On July 8, 2025, financial services firm JP Morgan, through analyst Brian Ossenbeck, released a report maintaining its "Neutral" rating on United Parcel Service (UPS, Financial). The report comes as part of JP Morgan's continued evaluation of the company's performance and market position.

While the rating remained unchanged at "Neutral," there was a downward adjustment in the price target. The price target for UPS was lowered from $110.00 USD to $107.00 USD, reflecting a percent change of -2.73%. The previous price target was set at $110.00 USD.

The adjustment in price target suggests a more cautious outlook from JP Morgan regarding United Parcel Service's near-term financial trajectory. Investors in UPS may need to consider these updates in light of their own portfolio strategies and market positions.

Wall Street Analysts Forecast

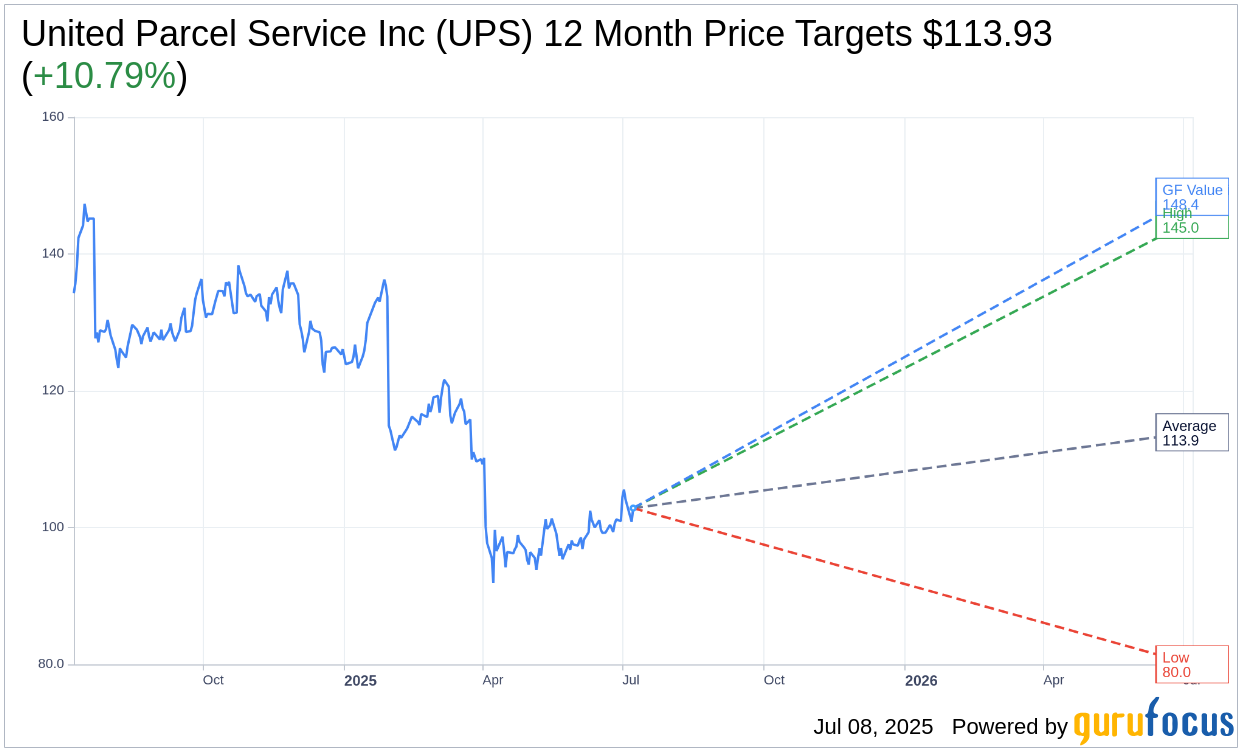

Based on the one-year price targets offered by 28 analysts, the average target price for United Parcel Service Inc (UPS, Financial) is $113.93 with a high estimate of $145.00 and a low estimate of $80.00. The average target implies an upside of 10.79% from the current price of $102.84. More detailed estimate data can be found on the United Parcel Service Inc (UPS) Forecast page.

Based on the consensus recommendation from 32 brokerage firms, United Parcel Service Inc's (UPS, Financial) average brokerage recommendation is currently 2.3, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for United Parcel Service Inc (UPS, Financial) in one year is $148.37, suggesting a upside of 44.27% from the current price of $102.84. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the United Parcel Service Inc (UPS) Summary page.