On June 30, 2025, BlackRock, Inc. (Trades, Portfolio) executed a notable transaction involving Guidewire Software Inc (GWRE, Financial), reducing its holdings by 1,972,055 shares. This move represents a significant change of -18.65% in BlackRock's position in the company. The transaction was carried out at a traded price of $235.45 per share, leaving BlackRock with a total of 8,602,251 shares in Guidewire Software. This adjustment now constitutes 0.04% of BlackRock's extensive portfolio, reflecting a minimal impact of -0.01 on the firm's overall holdings.

BlackRock, Inc. (Trades, Portfolio): A Profile of the Investment Giant

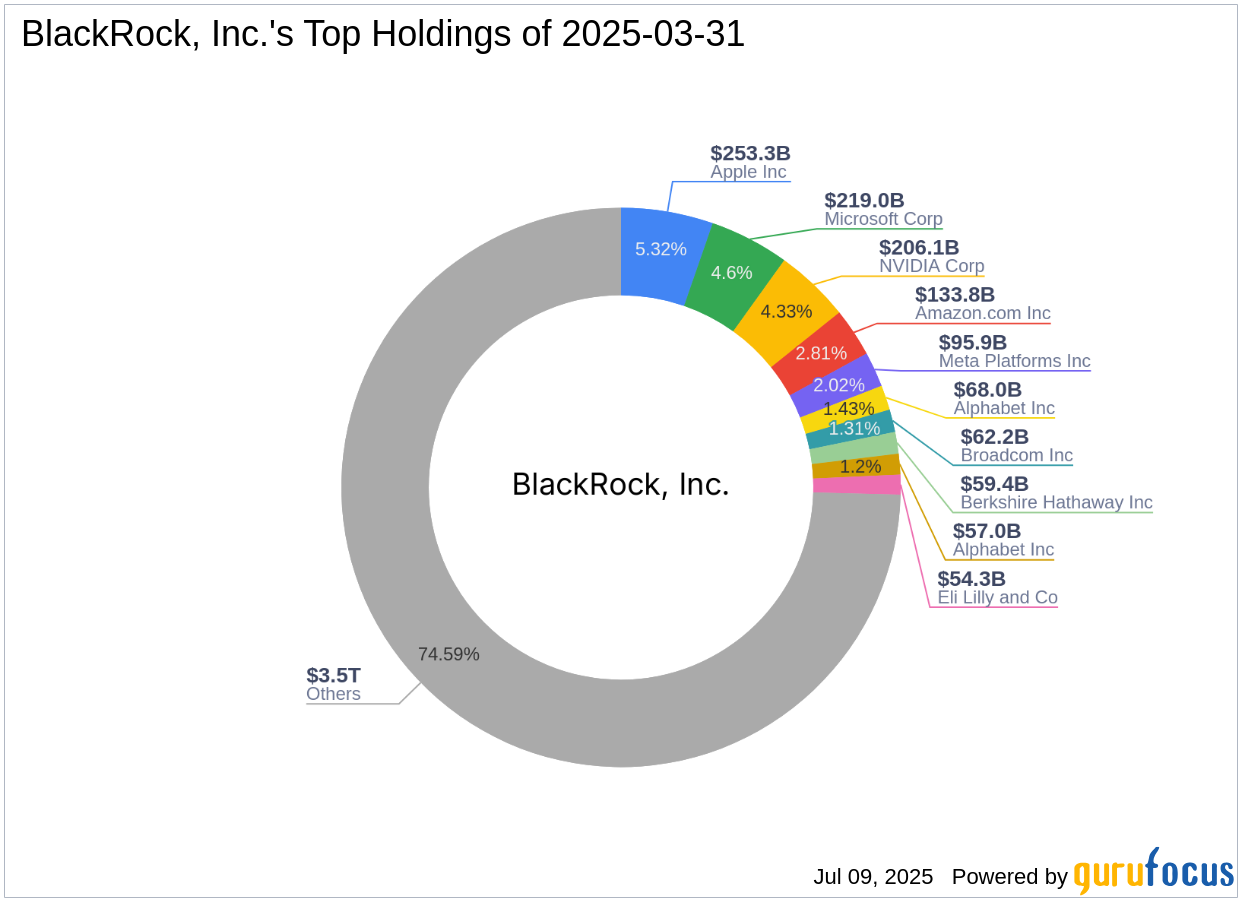

BlackRock, Inc. (Trades, Portfolio), headquartered at 50 Hudson Yards, New York, NY, is a leading investment firm with a substantial equity of $4,758.45 trillion. Known for its focus on technology and financial services, BlackRock's investment philosophy is reflected in its top holdings, which include major companies such as Apple Inc (AAPL, Financial), Amazon.com Inc (AMZN, Financial), Meta Platforms Inc (META, Financial), Microsoft Corp (MSFT, Financial), and NVIDIA Corp (NVDA, Financial). These strategic investments underscore BlackRock's commitment to sectors that drive innovation and growth.

Guidewire Software Inc: An Overview

Guidewire Software, based in the USA, specializes in providing software solutions for property and casualty insurers. The company's flagship product, InsuranceSuite, is an on-premises system of record that includes ClaimCenter, PolicyCenter, and BillingCenter, catering to claims management, policy management, and billing management, respectively. Guidewire also offers InsuranceNow, a cloud-based solution, along with various add-on applications. Since its IPO in 2012, Guidewire has grown to a market capitalization of $19.4 billion, positioning itself as a significant player in the software industry.

