Article Summary:

- AngloGold Ashanti exits G2 Goldfields with the complete sale of its nearly 36 million shares.

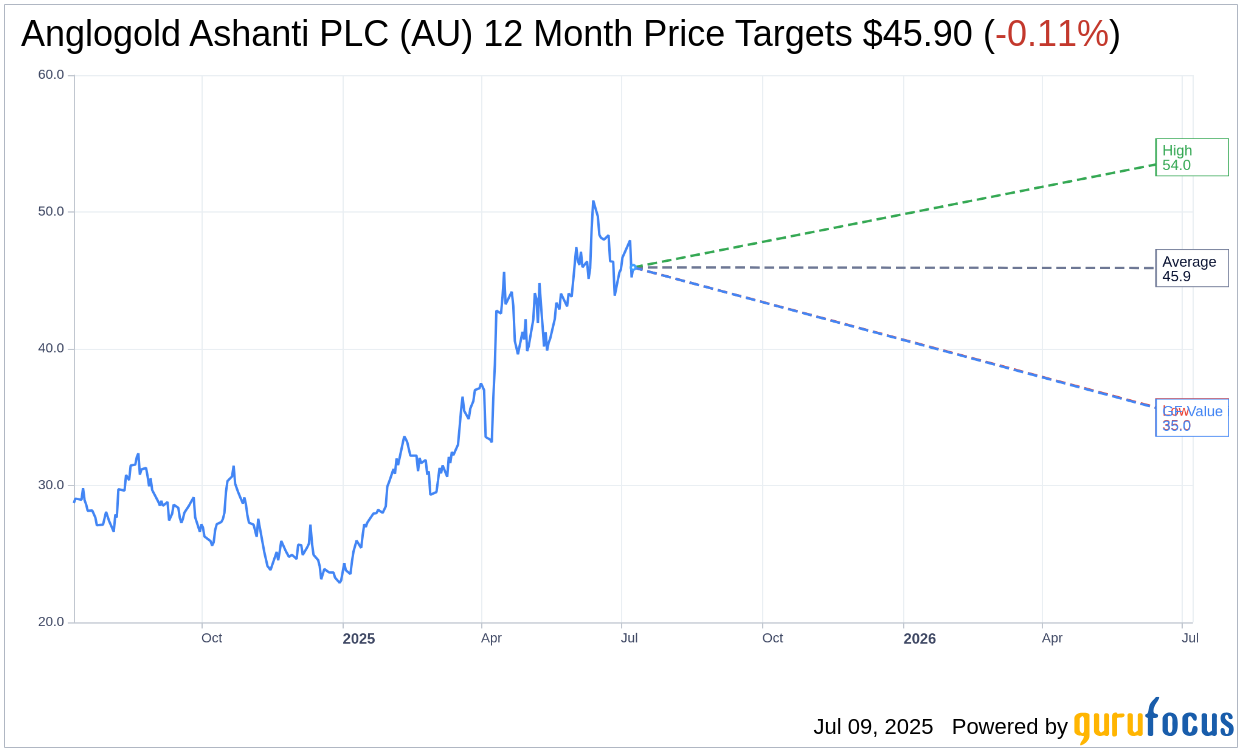

- Analysts present a mixed outlook for AngloGold Ashanti, with a one-year price target averaging $45.90.

- GuruFocus estimates suggest a potential downside for AngloGold Ashanti, citing a GF Value of $34.96.

AngloGold Ashanti Completes Exit from G2 Goldfields

AngloGold Ashanti (AU, Financial) has decisively divested its entire investment in G2 Goldfields, offloading close to 36 million shares on the Toronto exchange. This strategic move signifies AngloGold’s complete withdrawal from G2 Goldfields, encompassing roughly 14.95% of the company’s outstanding shares. The divestment aligns seamlessly with AngloGold’s routine portfolio evaluation processes, demonstrating its commitment to optimizing its investment strategy.

Wall Street Analysts' Projections

Analyst forecasts for Anglogold Ashanti PLC (AU, Financial) present a varied yet insightful landscape. Based on price targets from five analysts, the average target price stands at $45.90, with projections reaching as high as $54.00 and dipping as low as $35.00. These targets suggest a marginal downside of 0.11% from the current trading price of $45.95. Investors seeking further details on these projections can access the Anglogold Ashanti PLC (AU) Forecast page.

Brokerage Recommendations and GF Value Insight

Anglogold Ashanti PLC (AU, Financial) holds an "Outperform" status with an average brokerage recommendation of 2.5, derived from six brokerage firms. The rating scale used ranges from 1, indicating a Strong Buy, to 5, denoting a Sell. This consensus highlights the market's cautiously optimistic stance towards the company's performance.

Furthermore, according to GuruFocus metrics, the estimated GF Value for Anglogold Ashanti PLC (AU, Financial) is projected at $34.96 over the next year. This estimation points to a potential downside of 23.92% from the current price of $45.95. The GF Value represents GuruFocus’ calculation of the fair value at which the stock should trade. This value is derived from analyzing historical trading multiples and assessing both past business growth and future performance projections. Investors can delve into a more comprehensive analysis on the Anglogold Ashanti PLC (AU) Summary page.