BlackRock's Strategic Acquisition of Polaris Shares

On June 30, 2025, BlackRock, Inc. (Trades, Portfolio) executed a notable transaction by acquiring an additional 1,491,533 shares of Polaris Inc. This acquisition was made at a trade price of $40.65 per share, reflecting BlackRock's strategic decision to bolster its holdings in the company. This move increased BlackRock's total holdings in Polaris Inc. to 6,341,438 shares, which now represents 11.30% of the firm's portfolio. Despite the substantial addition, the transaction had a 0% impact on BlackRock's overall portfolio, indicating a calculated and balanced approach to investment.

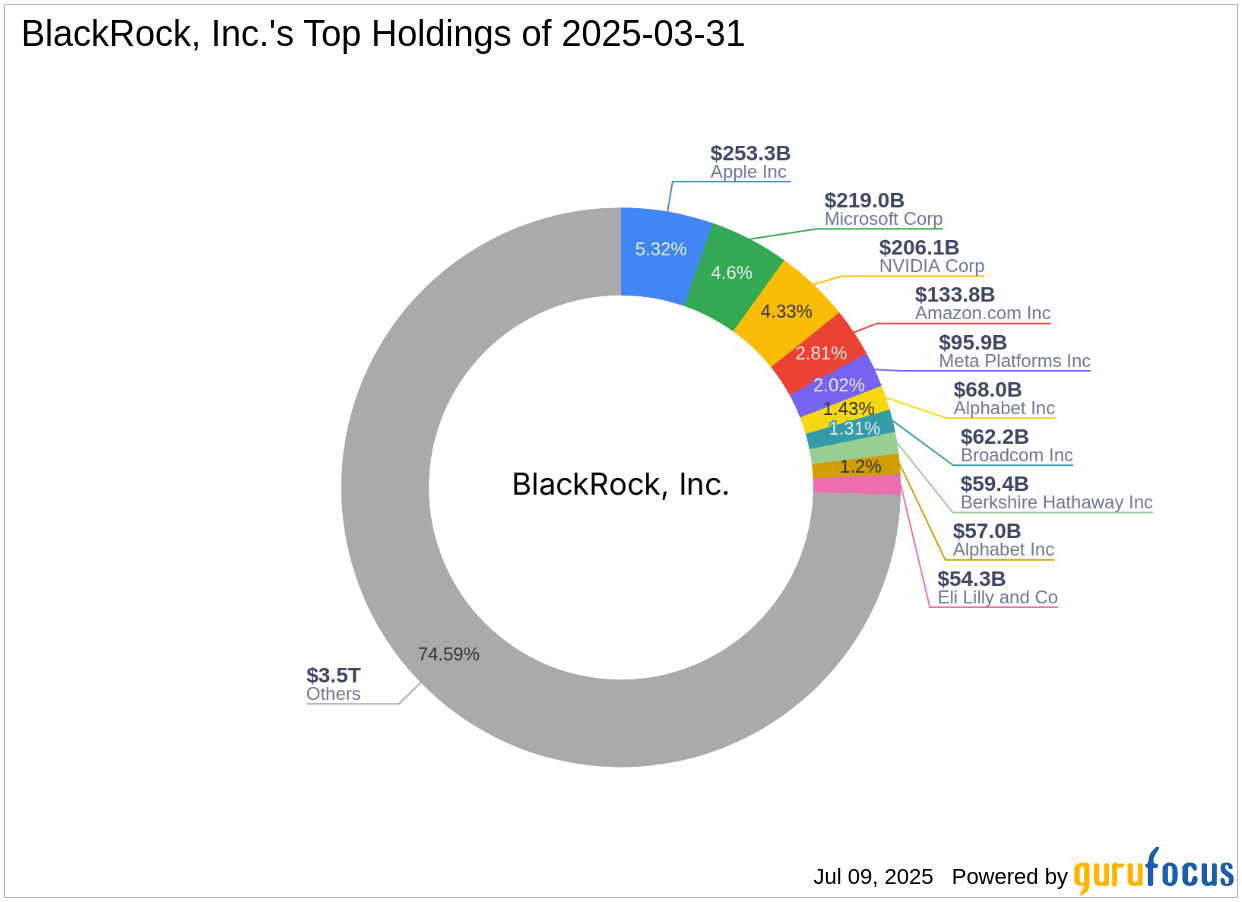

BlackRock, Inc. (Trades, Portfolio): A Profile of the Investment Giant

Headquartered at 50 Hudson Yards, New York, NY, BlackRock, Inc. (Trades, Portfolio) is a leading investment firm renowned for its diversified portfolio. The firm holds significant positions in major technology companies, including Apple Inc. (AAPL, Financial) and Amazon.com Inc. (AMZN, Financial), among others. With an equity value of $4,758.45 trillion, BlackRock's top sectors include technology and financial services, showcasing its strategic focus on high-growth industries.

An Overview of Polaris Inc.

Polaris Inc., trading under the symbol PII, is a USA-based company that specializes in designing and manufacturing off-road vehicles, snowmobiles, and motorcycles. With a market capitalization of $2.65 billion, Polaris is considered significantly undervalued, boasting a GF Value of $73.46. The company has expanded its market presence by entering the marine segment through the acquisition of Boat Holdings in 2018. Polaris products are distributed through an extensive network of over 2,500 dealers in North America and 1,500 international dealers, along with more than 25 subsidiaries and 90 distributors in over 100 countries.

Impact of the Transaction on BlackRock's Portfolio

The acquisition of additional shares in Polaris Inc. by BlackRock, Inc. (Trades, Portfolio) is a strategic move to increase its stake in a company with significant undervaluation potential. Despite the increase in shares, the transaction had a 0% impact on BlackRock's overall portfolio, indicating a well-balanced investment strategy. The current stock price of Polaris Inc. is $47.12, with a price-to-GF Value ratio of 0.64, further highlighting its undervaluation.

