On July 7, 2025, Educational Development Corp (EDUC, Financial) released its 8-K filing detailing the financial results for the fiscal first quarter ended May 31, 2025. The company, a prominent U.S. trade publisher of educational children's books, operates through two segments: PaperPie and Publishing. The Publishing Division markets its products to various retail accounts, including bookstores, schools, and museums.

Performance Overview and Challenges

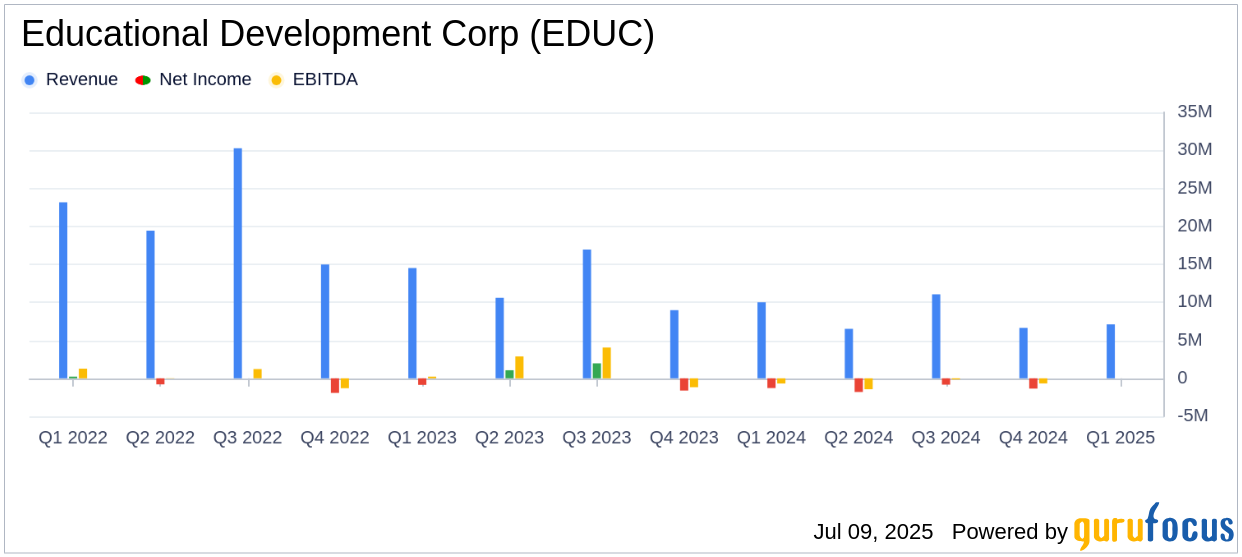

Educational Development Corp (EDUC, Financial) reported net revenues of $7.1 million for the first quarter, a significant decrease from $10.0 million in the same period last year. The company also saw a reduction in average active PaperPie Brand Partners, totaling 7,700 compared to 13,400 previously. Despite these challenges, the loss before income taxes improved slightly to $(1.4) million from $(1.7) million, and the net loss narrowed to $(1.1) million from $(1.3) million. The loss per share was $(0.13), compared to $(0.15) in the prior year.

Per Craig White, Chief Executive Officer, “During the quarter we ran several product discount promotions to increase cash which reduced our gross margins. Our strategy to increase cash remains short term and focused on turning excess inventory faster to pay down our debts and meet the requirements of our lender.”

Financial Achievements and Strategic Initiatives

Despite the revenue decline, Educational Development Corp (EDUC, Financial) has made strides in cost reduction, which helped mitigate losses even with lower sales. The company's strategy to convert excess inventory into cash is crucial for strengthening its financial position and reducing debt. The ongoing sale of the Hilti Complex is expected to fully retire outstanding debt, providing the company with the flexibility to invest in new titles and support its Brand Partners.

“We have implemented various cost savings, updated technologies and processes, and provided additional opportunities for our Brand Partners to have success,” stated Craig White.

Key Financial Metrics

| Three Months Ended May 31 | 2025 | 2024 |

|---|---|---|

| Net Revenues | $7,106,400 | $9,993,400 |

| Loss Before Income Taxes | $(1,449,300) | $(1,747,000) |

| Income Tax Benefit | $(374,100) | $(468,000) |

| Net Loss | $(1,075,200) | $(1,279,000) |

| Loss Per Share | $(0.13) | $(0.15) |

Analysis and Outlook

The decline in net revenues and active Brand Partners highlights the challenges Educational Development Corp (EDUC, Financial) faces in the current market environment. However, the company's focus on inventory management and cost reduction is a positive step towards financial stability. The anticipated completion of the Hilti Complex sale is expected to significantly improve the company's financial flexibility, allowing for strategic investments and growth opportunities in the future.

Educational Development Corp (EDUC, Financial)'s ability to adapt its strategies and manage its financial resources effectively will be crucial in navigating the current challenges and positioning itself for long-term success in the diversified media industry.

Explore the complete 8-K earnings release (here) from Educational Development Corp for further details.