Richardson Electronics (RELL, Financial) has entered into a worldwide partnership with Pakal Technologies, focusing on distributing advanced power switches. Through this collaboration, Richardson Electronics will offer Pakal's cutting-edge 650V and 1200V silicon-based power switches. These products are designed to significantly enhance efficiency for customers around the globe. This strategic alliance aims to deliver superior technology and energy solutions to meet the growing demand in various industries.

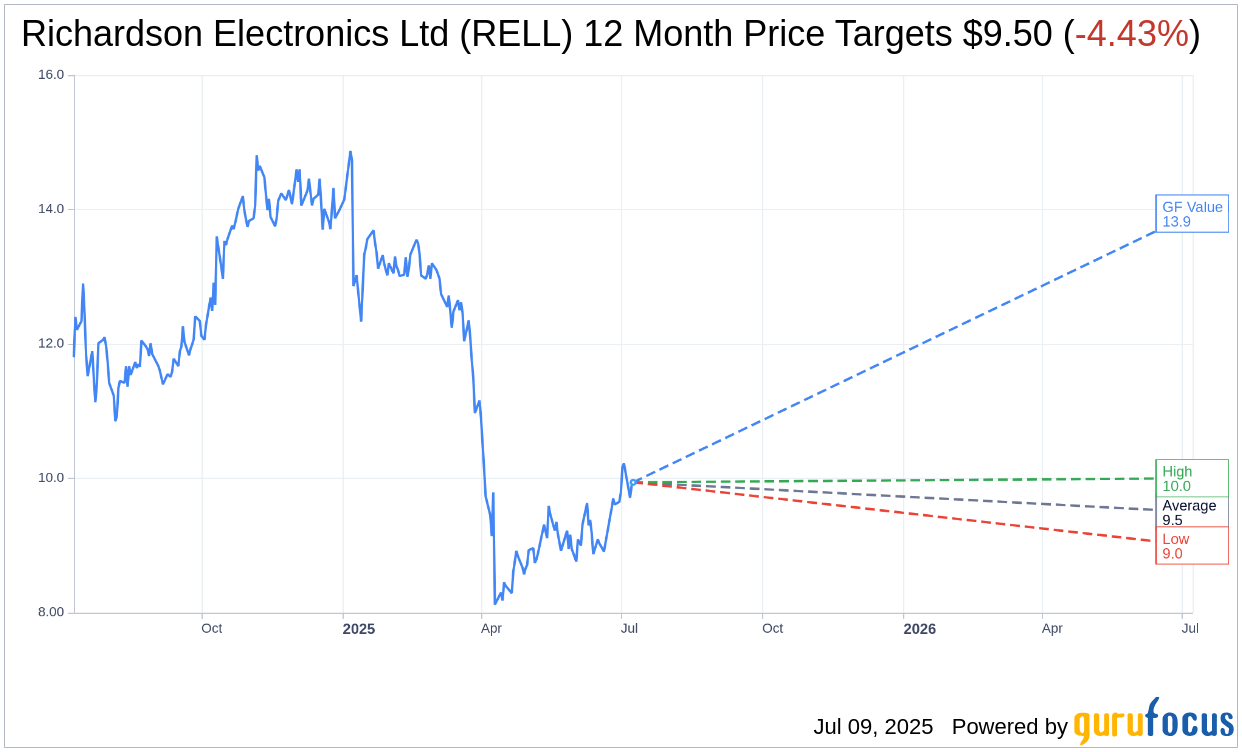

Wall Street Analysts Forecast

Based on the one-year price targets offered by 2 analysts, the average target price for Richardson Electronics Ltd (RELL, Financial) is $9.50 with a high estimate of $10.00 and a low estimate of $9.00. The average target implies an downside of 4.43% from the current price of $9.94. More detailed estimate data can be found on the Richardson Electronics Ltd (RELL) Forecast page.

Based on the consensus recommendation from 1 brokerage firms, Richardson Electronics Ltd's (RELL, Financial) average brokerage recommendation is currently 3.0, indicating "Hold" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Richardson Electronics Ltd (RELL, Financial) in one year is $13.94, suggesting a upside of 40.24% from the current price of $9.94. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Richardson Electronics Ltd (RELL) Summary page.

RELL Key Business Developments

Release Date: April 10, 2025

- Revenue: Increased 2.7% to $53.8 million in Q3 FY25 compared to $52.4 million in Q3 FY24.

- Semiconductor Wafer Fab Sales: Surged by 139% in Q3 FY25.

- Canvys Sales: Increased 39.5% in Q3 FY25.

- Operating Cash Flow: Positive for the fourth consecutive quarter, ending with $36.7 million in cash and equivalents.

- Non-GAAP Operating Profit: Rose to $2.2 million in Q3 FY25, up from $1 million in Q3 FY24.

- Gross Margin: Increased to 31.0% in Q3 FY25 from 29.5% in Q3 FY24.

- Operating Expenses: Improved to 26.9% of net sales in Q3 FY25 from 27.6% in Q3 FY24.

- Net Loss: $2.1 million in Q3 FY25; non-GAAP net income was $1.6 million.

- EBITDA: Negative $2.1 million; adjusted EBITDA was $2.8 million in Q3 FY25.

- Cash Flow from Operations: $4.6 million in Q3 FY25.

- Capital Expenditures: $0.5 million in Q3 FY25.

- Free Cash Flow: $4.1 million in Q3 FY25.

- Dividends: $0.9 million paid in Q3 FY25; declared a regular quarterly cash dividend of $0.06 per common share.

- Healthcare Asset Sale: $8.2 million from the sale in Q3 FY25.

- GES Sales: $9.3 million in Q3 FY25, a 55% increase over Q2 FY25 but down 19% year-over-year.

- PMT Sales: $32.2 million in Q3 FY25, up 7% year-over-year.

- Canvys Net Sales: Increased to $9.2 million in Q3 FY25 from $6.6 million in Q3 FY24.

- Canvys Gross Margin: Decreased to 33.2% in Q3 FY25 from 34.4% in Q3 FY24.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Richardson Electronics Ltd (RELL, Financial) reported significant growth in key segments, with semiconductor wafer fab sales surging by 139% and Canvys sales increasing by 39.5%.

- The company achieved positive operating cash flow for the fourth consecutive quarter, ending with no debt and $36.7 million in cash and equivalents.

- Gross margin improved to 31.0% of net sales, up from 29.5% in the previous year, driven by margin expansion in both PMT and GES segments.

- The company is well-positioned to capitalize on policies driving manufacturing back to the US, with strong vendor partnerships and a global infrastructure.

- Richardson Electronics Ltd (RELL) is focusing on growth in its Green Energy Solutions segment, with a strong backlog and expansion into new markets like Europe and Asia.

Negative Points

- The company reported a one-time $4.9 million healthcare charge due to the loss on the sale of assets, impacting overall financial results.

- Sales growth was partially offset by a $1.0 million decrease in healthcare sales and a $2.2 million decline in GES sales due to lower sales of wind turbine battery modules.

- Operating loss was $2.7 million, and net loss was $2.1 million for the third quarter of fiscal 2025.

- The healthcare asset sale resulted in a strategic shift, with potential ongoing losses from the ALTA tube manufacturing expected in FY26.

- The current operating environment is extremely fluid, with uncertainties related to tariffs and market conditions impacting business operations.