Perimeter Solutions (PRM, Financial) continues to capture the attention of investors as UBS analyst Joshua Spector has maintained a "Buy" rating on the stock while raising the price target significantly. The new price target is set at $20.00, up from the previous $15.00, reflecting a substantial increase of 33.33%.

The updated price target and reaffirmed rating highlight UBS's confidence in Perimeter Solutions' growth trajectory. As of July 9, 2025, PRM remains a strong candidate for investors looking for promising opportunities in the market.

Perimeter Solutions (PRM, Financial) is trading on the New York Stock Exchange and continues to show promising signs under the guidance of its management and strategic initiatives. Investors will be closely watching PRM to see if the company's performance aligns with the optimistic expectations set by UBS.

Wall Street Analysts Forecast

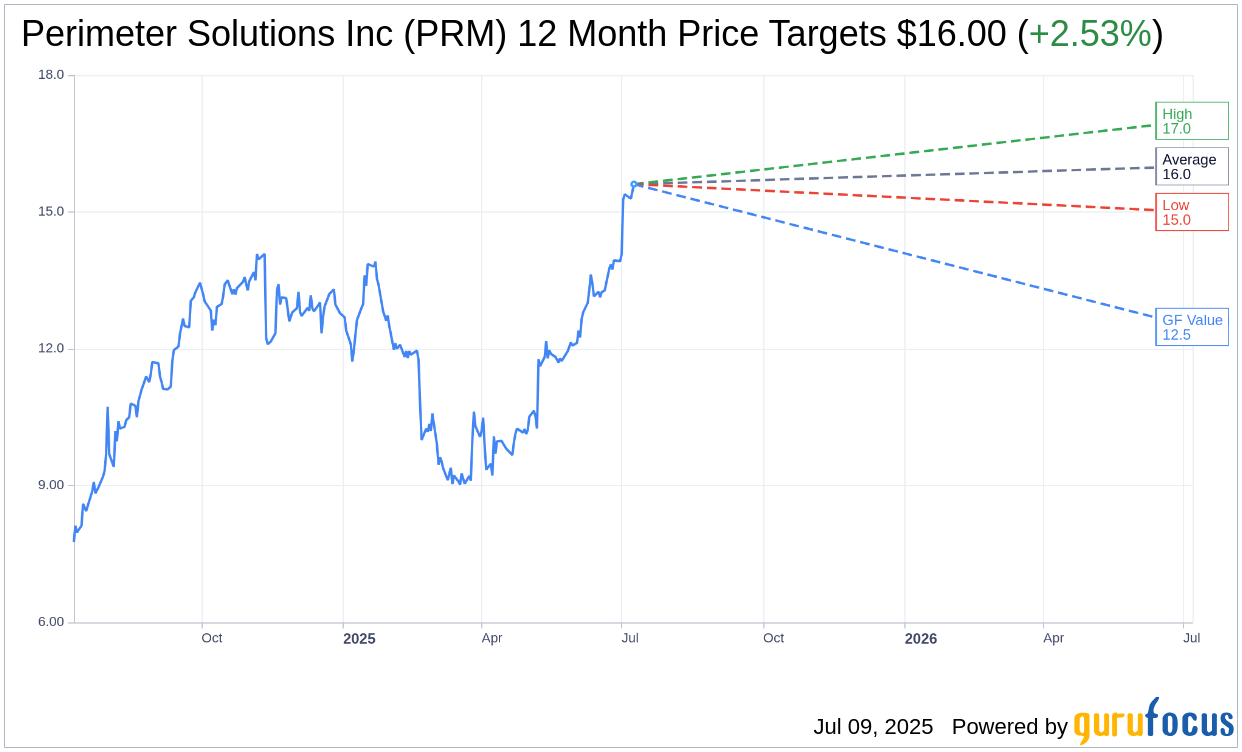

Based on the one-year price targets offered by 2 analysts, the average target price for Perimeter Solutions Inc (PRM, Financial) is $16.00 with a high estimate of $17.00 and a low estimate of $15.00. The average target implies an upside of 2.53% from the current price of $15.61. More detailed estimate data can be found on the Perimeter Solutions Inc (PRM) Forecast page.

Based on the consensus recommendation from 2 brokerage firms, Perimeter Solutions Inc's (PRM, Financial) average brokerage recommendation is currently 2.0, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Perimeter Solutions Inc (PRM, Financial) in one year is $12.48, suggesting a downside of 20.03% from the current price of $15.605. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Perimeter Solutions Inc (PRM) Summary page.