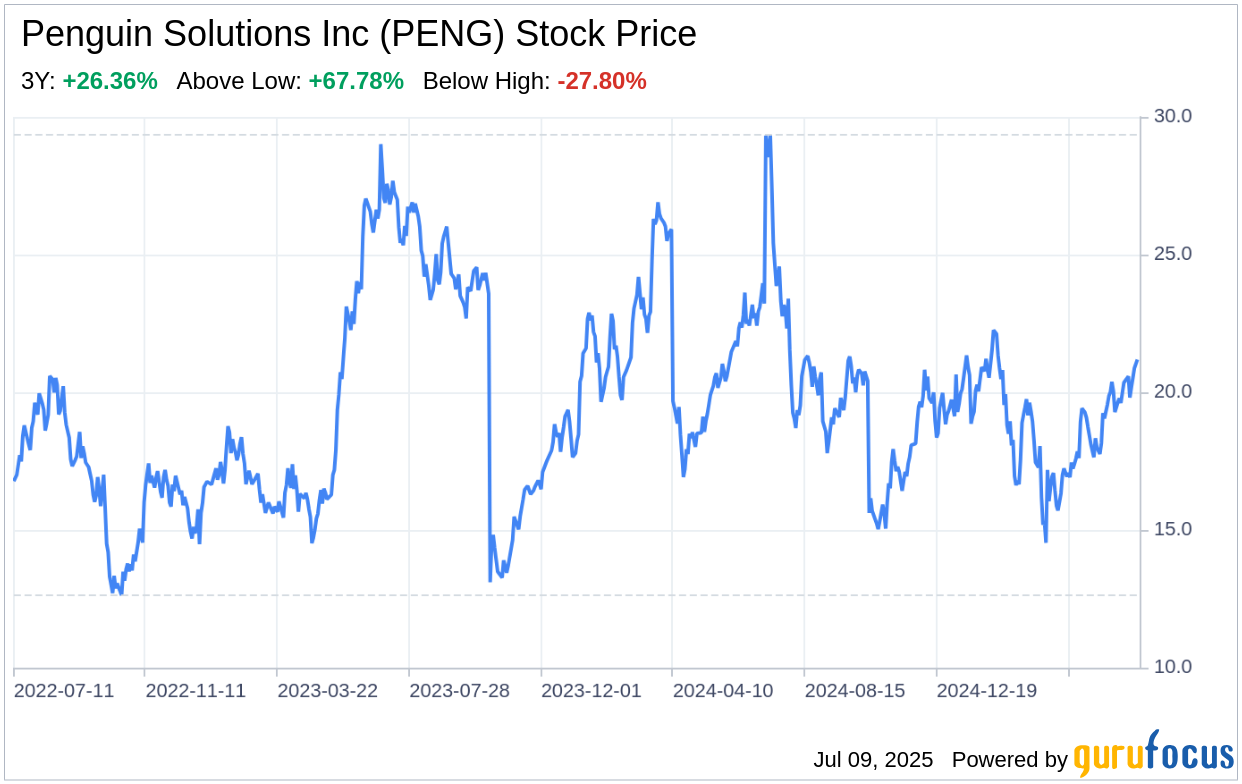

On July 8, 2025, Penguin Solutions Inc (PENG, Financial), a leading end-to-end technology company, filed its 10-Q report, revealing a detailed financial performance and strategic positioning. The company, known for its Intelligent Platform Solutions, Integrated Memory, and Optimized LED business, has reported a significant increase in net sales, up 19.9% for the nine months ended May 30, 2025, compared to the same period in the previous year. This financial overview indicates a strong market presence and an upward trajectory in Penguin Solutions Inc's business operations. As we delve into a SWOT analysis, we will explore the strengths, weaknesses, opportunities, and threats that shape the company's current and future landscape.

Strengths

Product Diversification and Revenue Growth: Penguin Solutions Inc's diverse product range, including AMD and Intel-based Servers, Scyld ClusterWare, and OCP HPC & AI systems, has contributed to its robust revenue growth. The company's net sales have increased significantly, with product sales in the Integrated Memory segment rising by 27.4% in the first nine months of 2025. This growth is indicative of the company's ability to meet market demand and adapt to changing technology trends.

Strategic Acquisitions: Penguin Solutions Inc has successfully expanded its market reach and capabilities through strategic acquisitions. The integration of companies such as Cree LED and Stratus Technologies has not only broadened the company's product portfolio but also enhanced its technological expertise, positioning it as a leader in the technology sector.

Weaknesses

Supply Chain Vulnerabilities: Despite its strong market position, Penguin Solutions Inc faces challenges in its supply chain. The reliance on third-party suppliers for key components, such as DRAM and AI components, exposes the company to potential disruptions. The global semiconductor shortage has already impacted the company's operating results, highlighting the need for a more resilient supply chain strategy.

Competitive Pressures: The technology industry is highly competitive, with rapid innovation cycles. Penguin Solutions Inc must continuously invest in research and development to maintain its competitive edge. The company's R&D expenses have remained substantial, indicating the pressure to innovate and keep pace with competitors.

Opportunities

Market Expansion: Penguin Solutions Inc has the opportunity to further expand its market presence, particularly in emerging markets and sectors such as AI data center infrastructure. The agreement with SKT to provide solutions for AI data center initiatives represents a significant opportunity for growth and expansion.

Product Innovation: The company's focus on product innovation, especially in the areas of AI and high-performance computing, positions it to capitalize on the growing demand for advanced technology solutions. By continuing to develop cutting-edge products, Penguin Solutions Inc can secure a larger market share and drive future revenue growth.

Threats

Global Economic Uncertainty: Penguin Solutions Inc operates in a global market that is subject to economic fluctuations and geopolitical tensions. Factors such as trade policies, tariffs, and interest rates can adversely affect the company's financial performance and operational success.

Technological Disruption: The rapid pace of technological change presents a threat to Penguin Solutions Inc's existing product lines. The company must stay ahead of disruptive technologies to avoid obsolescence and ensure long-term sustainability.

In conclusion, Penguin Solutions Inc (PENG, Financial) demonstrates a strong financial performance with significant revenue growth and a diversified product portfolio. The company's strategic acquisitions have strengthened its market position, but it must address supply chain vulnerabilities and competitive pressures to maintain its momentum. Opportunities for market expansion and product innovation are abundant, yet global economic uncertainty and technological disruption pose potential risks. By leveraging its strengths and addressing its weaknesses, Penguin Solutions Inc is well-positioned to capitalize on opportunities and navigate the threats in the dynamic technology industry.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.