Parsons Corporation (PSN, Financial) is enhancing its production capabilities through a strategic partnership with NCS Technologies. The collaboration focuses on Sealing Technologies, a division of Parsons, to develop Cyber Hunt Kits for the U.S. Department of Defense (DoD). By integrating NCS's ability to produce large quantities of standardized base nodes, SealingTech aims to scale and streamline its server manufacturing process.

This partnership is designed to meet the dynamic requirements of the DoD while optimizing production efficiency. The alliance is expected to significantly reduce internal assembly times and allow for a swift scale-up in production, aligning with the ever-changing demands of their mission. This move underscores Parsons' commitment to providing advanced technological solutions for defense applications.

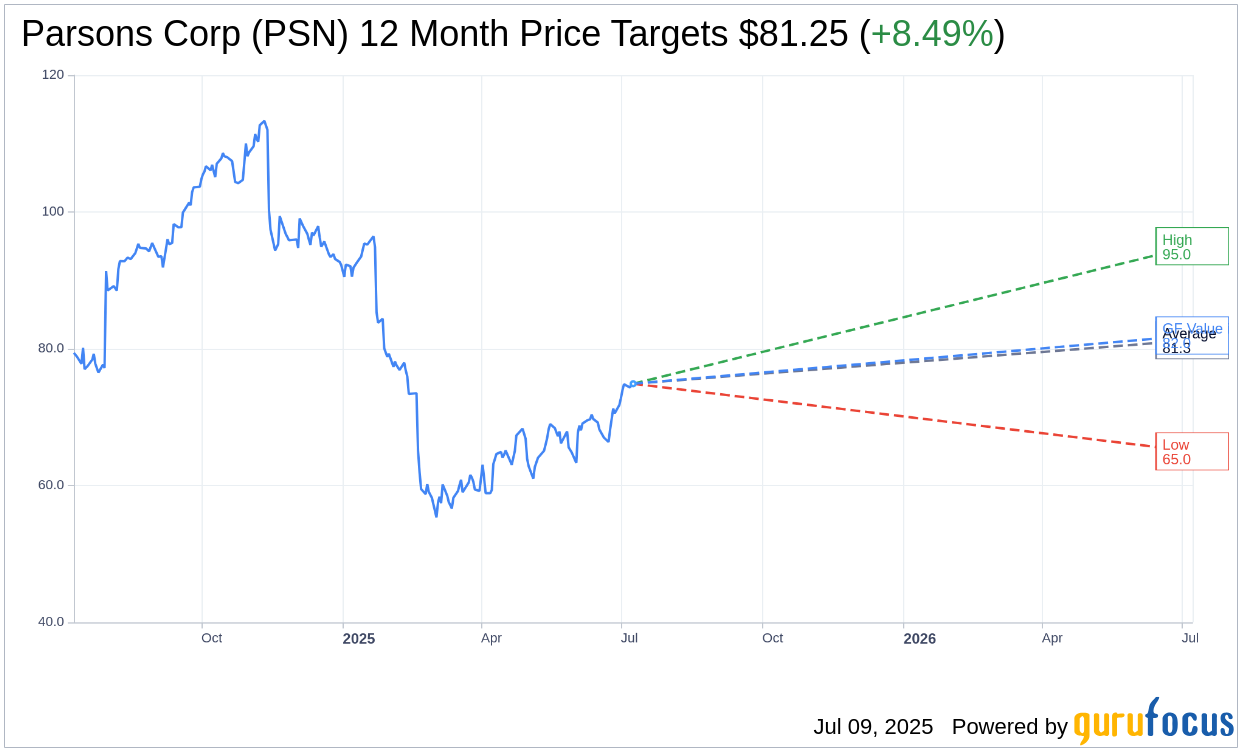

Wall Street Analysts Forecast

Based on the one-year price targets offered by 10 analysts, the average target price for Parsons Corp (PSN, Financial) is $81.25 with a high estimate of $95.00 and a low estimate of $65.00. The average target implies an upside of 8.49% from the current price of $74.89. More detailed estimate data can be found on the Parsons Corp (PSN) Forecast page.

Based on the consensus recommendation from 12 brokerage firms, Parsons Corp's (PSN, Financial) average brokerage recommendation is currently 2.3, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Parsons Corp (PSN, Financial) in one year is $81.95, suggesting a upside of 9.43% from the current price of $74.89. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Parsons Corp (PSN) Summary page.

PSN Key Business Developments

Release Date: April 30, 2025

- Total Revenue: $1.6 billion, a 1% increase over the prior year period.

- Organic Revenue Growth: 2% decline; excluding confidential contract, 7% growth.

- Adjusted EBITDA: $149 million, a 5% increase from the prior year.

- Adjusted EBITDA Margin: 9.6%, a 40 basis point increase.

- Net Income: Record first quarter net income achieved.

- Book to Bill Ratio: 1.1 times on an enterprise basis; 1.4 times in critical infrastructure.

- Backlog: Total backlog of $9.1 billion, a company record.

- Operating Cash Flow: $52 million year-over-year improvement.

- G&A Expenses: 15.7% of total revenue, increased from 14.4% in the prior year period.

- Capital Expenditures: $13 million in the first quarter.

- Free Cash Flow Conversion: 125% on a trailing 12-month basis.

- Net Debt Leverage Ratio: 1.6 times.

- Share Repurchase: $25 million in Q1, with $225 million remaining under authorization.

- Federal Solutions Revenue: Decreased 7%; excluding confidential contract, increased 8%.

- Critical Infrastructure Revenue: Increased 14%, driven by 8% organic growth.

- Guidance for 2025: Revenue between $7.0 billion and $7.5 billion; adjusted EBITDA between $640 million and $710 million.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Parsons Corp (PSN, Financial) achieved record first-quarter results for total revenue, net income, earnings per share, adjusted EBITDA, and adjusted EBITDA margin.

- Total backlog and funded backlog are at all-time highs, indicating strong future revenue potential.

- The company reported a significant year-over-year improvement in operating cash flow by $52 million.

- Parsons Corp (PSN) achieved a book-to-bill ratio of 1.1 times, with a particularly strong 1.4 times in the critical infrastructure segment.

- The company is capitalizing on unprecedented infrastructure spending in North America and the Middle East, positioning itself well for long-term growth.

Negative Points

- A confidential Federal contract is operating at a reduced volume due to a Presidential Executive Order, impacting revenue.

- Federal Solutions segment revenue decreased by 7% from the prior year period, with a 9% decline on an organic basis.

- General and administrative expenses increased by 10% from the prior year period, impacting profitability.

- The company faces challenges with contract mix, affecting Federal Solutions adjusted EBITDA margin, which decreased by 120 basis points.

- There is uncertainty regarding the continuation and volume of the confidential contract, which could impact future financial performance.