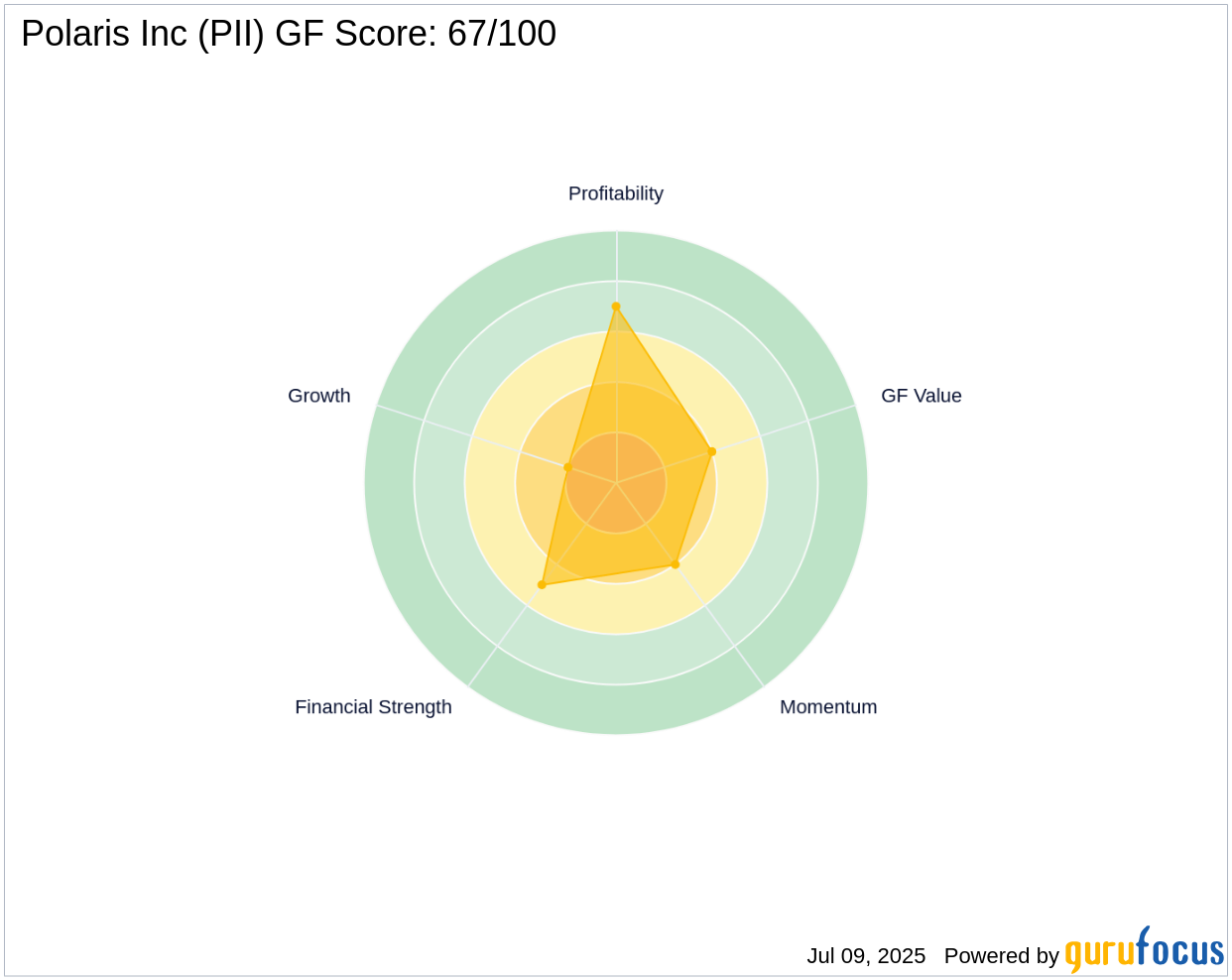

Financial Metrics and Valuation of Polaris Inc.

Polaris Inc. presents a mixed financial outlook. The company has a GF Score of 67/100, suggesting poor future performance potential. Its profitability rank is 7/10, while its growth rank is 2/10, reflecting challenges in growth and profitability. The year-to-date price change is -16.42%, and the 3-year revenue growth is 2.10%, indicating modest growth prospects.

Performance and Growth Indicators

Polaris Inc. has faced challenges in maintaining robust growth and profitability. The company's operating margin growth has declined by -8.40%, and its EBITDA growth over three years is -11.20%. Despite these challenges, Polaris maintains a profitability rank of 7/10, suggesting some resilience in its core operations.

Other Notable Investors in Polaris Inc.

Besides BlackRock, Inc. (Trades, Portfolio), other prominent investors in Polaris Inc. include Joel Greenblatt (Trades, Portfolio) and Jefferies Group (Trades, Portfolio). Hotchkis & Wiley Capital Management LLC holds the largest share of Polaris Inc., indicating strong interest from various investment firms in the company's potential.

Conclusion: A Strategic Move by BlackRock, Inc. (Trades, Portfolio)

The recent acquisition of Polaris Inc. shares by BlackRock, Inc. (Trades, Portfolio) underscores a strategic move to increase its stake in a company with significant undervaluation potential. Despite the challenges faced by Polaris Inc., its current valuation and the involvement of prominent investment firms make it an attractive prospect for value investors. As BlackRock continues to diversify its portfolio, this transaction highlights its commitment to identifying and capitalizing on undervalued opportunities in the market.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.