On July 9, 2025, Citigroup analyst Ariel Rosa announced an update on TFI International (TFII, Financial), maintaining a "Buy" rating while adjusting the price target. The price target for TFII has been raised from $107.00 to $108.00 USD, representing a 0.93% increase.

The decision to maintain the "Buy" rating indicates continued confidence in TFI International's performance and market position. The updated price target suggests an optimistic outlook for the company's future growth potential.

Investors and stakeholders in TFI International (TFII, Financial) may find this update noteworthy as it highlights the analyst's positive sentiment towards the company's prospects in the near term.

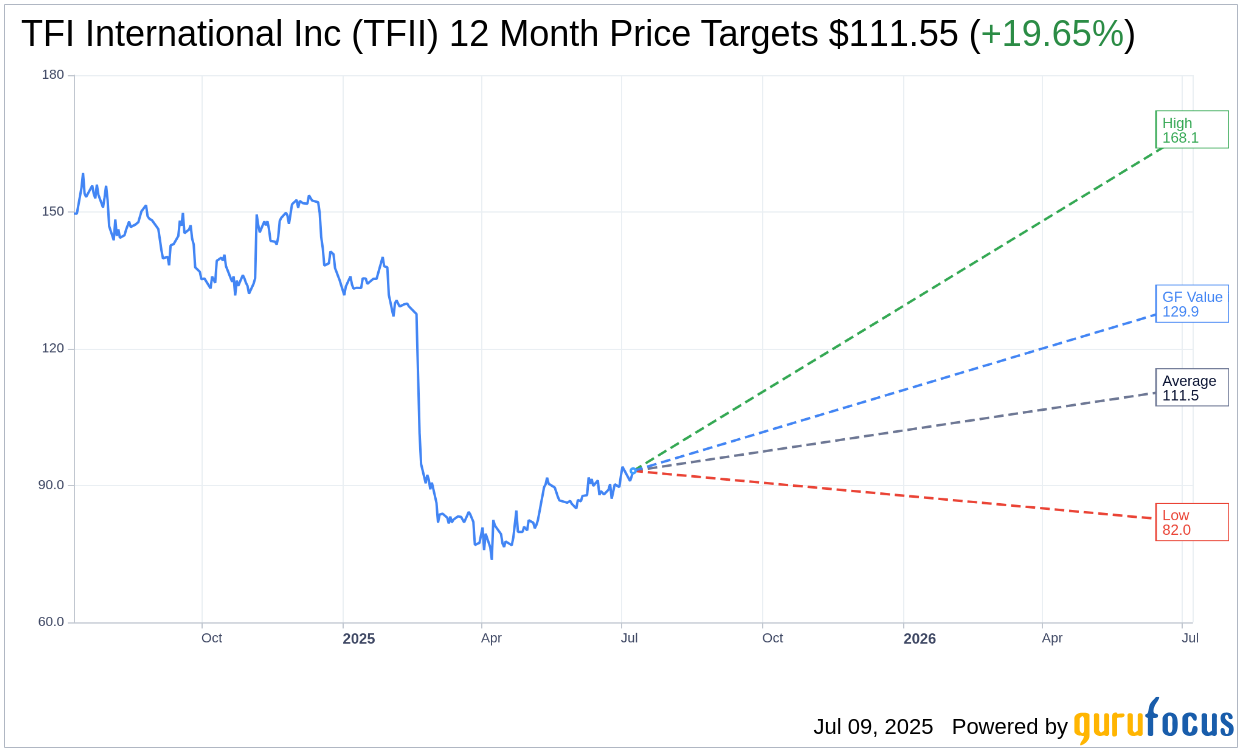

Wall Street Analysts Forecast

Based on the one-year price targets offered by 15 analysts, the average target price for TFI International Inc (TFII, Financial) is $111.55 with a high estimate of $168.10 and a low estimate of $82.00. The average target implies an upside of 19.65% from the current price of $93.23. More detailed estimate data can be found on the TFI International Inc (TFII) Forecast page.

Based on the consensus recommendation from 20 brokerage firms, TFI International Inc's (TFII, Financial) average brokerage recommendation is currently 2.1, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for TFI International Inc (TFII, Financial) in one year is $129.90, suggesting a upside of 39.34% from the current price of $93.225. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the TFI International Inc (TFII) Summary page.