Highlights:

- Hyperscale Data's subsidiary Sentinum mined approximately 103.7 bitcoins in 2023.

- GPUS shares saw a modest pre-market rise of 1.44%.

- Investment analysts forecast a remarkable price target for GPUS stock.

Hyperscale Data Inc. (GPUS) has been making notable strides in the cryptocurrency mining sector. This year, its subsidiary, Sentinum, successfully mined approximately 103.7 bitcoins, with June alone contributing around 13.7 bitcoins to this tally. The company's operational expansion continues with the activation of two new Bitcoin mining sites, collectively bringing about 18,200 Antminers online. These advancements have sparked a 1.44% increase in GPUS shares during pre-market trading, reflecting growing investor confidence.

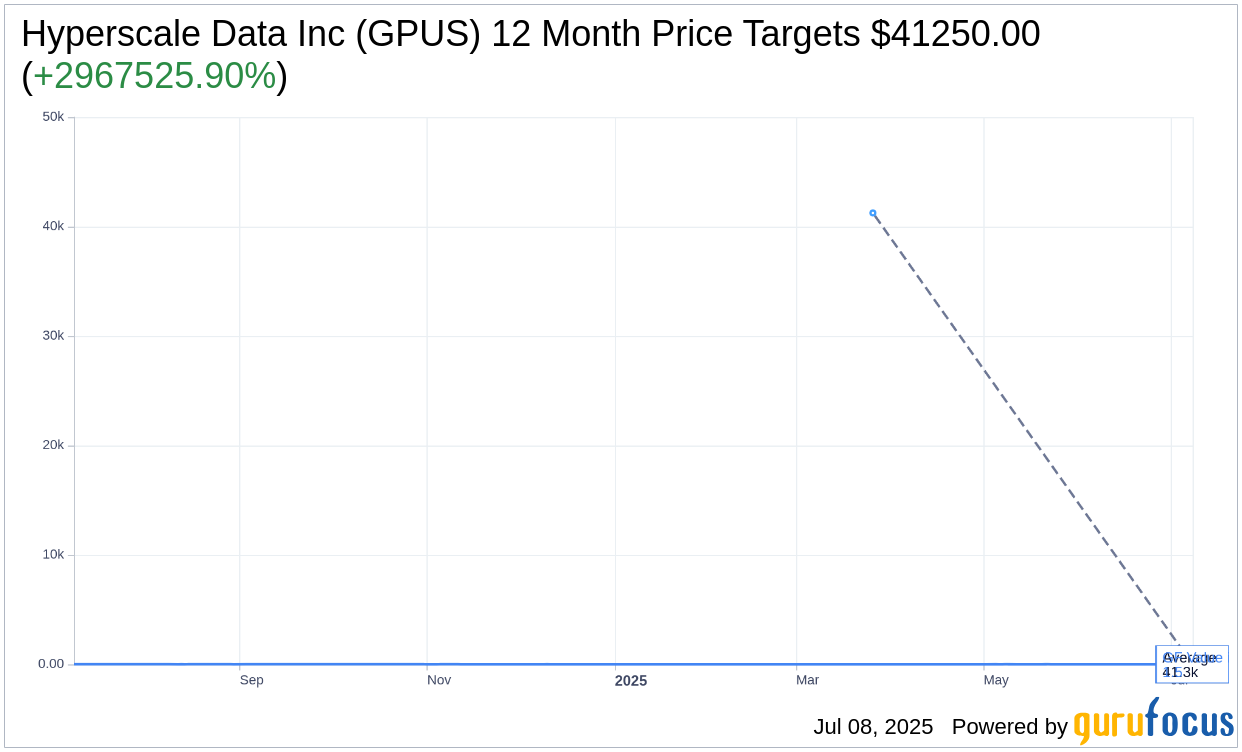

Wall Street Analysts Forecast

Industry analysts are bullish about Hyperscale Data Inc.'s future prospects. According to the latest price targets from analysts, the average target price for GPUS is set at a staggering $41,250.00. This single projection indicates a potential upside of 2,967,525.90% from the current market price of $1.39, highlighting investor optimism. For further insights and detailed data, visit the Hyperscale Data Inc (GPUS, Financial) Forecast page.

When considering brokerage evaluations, Hyperscale Data Inc. holds an average recommendation of 2.0 from 1 brokerage firm, translating to an "Outperform" status. This rating suggests that the stock currently holds favorable growth potential, rated on a scale from 1 (Strong Buy) to 5 (Sell).

On the valuation front, according to GuruFocus estimates, the projected GF Value for GPUS in a year stands at $1.48. This estimate indicates a modest upside of 6.47% from its present price of $1.39. The GF Value represents GuruFocus' calculated fair market value, considering historical trading multiples, past growth trajectories, and future business performance projections. To explore more about these estimates, navigate to the Hyperscale Data Inc (GPUS, Financial) Summary page.