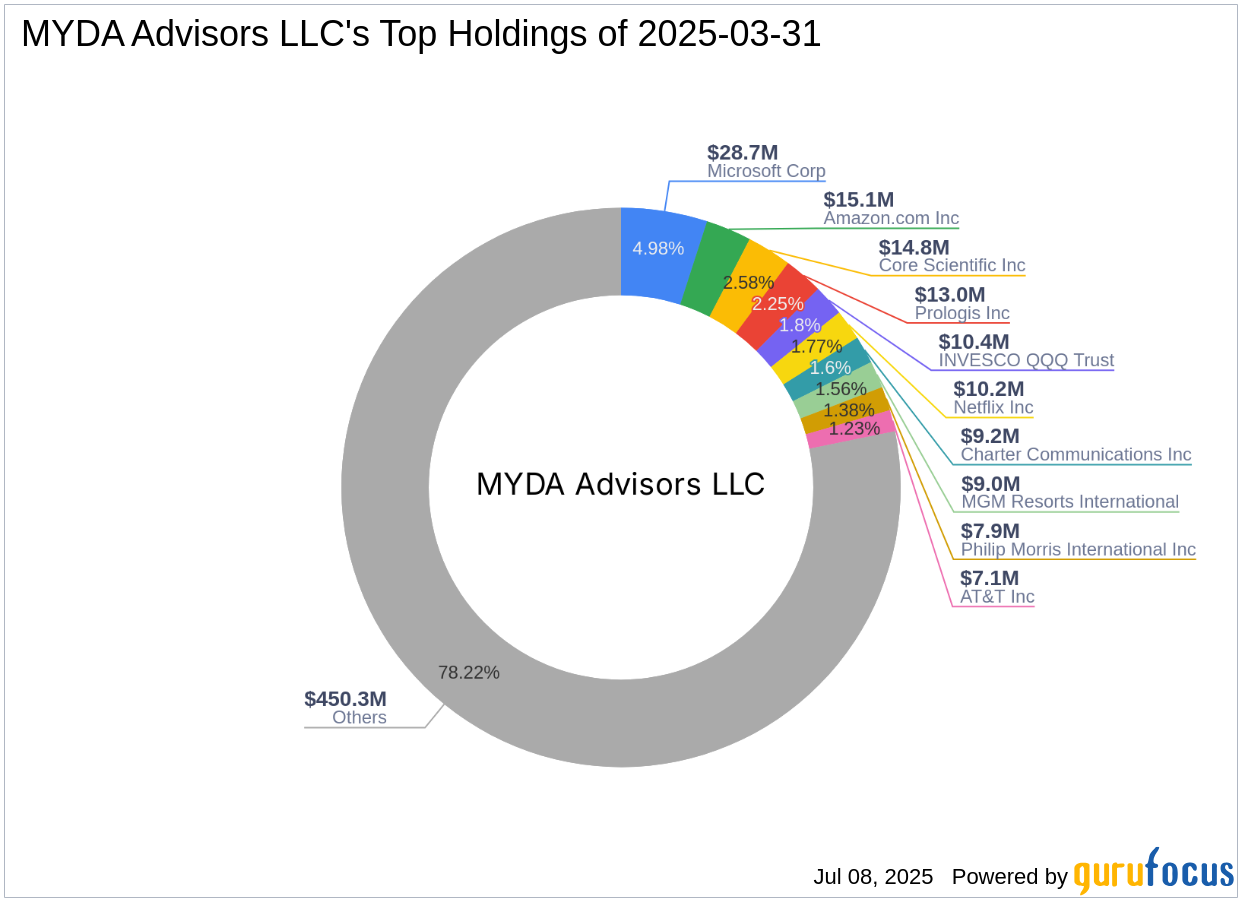

Profile of MYDA Advisors LLC (Trades, Portfolio)

MYDA Advisors LLC (Trades, Portfolio), based in Inwood, NY, is a recognized investment firm with a focus on the technology and communication services sectors. The firm is known for its strategic investments in leading companies such as Amazon.com Inc (AMZN, Financial), Microsoft Corp (MSFT, Financial), and INVESCO QQQ Trust (QQQ, Financial). With a portfolio equity of $576 million, MYDA Advisors LLC (Trades, Portfolio) holds 142 stocks, demonstrating a diversified investment approach. The firm's top holdings reflect its commitment to high-growth sectors, aligning with its investment philosophy.

Introduction to SmartKem Inc

SmartKem Inc, a UK-based company, specializes in the design and development of organic semiconductors. The company's business model revolves around its TRUFLEX inks and demonstration products, which are integral to applications such as mini-LED displays and fingerprint sensors. With a market capitalization of $4.432 million, SmartKem Inc is a niche player in the semiconductor industry. The company's current stock price stands at $1, reflecting its market position and financial performance.

Impact of the Transaction on MYDA Advisors LLC (Trades, Portfolio)'s Portfolio

The reduction in SmartKem Inc shares by MYDA Advisors LLC (Trades, Portfolio) resulted in a -0.02% change in the firm's portfolio. Despite this adjustment, SmartKem Inc continues to hold a position in the firm's portfolio, albeit a minor one at 0.04%. This transaction indicates a strategic realignment by MYDA Advisors LLC (Trades, Portfolio), possibly reflecting a reassessment of the company's growth prospects or market conditions.

