Charles River Laboratories (CRL, Financial) has been upgraded by Citi analyst Patrick Donnelly from a Neutral to a Buy rating. Donnelly has also raised the stock's price target from $150 to $200. This change reflects a belief in the conservative nature of Charles River’s predictions for the second half of 2025, along with comfort in the company's current 2026 estimates. Additionally, the company's strategic review process and activist involvement are expected to support the shares' valuation, providing a stable outlook for investors.

Wall Street Analysts Forecast

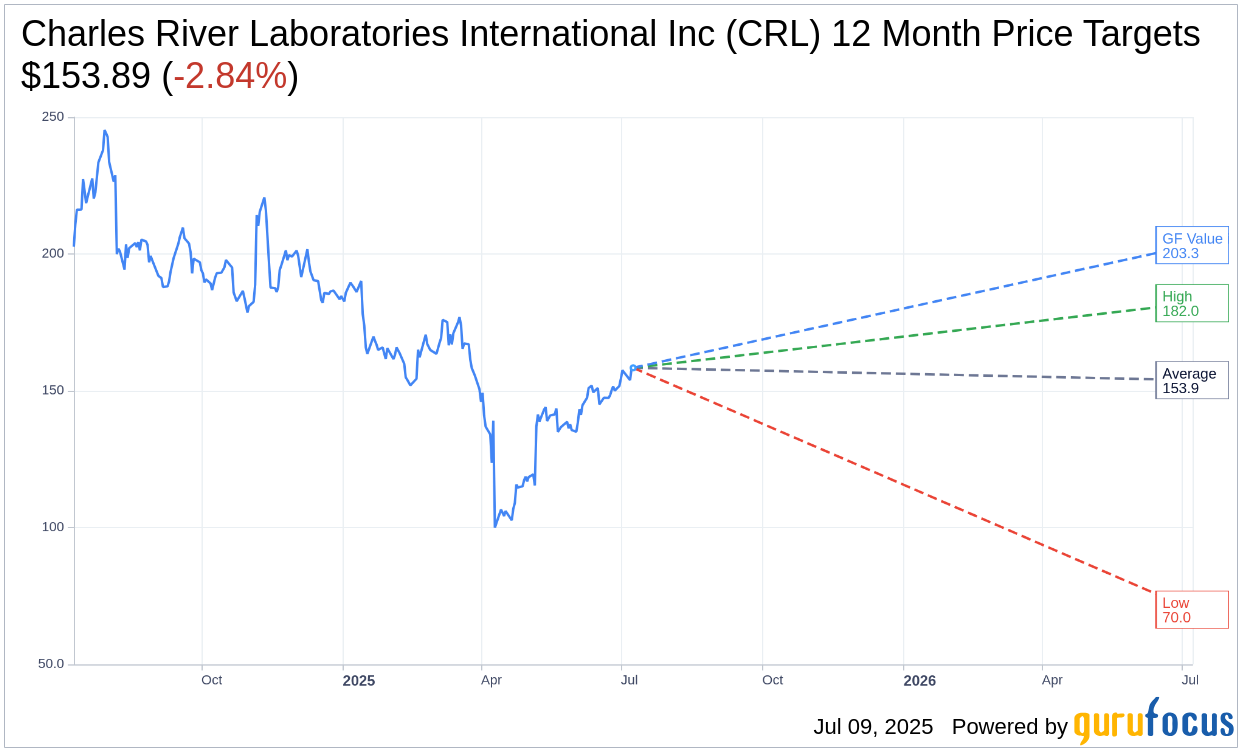

Based on the one-year price targets offered by 14 analysts, the average target price for Charles River Laboratories International Inc (CRL, Financial) is $153.89 with a high estimate of $182.00 and a low estimate of $70.00. The average target implies an downside of 2.84% from the current price of $158.39. More detailed estimate data can be found on the Charles River Laboratories International Inc (CRL) Forecast page.

Based on the consensus recommendation from 19 brokerage firms, Charles River Laboratories International Inc's (CRL, Financial) average brokerage recommendation is currently 2.8, indicating "Hold" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Charles River Laboratories International Inc (CRL, Financial) in one year is $203.26, suggesting a upside of 28.33% from the current price of $158.39. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Charles River Laboratories International Inc (CRL) Summary page.

CRL Key Business Developments

Release Date: May 07, 2025

- Revenue: $984.2 million in Q1 2025, a 2.7% decrease year-over-year.

- Organic Revenue Decline: 1.8% decrease driven by low single-digit declines in all business segments.

- Operating Margin: 19.1%, an increase of 60 basis points year-over-year.

- Earnings Per Share (EPS): $2.34, a 3.1% increase from Q1 2024.

- DSA Revenue: $592.6 million, a 1.4% organic decrease.

- RMS Revenue: $213.1 million, a 2.5% organic decrease.

- Manufacturing Revenue: $178.5 million, a 2.2% organic decrease.

- Free Cash Flow: $112.4 million in Q1 2025, up from $50.7 million in Q1 2024.

- Capital Expenditures (CapEx): $59.3 million, approximately 6% of revenue.

- Net Book-to-Bill Ratio: 1.04 times in Q1 2025.

- Debt: $2.5 billion at the end of Q1 2025.

- Gross Leverage: 2.5 times.

- Net Leverage: 2.4 times.

- 2025 Revenue Guidance: Organic revenue expected to decline 2.5% to 4.5%.

- 2025 EPS Guidance: $9.30 to $9.80.

- Cost Savings: Over $175 million expected in 2025, approximately $225 million in 2026.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Charles River Laboratories International Inc (CRL, Financial) reported better-than-expected DSA performance, leading to a modest increase in financial guidance for the year.

- The company saw a return to a net book-to-bill ratio above 1 for the first time in over two years, indicating improved quarterly bookings.

- Operating margin increased by 60 basis points year-over-year, driven by cost savings from restructuring initiatives.

- Earnings per share rose by 3.1% from the first quarter of last year, supported by operating margin improvement and reductions in tax rate and interest expense.

- Charles River Laboratories International Inc (CRL) is actively investing in New Approach Methods (NAMs) and has a growing portfolio of capabilities in this area, positioning itself as a leader in preclinical drug development.

Negative Points

- Revenue for the first quarter of 2025 decreased by 2.7% compared to the previous year, with an organic decline of 1.8%.

- The company faces uncertainty due to government funding cuts, particularly at the NIH and FDA, and a slower start for biotech funding.

- RMS revenue declined by 2.5% on an organic basis, impacted by the timing of NHP shipments in China and lower revenue for the Cell Solutions business.

- The manufacturing segment's operating margin declined by 220 basis points due to lower commercial revenue in the CDMO business.

- The company is cautious about the second half of the year, with no assumption of a similar bookings tailwind benefiting revenue as seen in the first quarter.