Kratos Defense & Security (KTOS, Financial), a prominent player in the defense technology sector, has recently attracted attention from financial analysts. On July 8, 2025, Cantor Fitzgerald, through analyst Colin Canfield, announced the initiation of coverage on KTOS, assigning it a favorable outlook.

In this recent coverage initiation, Kratos Defense & Security (KTOS, Financial) has been given an "Overweight" rating. This suggests that Cantor Fitzgerald believes the stock will outperform the broader market or sector averages.

The analyst has set a price target for KTOS at $60.00 USD. This signifies confidence in the company's potential for growth, aligning with the optimistic rating provided.

The announcement of coverage and the designated price target are pivotal for investors monitoring the defense and security sector, providing insight into potential stock performance. As Kratos Defense & Security (KTOS, Financial) continues its trajectory, investors may find this new analytical perspective valuable.

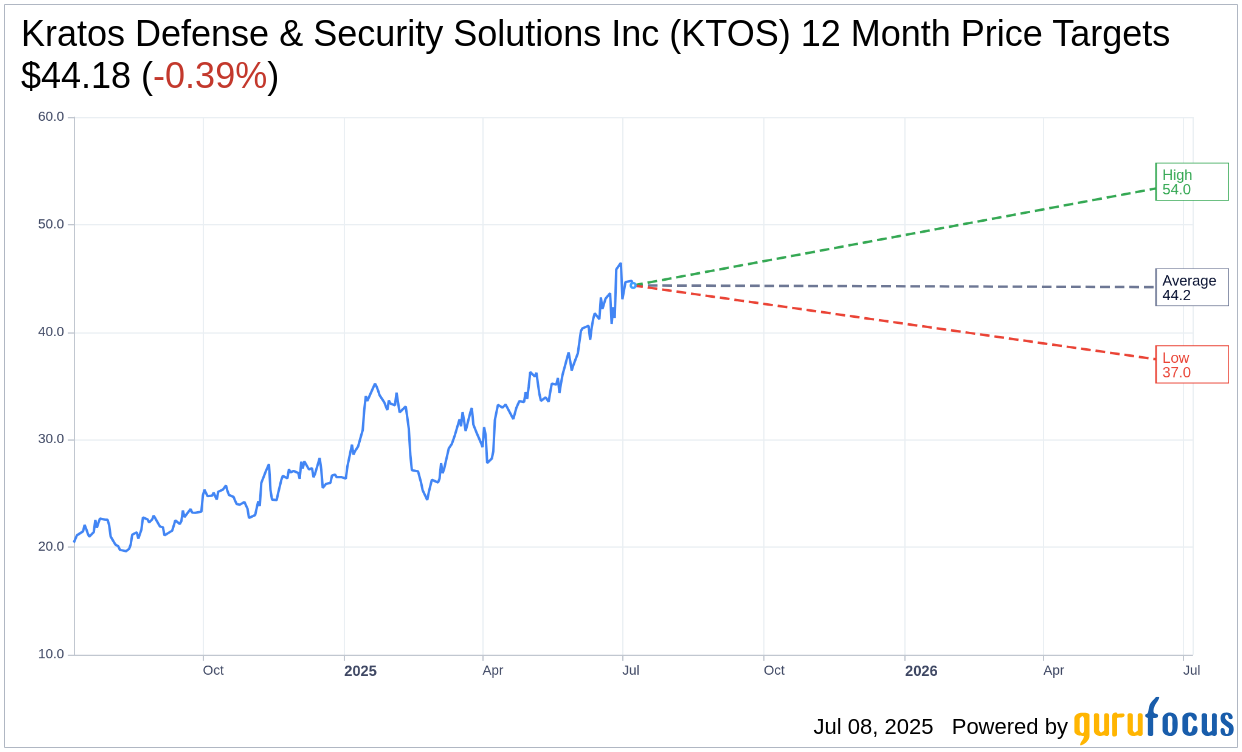

Wall Street Analysts Forecast

Based on the one-year price targets offered by 11 analysts, the average target price for Kratos Defense & Security Solutions Inc (KTOS, Financial) is $44.18 with a high estimate of $54.00 and a low estimate of $37.00. The average target implies an downside of 0.39% from the current price of $44.36. More detailed estimate data can be found on the Kratos Defense & Security Solutions Inc (KTOS) Forecast page.

Based on the consensus recommendation from 13 brokerage firms, Kratos Defense & Security Solutions Inc's (KTOS, Financial) average brokerage recommendation is currently 2.0, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Kratos Defense & Security Solutions Inc (KTOS, Financial) in one year is $20.41, suggesting a downside of 53.98% from the current price of $44.355. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Kratos Defense & Security Solutions Inc (KTOS) Summary page.