Key Takeaways:

- Super Micro Computer (SMCI, Financial) aims to expand its manufacturing capabilities in Europe due to rising AI demand.

- Analysts predict a potential downside in stock price, but GuruFocus estimates a significant upside in GF Value.

- Wall Street's consensus recommendation for SMCI is currently "Hold."

Super Micro Computer Inc (SMCI) is strategically enhancing its manufacturing footprint in Europe to cater to the surging demand for artificial intelligence technology. CEO Charles Liang emphasized the rapid expansion within this market and has announced plans for additional production facilities in the region. This decision comes on the back of Super Micro Computer’s solid revenue growth in the first fiscal quarter, although earnings fell short of Wall Street expectations, largely due to postponed orders as customers await Nvidia's latest AI GPUs.

Wall Street Analysts Forecast

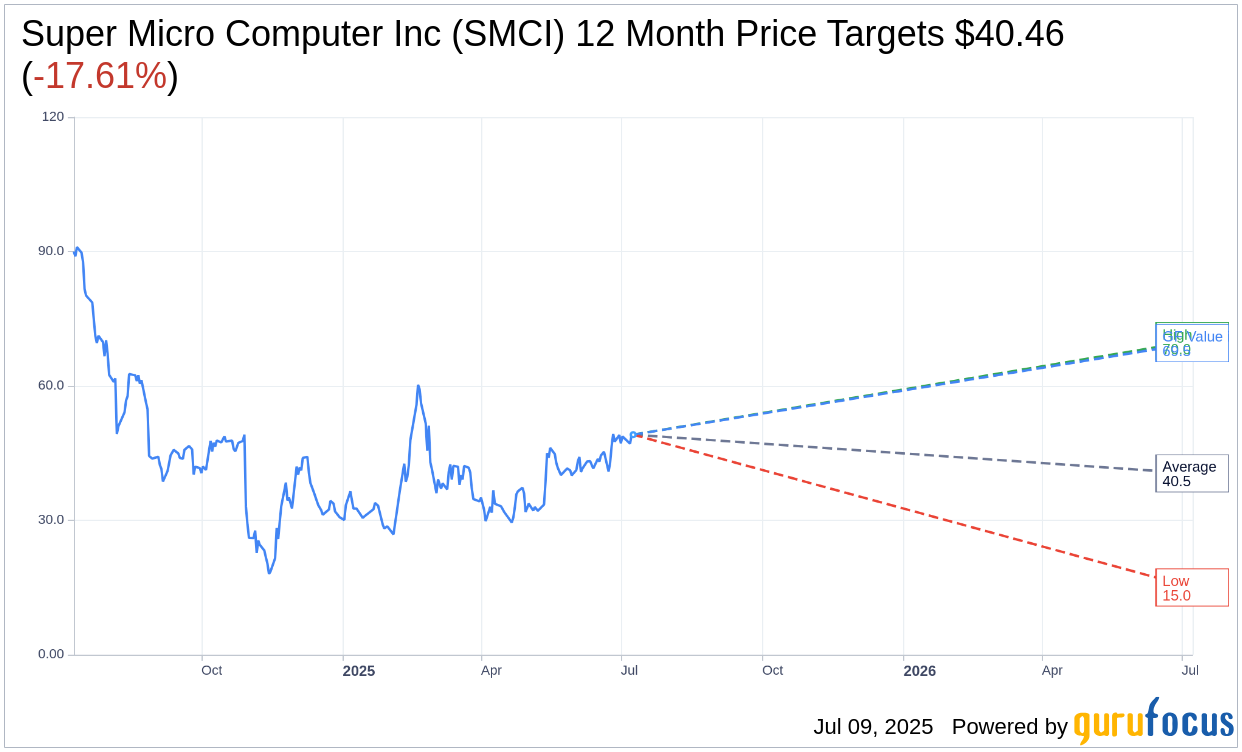

According to projections by 15 analysts, the average one-year price target for Super Micro Computer Inc (SMCI, Financial) is $40.46. The estimates range from a high of $70.00 to a low of $15.00, suggesting a potential downside of 17.61% from its current trading price of $49.11. Investors seeking detailed estimate data can access the Super Micro Computer Inc (SMCI) Forecast page.

The combined insights from 17 brokerage firms position Super Micro Computer Inc (SMCI, Financial) with an average brokerage recommendation of 2.7, classifying it under a "Hold" status on the rating scale. This scale spans from 1, indicating a Strong Buy, to 5, signaling a Sell.

From a valuation perspective, GuruFocus estimates that the GF Value of Super Micro Computer Inc (SMCI, Financial) is estimated to be $69.53 within a year. This estimate heralds a promising upside of 41.58% from its latest price of $49.11. The GF Value represents GuruFocus' calculated fair value for the stock, derived from historical trading multiples, past business performance, and future business projections. For a deeper dive into these metrics, visit the Super Micro Computer Inc (SMCI) Summary page.