Summary:

- Shoals Technologies expands into South America with a new contract in Chile.

- Current analyst forecasts suggest potential growth for SHLS shares.

- GuruFocus estimates a significant upside for SHLS based on GF Value.

Shoals Technologies Group Inc. (SHLS, Financial) has taken a significant step by entering the South American market. Partnering with CJR Renewables, Shoals is set to supply its innovative Big Lead Assembly for the 110 MW Alcones solar project in Chile. This strategic move is expected to speed up installation and enhance system reliability, though the market initially reacted with a more than 6% drop in SHLS shares during premarket trading.

Wall Street Analysts’ Predictions

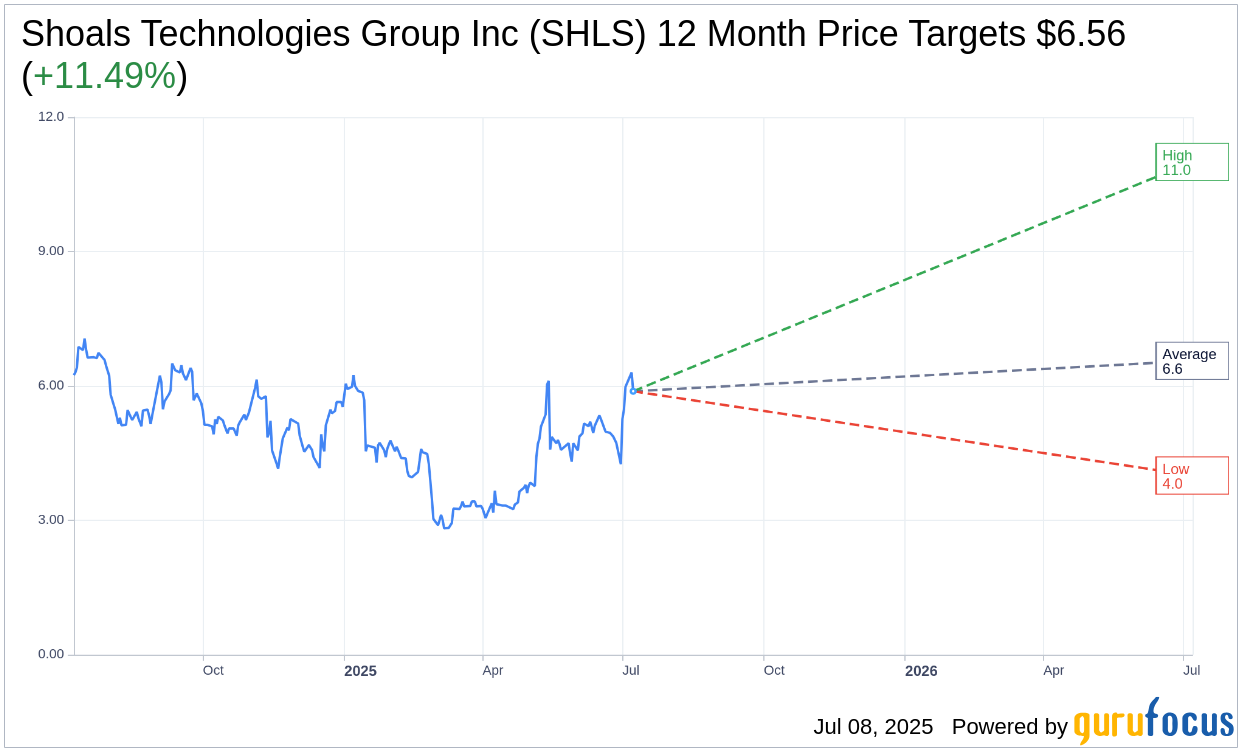

According to forecasts from 18 analysts, Shoals Technologies Group Inc. (SHLS, Financial) has an average one-year price target of $6.56. The projections range from a high of $11.00 to a low of $4.00, suggesting an optimistic 11.49% upside from the current trading price of $5.88. For more in-depth analysis, visit the Shoals Technologies Group Inc (SHLS) Forecast page.

The consensus among 20 brokerage firms is a strong endorsement of Shoals Technologies Group Inc. (SHLS, Financial), with an average brokerage recommendation of 2.1. This recommends an "Outperform" status on a scale where 1 is a Strong Buy and 5 signifies a Sell.

GuruFocus's GF Value Estimation

Utilizing GuruFocus's sophisticated metrics, the estimated GF Value for Shoals Technologies Group Inc. (SHLS, Financial) is projected to be $15.08 in one year. This estimation implies a substantial upside of 156.46% from the current price of $5.88. The GF Value reflects GuruFocus's assessment of the stock's fair trading value, based on historical trading multiples, past growth, and anticipated future performance. Further details can be accessed on the Shoals Technologies Group Inc (SHLS) Summary page.