Financial Metrics and Valuation of Guidewire Software

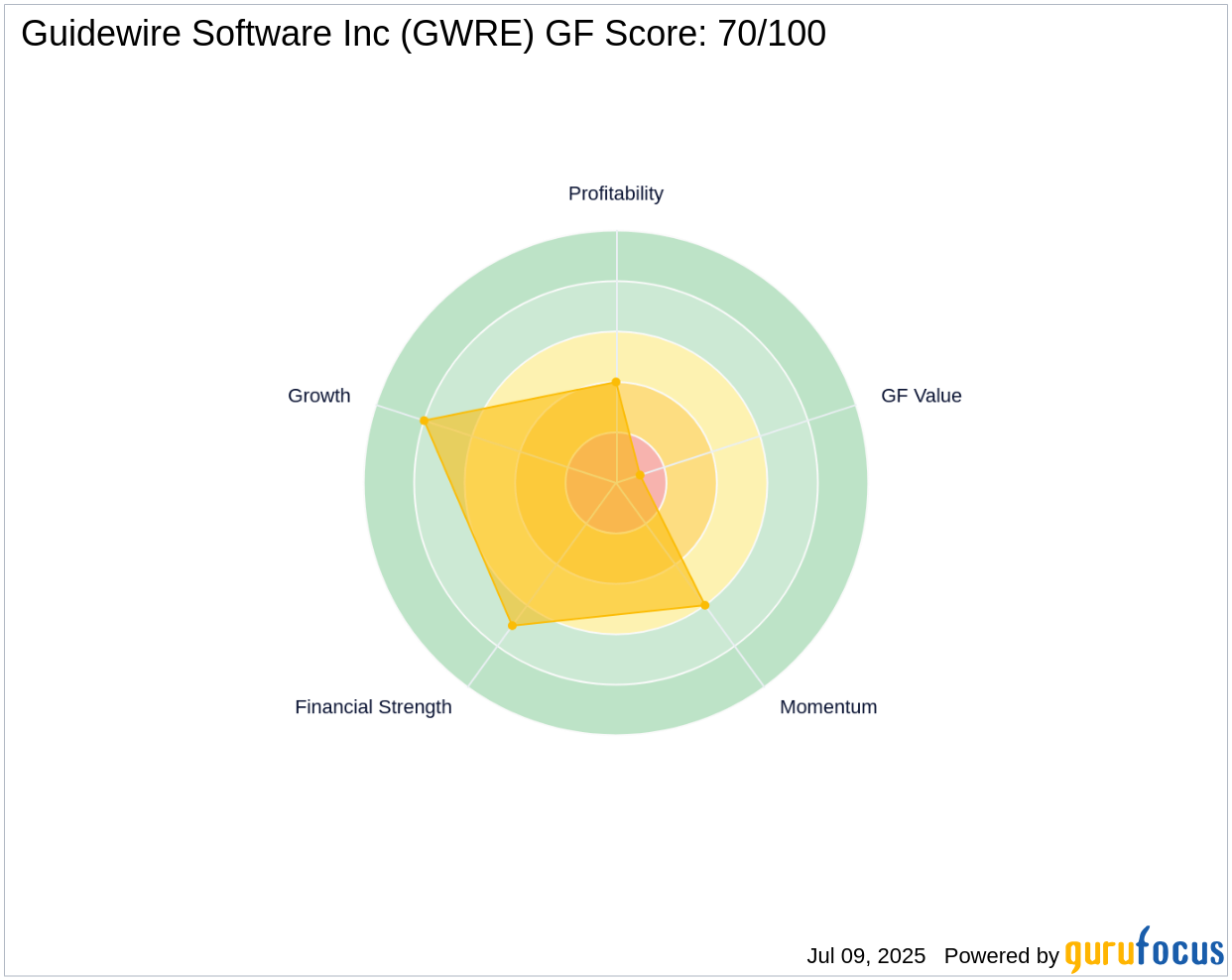

Guidewire Software is currently trading at $230.39, with a price-to-earnings (PE) ratio of 575.98, indicating a significant overvaluation compared to its GF Value of $126.22. The stock's GF Score of 70/100 suggests poor future performance potential. Despite this, the company maintains a solid Balance Sheet Rank of 7/10, reflecting its financial strength. However, the high valuation and modest growth indicators may pose challenges for future performance.

Impact of the Transaction on BlackRock’s Portfolio

Following the transaction, Guidewire Software now represents a minor portion of BlackRock's portfolio, accounting for just 0.04%. The firm's decision to reduce its stake by 1,972,055 shares reflects a strategic adjustment, with the current holding of 8,602,251 shares. This move had a negligible impact on BlackRock's overall portfolio, with a change of -0.01, indicating a calculated decision to optimize its investment strategy.

Market Performance and Growth Indicators

Guidewire Software has demonstrated a year-to-date price change of 35.92% and an impressive price gain of 1,275.46% since its IPO. The company has achieved a revenue growth of 10.20% over the past three years, coupled with an earnings growth of 40.20% in the same period. These growth metrics highlight Guidewire's ability to expand its market presence and enhance its financial performance, despite the challenges posed by its current valuation.

Other Notable Investors in Guidewire Software

In addition to BlackRock, other prominent investors in Guidewire Software include Joel Greenblatt (Trades, Portfolio) and Jefferies Group (Trades, Portfolio). Notably, Baron Funds holds the largest share percentage among the gurus invested in Guidewire Software, underscoring the company's appeal to a diverse range of institutional investors. This broad interest reflects confidence in Guidewire's strategic direction and potential for long-term growth.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.