Observed trading activity in TakeTwo Interactive Software (TTWO, Financial) reveals a significant bearish outlook, with 4,189 put options changing hands—three times the anticipated volume. The most actively traded contracts are the August 25th 210 puts and the July 25th 235 puts, collectively accounting for around 3,400 contracts. The Put/Call Ratio stands at a high of 7.03, indicating a strong preference for puts over calls. Meanwhile, the at-the-money implied volatility has risen by over one point today. Investors anticipate the company will announce earnings on August 7th.

Wall Street Analysts Forecast

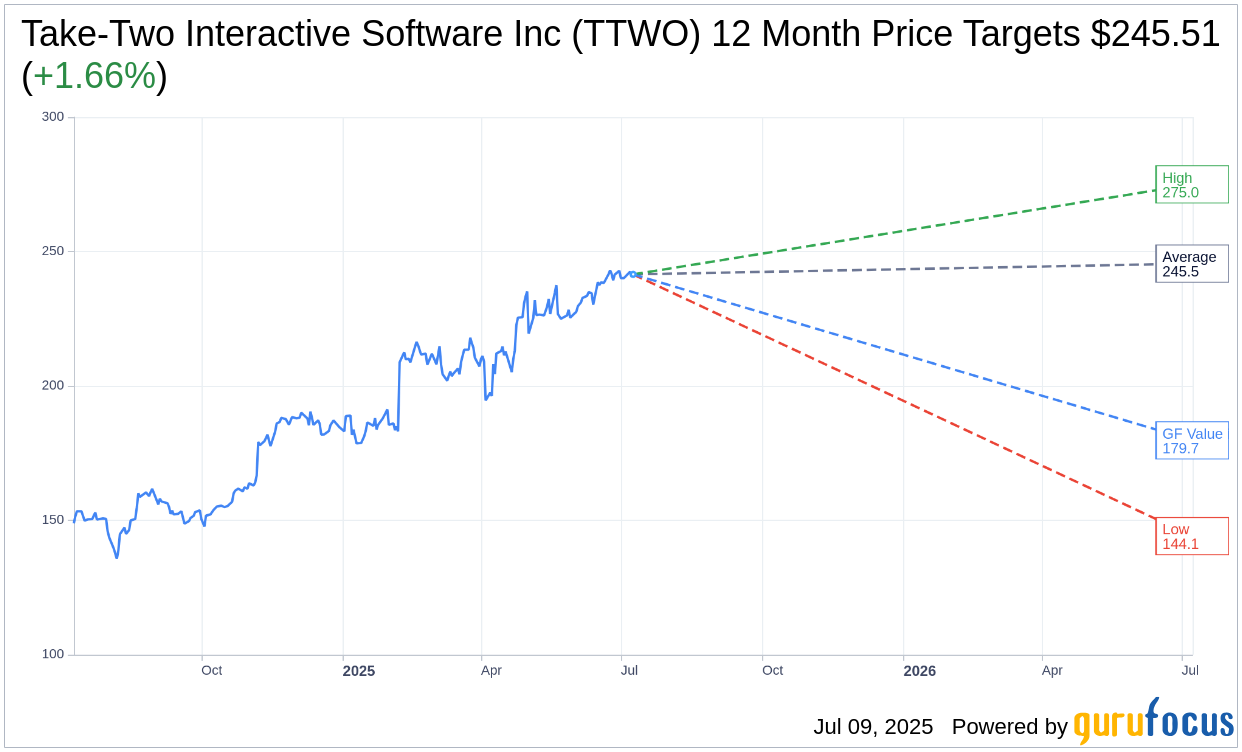

Based on the one-year price targets offered by 28 analysts, the average target price for Take-Two Interactive Software Inc (TTWO, Financial) is $245.51 with a high estimate of $275.00 and a low estimate of $144.11. The average target implies an upside of 1.66% from the current price of $241.50. More detailed estimate data can be found on the Take-Two Interactive Software Inc (TTWO) Forecast page.

Based on the consensus recommendation from 30 brokerage firms, Take-Two Interactive Software Inc's (TTWO, Financial) average brokerage recommendation is currently 1.8, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Take-Two Interactive Software Inc (TTWO, Financial) in one year is $179.74, suggesting a downside of 25.57% from the current price of $241.495. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Take-Two Interactive Software Inc (TTWO) Summary page.

TTWO Key Business Developments

Release Date: May 15, 2025

- Net Bookings: $1.58 billion for Q4 2025, top of guidance range.

- Recurrent Consumer Spending Growth: Increased 14% year-over-year, accounting for 77% of net bookings.

- GAAP Net Revenue: Increased 13% to $1.58 billion for Q4 2025.

- Operating Expenses: Increased 44% to $4.6 billion due to a $3.6 billion impairment expense.

- Fiscal 2025 Net Bookings: $5.65 billion, top of guidance range.

- Operating Cash Flow: Outflow of $45 million, better than forecasted outflow of $200 million.

- Capital Expenditures: $169 million, above forecast due to higher game technology expenses.

- Fiscal 2026 Net Bookings Outlook: $5.9 billion to $6 billion, representing 5% growth at midpoint.

- Fiscal 2026 GAAP Net Revenue Outlook: $5.95 billion to $6.05 billion.

- Fiscal 2026 Operating Cash Flow: Expected to be approximately $130 million.

- Fiscal Q1 2026 Net Bookings Outlook: $1.25 billion to $1.3 billion.

- Fiscal Q1 2026 GAAP Net Revenue Outlook: $1.35 billion to $1.4 billion.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Take-Two Interactive Software Inc (TTWO, Financial) concluded fiscal year 2025 with outstanding results, achieving fourth quarter net bookings of $1.58 billion, which was at the top of their guidance range.

- NBA 2K delivered one of its strongest periods on record, with recurrent consumer spending growth of 42% and a 7% increase in unit sales compared to NBA 2K24.

- Rockstar Games exceeded expectations with the Grand Theft Auto and Red Dead Redemption series, with GTA V selling over 215 million units.

- Zynga continued to gain momentum, with successful titles like Match Factory!, Toon Blast, and Color Block Jam contributing to strong mobile performance.

- The company is optimistic about its upcoming pipeline, planning to release 38 titles through fiscal 2028, including highly anticipated games like Grand Theft Auto VI and Borderlands 4.

Negative Points

- Operating expenses increased by 44% to $4.6 billion due to an impairment expense of $3.6 billion related to goodwill and acquired intangible assets.

- Recurrent consumer spending is expected to be flat in fiscal 2026 compared to fiscal 2025, with declines anticipated in mobile and Grand Theft Auto Online.

- The company faced challenges in the mobile gaming segment, with expectations of moderation in trends for mature titles in fiscal 2026.

- There is uncertainty regarding the impact of console price increases on the company's guidance for the year.

- The company experienced higher development costs for titles not technologically feasible, impacting operating expenses.