Candel Therapeutics (CADL, Financial) has been included in several Russell indexes following the 2025 annual reconstitution of the Russell US Indexes, effective from June 30, 2025. The company is now part of the Russell 2500 Value Index, Russell Small Cap Value Index, Russell 2000 Value Index, Russell Microcap Value Index, and Russell 3000E Value Index. Additionally, CADL continues to be a part of the broad-market Russell 3000 Index, where it has been listed since 2024.

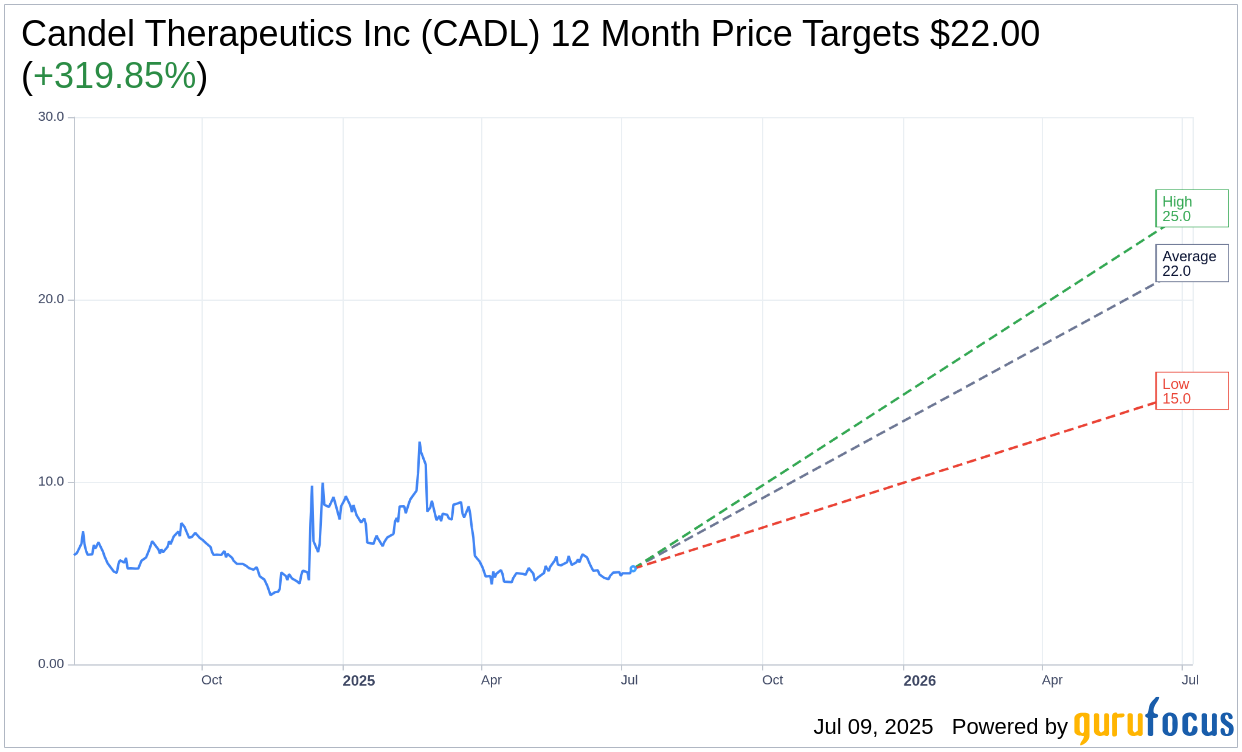

Wall Street Analysts Forecast

Based on the one-year price targets offered by 4 analysts, the average target price for Candel Therapeutics Inc (CADL, Financial) is $22.00 with a high estimate of $25.00 and a low estimate of $15.00. The average target implies an upside of 319.85% from the current price of $5.24. More detailed estimate data can be found on the Candel Therapeutics Inc (CADL) Forecast page.

Based on the consensus recommendation from 4 brokerage firms, Candel Therapeutics Inc's (CADL, Financial) average brokerage recommendation is currently 1.5, indicating "Buy" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Candel Therapeutics Inc (CADL, Financial) in one year is $0.80, suggesting a downside of 84.73% from the current price of $5.24. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Candel Therapeutics Inc (CADL) Summary page.