- Kura Sushi USA, Inc. (KRUS, Financial) reports third-quarter sales of $74 million.

- Strategic expansion plans include opening 15 new locations.

- Analysts suggest an average target price of $78.44, with a recommendation to "Outperform".

Kura Sushi USA, Inc. (KRUS) has announced its third-quarter financial results, revealing sales totalling $74 million. Despite a slight dip in comparable sales by 2.1%, the company remains focused on a robust expansion strategy. In an ambitious move, Kura Sushi plans to open 15 new establishments, thereby elevating its annual unit growth to surpass 20%. Additionally, strategic intellectual property collaborations are anticipated to bolster future growth prospects.

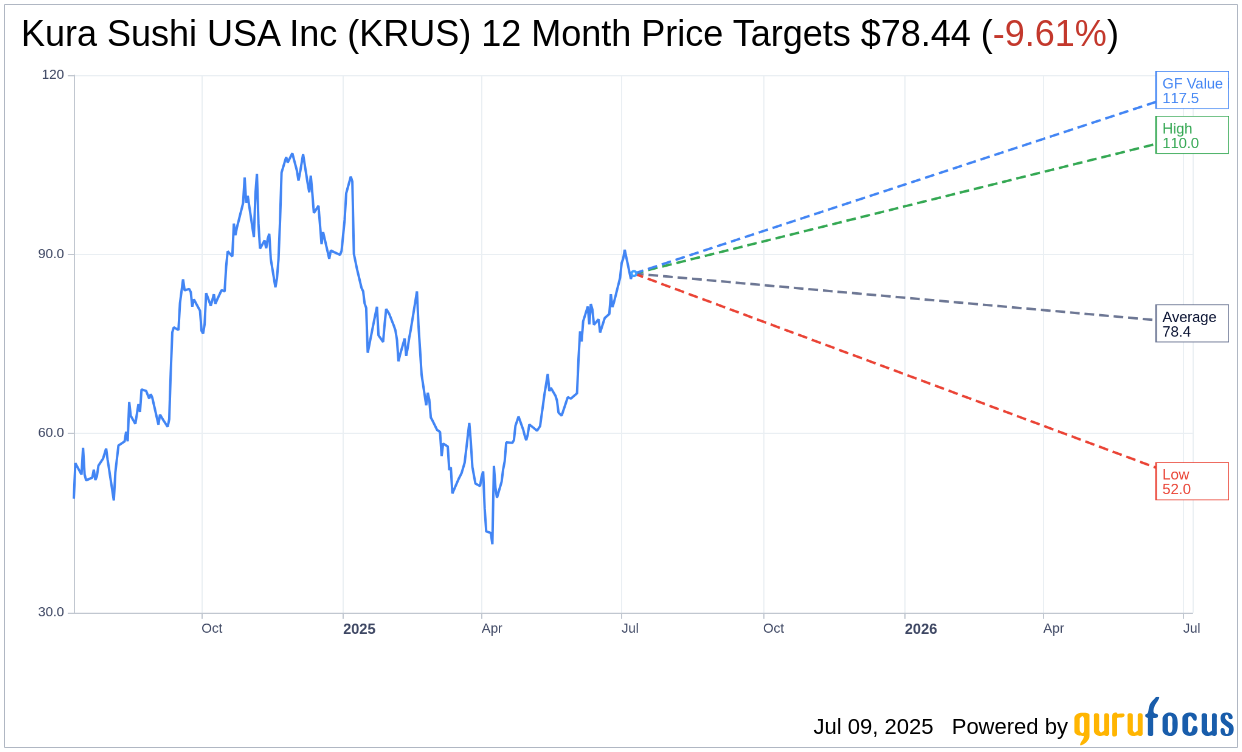

Wall Street Analysts Forecast

Analyst projections for Kura Sushi USA Inc (KRUS, Financial) over the next year indicate an average target price of $78.44. The estimates range from a high of $110.00 to a low of $52.00. This average target suggests a potential downside of 9.61% from the current trading price of $86.78. For more comprehensive estimates, please visit the Kura Sushi USA Inc (KRUS) Forecast page.

The company holds an "Outperform" rating according to the consensus from 10 brokerage firms, with an average recommendation score of 2.2 on a scale where 1 equates to a Strong Buy and 5 to a Sell. This underscores market confidence in Kura Sushi's potential to exceed expectations.

In terms of valuation, GuruFocus estimates the one-year GF Value for Kura Sushi USA Inc (KRUS, Financial) to be $117.53, indicating a significant upside of 35.43% from the current price of $86.78. The GF Value is calculated using historical trading multiples in combination with past business growth and forecasted future performance. Further insights are available on the Kura Sushi USA Inc (KRUS) Summary page.