BK Technologies, symbolized as BKTI, has announced that Stephen Theisen will assume the role of Senior Vice President and General Manager for their Land Mobile Radio division. Reporting directly to CEO John Suzuki, Theisen will be responsible for steering the sales, marketing, operations, and customer service for this segment. Having joined BK Technologies in 2017, Theisen has held several key positions in sales and marketing, rising through the ranks since starting as the Northwest Regional Sales Manager. His most recent achievement includes leading the sales and marketing team to a record-breaking year in 2024. Theisen will be relocating to the company's headquarters in Melbourne, Florida, to undertake his new responsibilities.

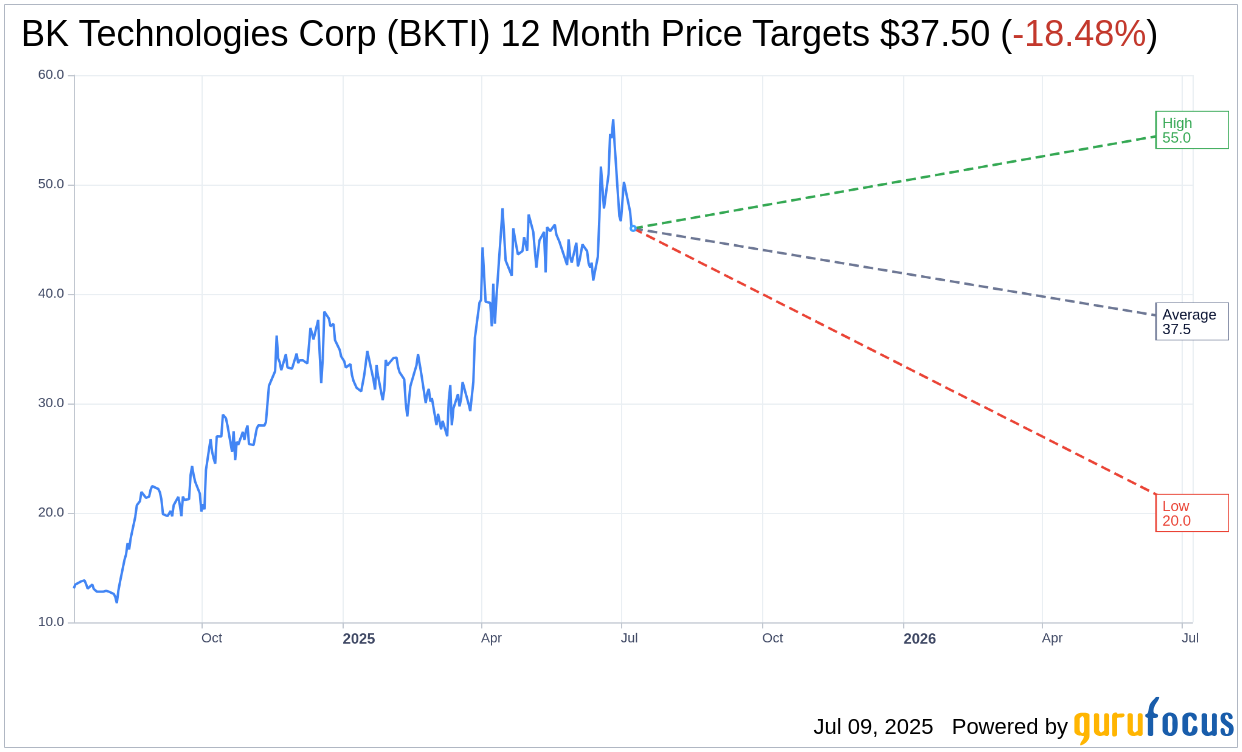

Wall Street Analysts Forecast

Based on the one-year price targets offered by 2 analysts, the average target price for BK Technologies Corp (BKTI, Financial) is $37.50 with a high estimate of $55.00 and a low estimate of $20.00. The average target implies an downside of 18.48% from the current price of $46.00. More detailed estimate data can be found on the BK Technologies Corp (BKTI) Forecast page.

Based on the consensus recommendation from 1 brokerage firms, BK Technologies Corp's (BKTI, Financial) average brokerage recommendation is currently 2.0, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for BK Technologies Corp (BKTI, Financial) in one year is $20.01, suggesting a downside of 56.5% from the current price of $46. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the BK Technologies Corp (BKTI) Summary page.

BKTI Key Business Developments

Release Date: May 13, 2025

- Revenue: $19.1 million, a 4.5% increase year-over-year and a 6.3% increase sequentially.

- Gross Margin: 47%, up from 34.5% in Q1 2024 and 41.2% in Q4 2024.

- Net Income: $2.1 million or $0.55 per diluted share, compared to $681,000 or $0.19 per diluted share in Q1 2024.

- Non-GAAP Adjusted Earnings: $2.6 million or $0.68 per diluted share, compared to $1.1 million or $0.30 per diluted share in Q1 2024.

- Non-GAAP Adjusted EBITDA: $3.2 million, compared to $1.4 million in Q1 2024.

- SG&A Expenses: Approximately $6 million, up from $5.3 million in Q1 2024.

- Operating Income: $2.9 million, compared to $983,000 in Q1 2024.

- Backlog: $18.8 million as of March 31, 2025, compared to $19 million at the end of Q1 2024.

- Cash and Cash Equivalents: Approximately $8.9 million with no debt as of March 31, 2025.

- Working Capital: Improved to approximately $24.6 million as of March 31, 2025.

- Shareholders' Equity: Increased to $32.4 million from $29.8 million at December 31, 2024.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- BK Technologies Corp (BKTI, Financial) reported a strong start to 2025 with first-quarter revenue of $19.1 million, marking an increase both year over year and sequentially.

- The company achieved a significantly improved gross margin of 47%, driven by a shift to higher margin product mix and successful transition to a contract manufacturing model.

- BK Technologies Corp (BKTI) reported a net income of $2.1 million or $0.55 per diluted share, compared to $681,000 or $0.19 per diluted share in the first quarter of 2024.

- The company achieved its seventh consecutive quarter of profitability, with non-GAAP adjusted earnings of $2.6 million or $0.68 per diluted share.

- BK Technologies Corp (BKTI) maintained a strong balance sheet with approximately $8.9 million of cash and cash equivalents and no debt as of March 31, 2025.

Negative Points

- The uncertain macroeconomic environment, particularly regarding tariffs, poses potential risks to BK Technologies Corp (BKTI)'s financial performance.

- Products produced in Vietnam are now subject to a 10% tariff, which may rise to 46% if a trade deal is not reached, impacting cost structures.

- Less than 5% of product revenue comes from China, but a new 145% tariff has led to halted shipments and a costly transfer of production to Taiwan.

- Federal orders were light in the first quarter due to delays in Congress passing the continuing resolution to fund the government through 2025.

- Selling, general, and administrative expenses increased to approximately $6 million, up from $5.3 million in the same quarter last year, impacting operating income.