On July 8, 2025, JP Morgan analyst Brian Ossenbeck released an update on Knight-Swift (KNX, Financial), maintaining a Neutral rating while adjusting the stock's price target. The new price target for KNX is set at $45.00, down from the previous target of $46.00. This reflects a price target percentage change of -2.17%.

Knight-Swift (KNX, Financial), a prominent name in the transportation and logistics sector, continues to be under the spotlight as investors assess the implications of the updated price target. The Neutral rating signifies a balanced view, suggesting that the stock is expected to perform in line with the market or other stocks in its sector.

The adjustment in the price target by JP Morgan underscores the need for shareholders and potential investors to stay informed about market trends and company performance. As of now, the updated price target stands at $45.00, maintaining the company's position in the financial markets while signaling potential valuation considerations for market participants.

Wall Street Analysts Forecast

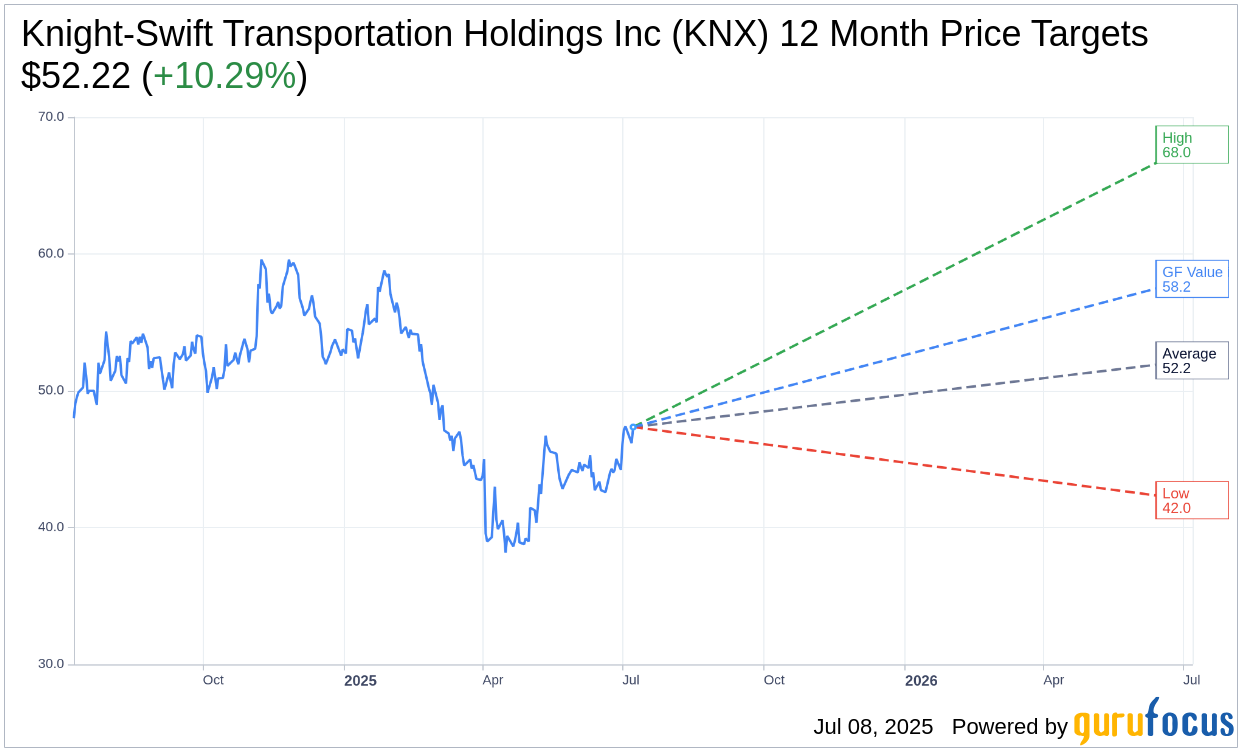

Based on the one-year price targets offered by 19 analysts, the average target price for Knight-Swift Transportation Holdings Inc (KNX, Financial) is $52.22 with a high estimate of $68.00 and a low estimate of $42.00. The average target implies an upside of 10.29% from the current price of $47.35. More detailed estimate data can be found on the Knight-Swift Transportation Holdings Inc (KNX) Forecast page.

Based on the consensus recommendation from 22 brokerage firms, Knight-Swift Transportation Holdings Inc's (KNX, Financial) average brokerage recommendation is currently 2.3, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Knight-Swift Transportation Holdings Inc (KNX, Financial) in one year is $58.18, suggesting a upside of 22.87% from the current price of $47.35. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Knight-Swift Transportation Holdings Inc (KNX) Summary page.