Highlights:

- GlobalFoundries' stock surges 6% as it reveals plans to acquire MIPS, enhancing its AI capabilities.

- Wall Street analysts provide a favorable outlook with an average target price of $43.86.

- GuruFocus estimates suggest a significant upside potential of 23.4% for GFS.

GlobalFoundries (GFS, Financial) recently experienced a notable 6% increase in its stock value following the announcement of its strategic plan to acquire MIPS, a recognized leader in compute subsystems for autonomous technologies. This acquisition is poised to significantly enhance GlobalFoundries' capabilities in the AI-driven automotive and industrial sectors, with expectations to complete the transaction by the end of the year.

Wall Street Analysts Forecast

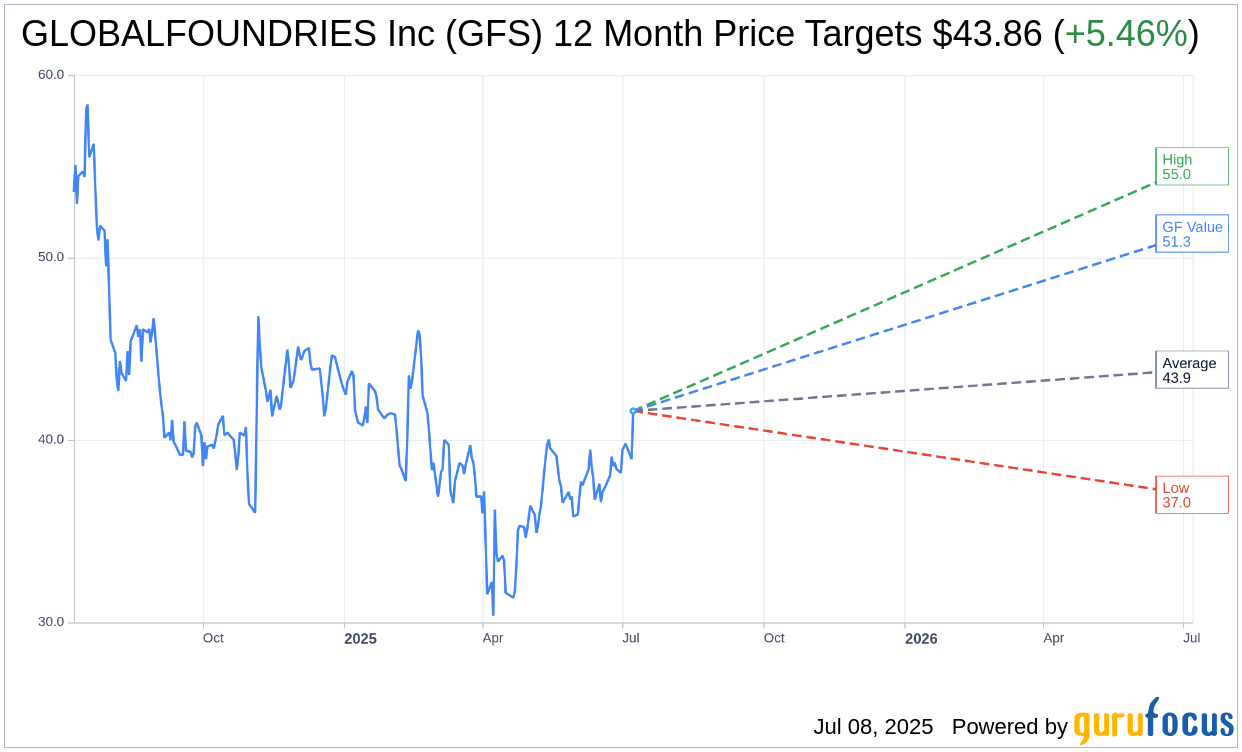

In their analysis, 18 Wall Street analysts have provided a range of one-year price targets for GLOBALFOUNDRIES Inc (GFS, Financial), with an average target price of $43.86. This forecast includes a high estimate of $55.00 and a low estimate of $37.00. The average target implies an upside potential of 5.46% from the current price of $41.59. For more in-depth estimate data, visit the GLOBALFOUNDRIES Inc (GFS) Forecast page.

Furthermore, based on the consensus recommendation from 20 brokerage firms, GLOBALFOUNDRIES Inc's (GFS, Financial) average brokerage recommendation stands at 2.3, indicating an "Outperform" status. The rating scale used ranges from 1 to 5, where 1 signifies a Strong Buy and 5 denotes a Sell recommendation.

GuruFocus Value Estimates

GuruFocus estimates provide a compelling outlook for GLOBALFOUNDRIES Inc (GFS, Financial), with the estimated GF Value for the company in one year projected at $51.32. This estimation suggests a significant upside potential of 23.4% from the current price of $41.59. The GF Value is GuruFocus' evaluation of the fair value at which the stock should trade, calculated based on historical multiples, past business growth, and future performance estimates. For more comprehensive data, visit the GLOBALFOUNDRIES Inc (GFS) Summary page.