- Intel plans strategic share conversions and sales for Mobileye, aligning with updated positive forecasts.

- Analyst consensus shows optimism with a robust "Outperform" recommendation for Mobileye.

- GuruFocus projections indicate significant upside potential for Mobileye based on GF Value metrics.

Intel (INTC) is set to refine its stake in Mobileye (MBLY, Financial) by selling 45 million Class A shares and converting 50 million Class B shares to Class A. This move coincides with Mobileye's upward revision of its second-quarter guidance, surpassing analysts' estimates, and the announcement of a new supply agreement with TSMC. This strategic alignment led to a 2% increase in Mobileye's share price.

Wall Street Analysts' Projections

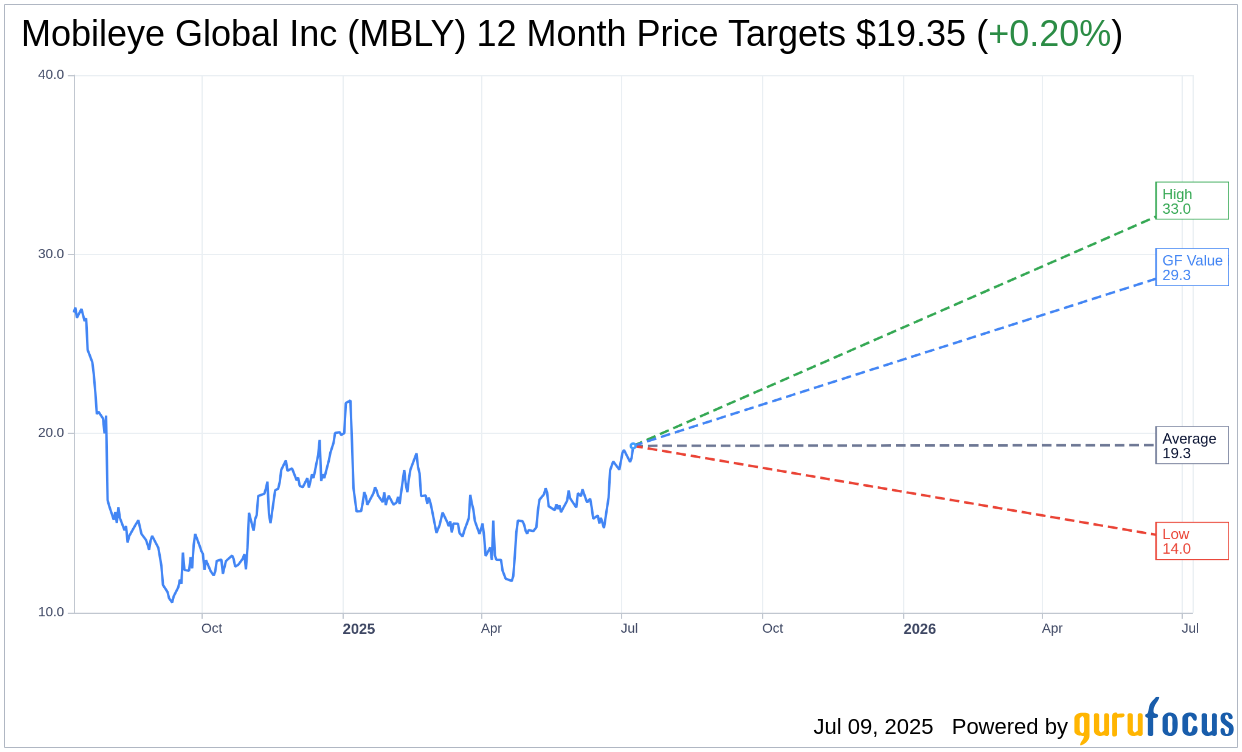

According to the forecasts from 26 analysts, the average price target for Mobileye Global Inc (MBLY, Financial) stands at $19.35. The highest estimate reaches $33.00, while the lowest is $14.00. This average target reflects a modest potential upside of 0.20% from Mobileye's current price of $19.31. For a comprehensive analysis, please visit the Mobileye Global Inc (MBLY) Forecast page.

The consensus from 27 brokerage firms positions Mobileye Global Inc (MBLY, Financial) with an average recommendation of 2.4, indicating an "Outperform" status. This rating suggests a positive outlook, with the scale ranging from 1 (Strong Buy) to 5 (Sell).

Valuation Insights from GuruFocus

GuruFocus provides insightful metrics with their estimated GF Value for Mobileye Global Inc (MBLY, Financial), projected at $29.29 in one year. This projection suggests a potential upside of 51.68% from the current trading price of $19.31. The GF Value metric is calculated using historical stock multiples, past business growth, and anticipated future performance. For further details, explore the Mobileye Global Inc (MBLY) Summary page.