Investors should note that a virtual meeting for FC is scheduled for July 17. This event is organized by Roth MKM and presents an opportunity for shareholders and interested parties to gain insights. For those looking to enhance their investment strategies, TipRanks is offering a limited-time half-year sale with 50% off their premium service. This subscription provides access to advanced investing tools and expert insights, aiming to support more informed decision-making. Additionally, TipRanks offers a weekly newsletter with expertly curated investment picks, catering to those seeking to stay updated and make smarter investment choices.

Wall Street Analysts Forecast

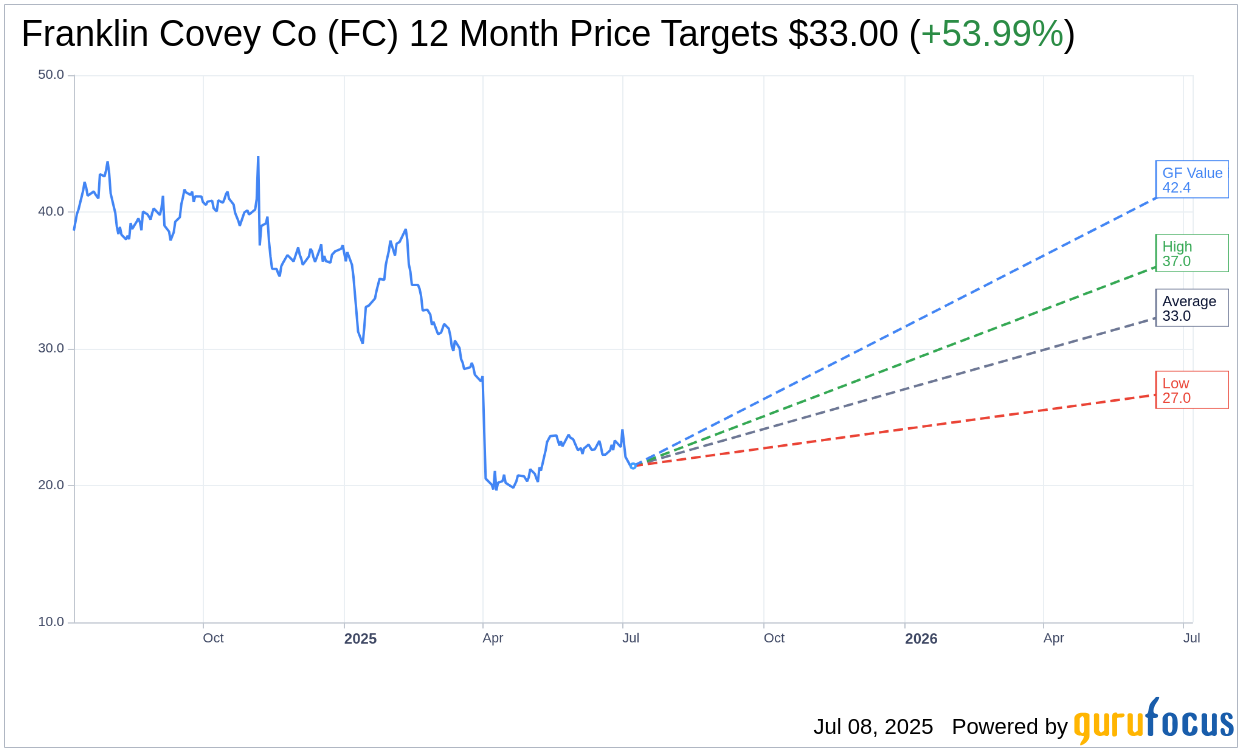

Based on the one-year price targets offered by 3 analysts, the average target price for Franklin Covey Co (FC, Financial) is $33.00 with a high estimate of $37.00 and a low estimate of $27.00. The average target implies an upside of 53.99% from the current price of $21.43. More detailed estimate data can be found on the Franklin Covey Co (FC) Forecast page.

Based on the consensus recommendation from 3 brokerage firms, Franklin Covey Co's (FC, Financial) average brokerage recommendation is currently 1.7, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Franklin Covey Co (FC, Financial) in one year is $42.39, suggesting a upside of 97.81% from the current price of $21.43. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Franklin Covey Co (FC) Summary page.

FC Key Business Developments

Release Date: July 02, 2025

- Revenue: $67.1 million for the third quarter, down 9% from the prior year.

- Adjusted EBITDA: $7.3 million, exceeding the top end of the guidance range of $4 million to $6.5 million.

- Gross Margin: Approximately flat year over year at 76.5% of revenue.

- Operating Expenses: $53.5 million, increased by $5.7 million compared to the prior year.

- Restructuring Charges: $4 million increase in restructuring charges.

- SG&A Expenses: Increased by $1.6 million due to go-to-market acceleration initiative.

- Cash Flow from Operating Activities: $19 million year-to-date, down from $38.4 million last year.

- Free Cash Flow: $10.6 million year-to-date, compared to $30.6 million last year.

- Enterprise Division Revenue: $47.3 million, down from $51.9 million in the prior year.

- Education Division Revenue: $18.6 million, down 8% from the prior year.

- Education Subscription Revenue: Increased 13% in the third quarter to $11.8 million.

- Deferred Subscription Revenue: Increased 7% to $89.3 million.

- Share Repurchase: Approximately 372,000 shares purchased in the third quarter at a cost of $8.3 million.

- Fiscal 2025 Revenue Guidance: Revised to $265 million to $275 million.

- Fiscal 2025 Adjusted EBITDA Guidance: Widened to $28 million to $33 million.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Franklin Covey Co (FC, Financial) reported third-quarter revenue of $67.1 million, in line with expectations, and adjusted EBITDA of $7.3 million, exceeding the top end of the expected range.

- The company successfully implemented cost reductions, which are expected to result in meaningful year-over-year increases in adjusted EBITDA next year.

- Franklin Covey Co (FC) achieved strong traction in its go-to-market transformation in the Enterprise North America business, with an increase in new client wins and revenue per win.

- The Education business continues to be strong, with subscription revenue growing 13% and deferred revenue increasing 21% in the third quarter.

- The company reported a high attachment rate of strategically important subscription services, with a 60% attach rate in the Enterprise division.

Negative Points

- Revenue was down 9% from the prior year quarter, primarily due to the impact of government actions and macroeconomic uncertainty.

- Operating expenses increased by $5.7 million compared to the prior year, driven by restructuring charges and increased SG&A expenses.

- The company revised its fiscal 2025 revenue guidance to a range of $265 million to $275 million, reflecting continued uncertainty impacting client decision-making.

- Subscription revenue invoiced was down 8% year-over-year, attributed to government contract cancellations and economic uncertainty.

- The company experienced some client downsizing in subscription sizes, impacting overall subscription growth.