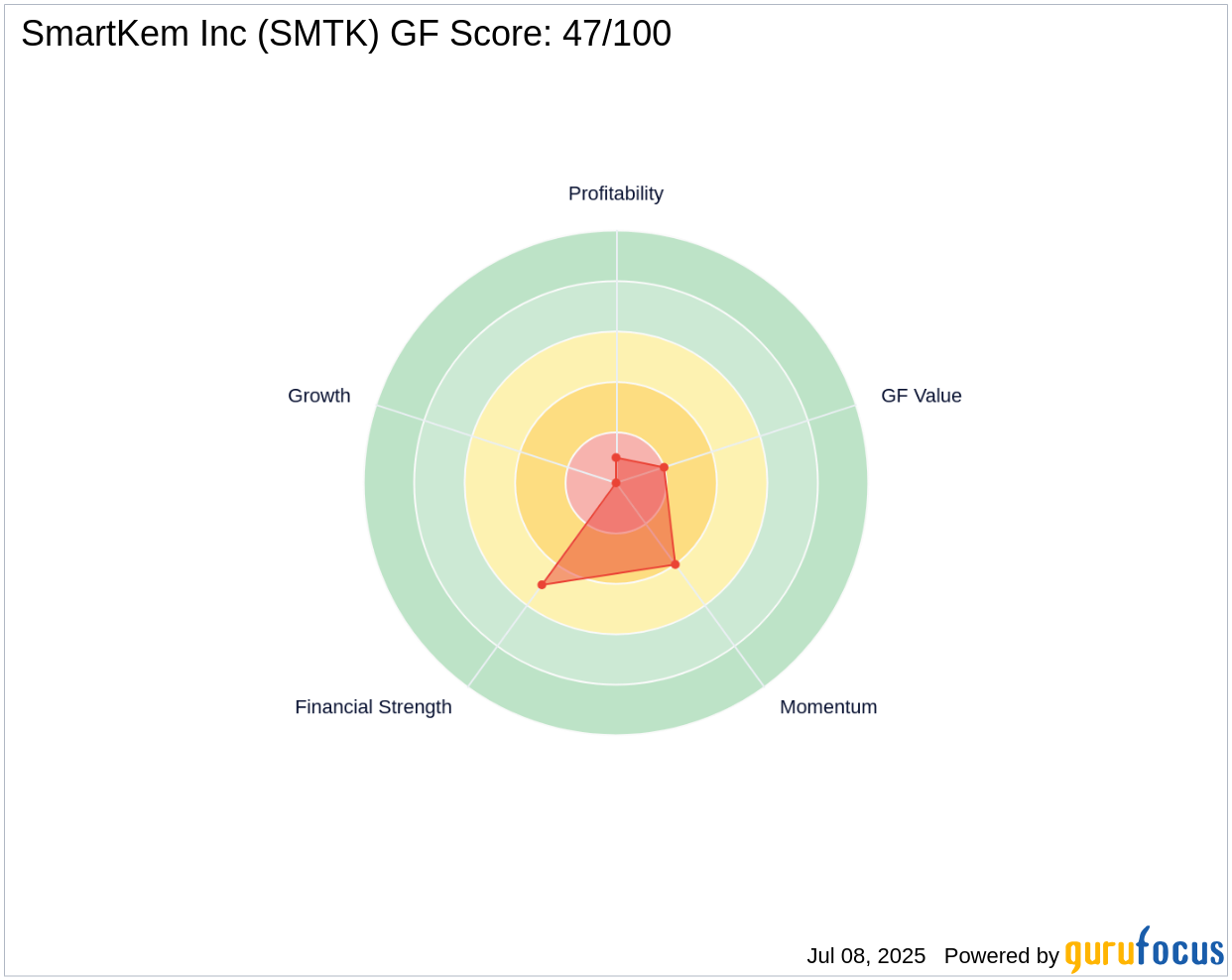

Financial Performance and Valuation of SmartKem Inc

SmartKem Inc's financial metrics present a challenging picture. With a market cap of $4.432 million and a PE percentage of 0.00, the company is currently operating at a loss. The [GF Valuation](https://www.gurufocus.com/term/gf-value/SMTK) suggests a possible value trap, with a GF Value of 7.38. The company's [GF Score](https://www.gurufocus.com/term/gf-score/SMTK) is 47/100, indicating poor future performance potential. Additionally, the [Balance Sheet Rank](https://www.gurufocus.com/term/rank-balancesheet/SMTK) is 5/10, reflecting moderate financial strength.

Stock Performance and Market Sentiment

SmartKem Inc's stock performance has been underwhelming, with a year-to-date price change of -68.19%. The stock's momentum indicators, including a 14-day RSI of 37.49, suggest bearish sentiment. Since its IPO, the stock has experienced a price change of -98.86%, highlighting significant challenges in achieving market traction. These metrics underscore the volatility and risk associated with investing in SmartKem Inc.

Conclusion

In summary, MYDA Advisors LLC (Trades, Portfolio)'s recent transaction involving SmartKem Inc reflects a strategic decision to reduce exposure to a company facing financial and market challenges. While SmartKem Inc continues to innovate in the semiconductor space, its current valuation and financial performance present potential risks for value investors. As the market conditions evolve, investors should carefully consider the implications of these factors when evaluating investment opportunities in SmartKem Inc.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.