- Enphase Energy (ENPH, Financial) experiences a 5.1% decline due to policy changes affecting solar and wind tax incentives.

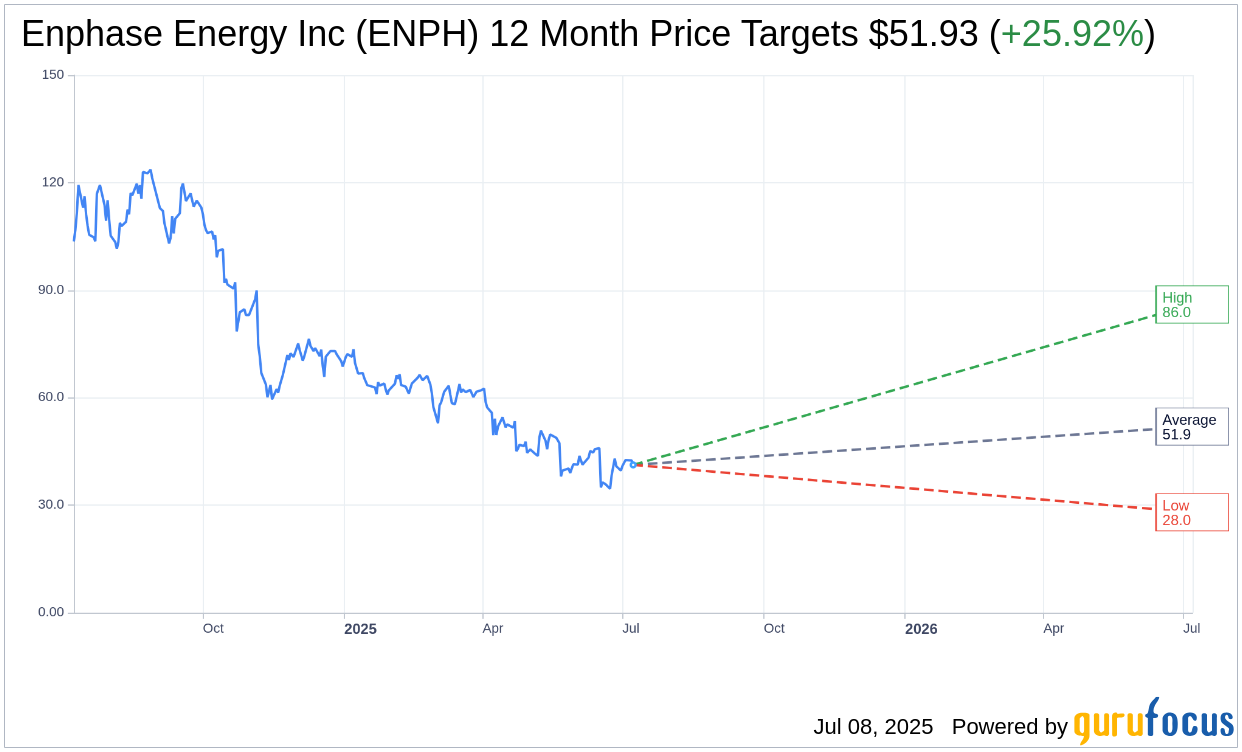

- Analyst forecasts suggest an average price target of $51.93, indicating potential growth.

- GuruFocus estimates a significant upside for ENPH based on its GF Value metric.

Enphase Energy (ENPH) shares recently declined by 5.1% following a significant policy shift. President Trump's executive order, which eliminates solar and wind tax credits post-2026, threatens to impact renewable energy companies reliant on these incentives for upcoming projects.

Wall Street Analysts' Forecasts

Thirty-three analysts have provided one-year price targets for Enphase Energy Inc (ENPH, Financial), presenting an average target price of $51.93. This estimate suggests a potential upside of 25.92% from the current trading price of $41.24. The highest forecasted price is $86.00, while the lowest stands at $28.00. For more in-depth forecast data, refer to the Enphase Energy Inc (ENPH) Forecast page.

Analyst Recommendations

The consensus from 37 brokerage firms assigns Enphase Energy Inc (ENPH, Financial) an average recommendation of 3.0, categorizing the stock under a "Hold" status. On the recommendation scale, 1 indicates a "Strong Buy," whereas 5 signifies "Sell."

GuruFocus Valuation Insight

Leveraging GuruFocus' proprietary metrics, the estimated GF Value for Enphase Energy Inc (ENPH, Financial) in one year is projected at $100.44. This suggests a remarkable potential upside of 143.55% from the current share price of $41.24. The GF Value is a calculation reflecting the stock's fair trading value, based on historical trading multiples, past business growth, and projected future performance. For further valuation details, navigate to the Enphase Energy Inc (ENPH) Summary page.