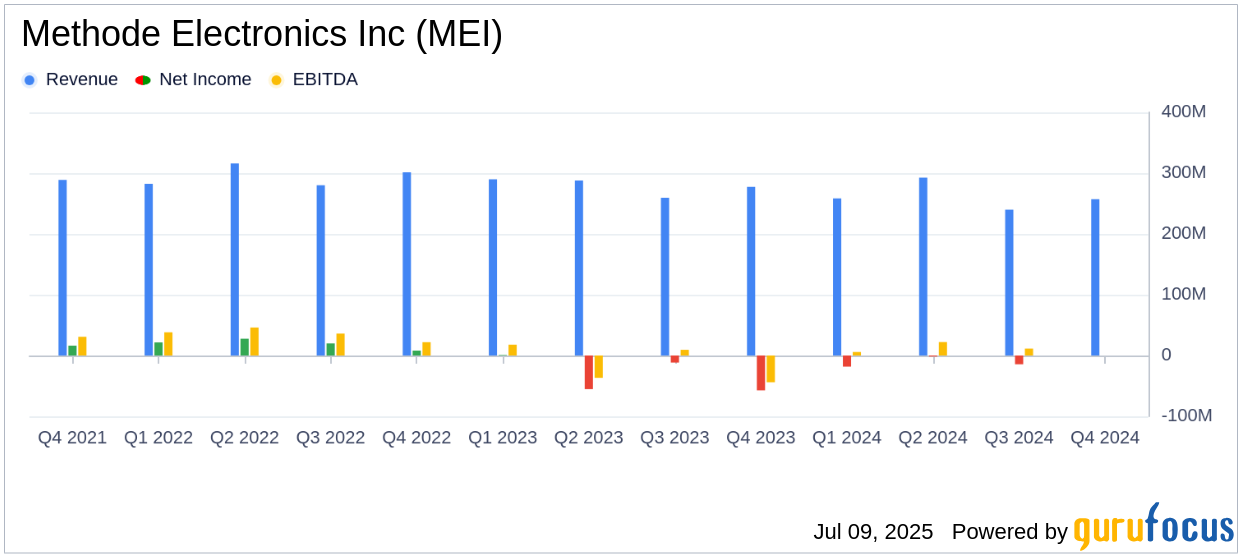

On July 9, 2025, Methode Electronics Inc (MEI, Financial) released its 8-K filing detailing the financial results for the fourth quarter and full year ended May 3, 2025. The company, a global supplier of custom-engineered solutions, reported a net sales figure of $257.1 million for the quarter, surpassing the analyst estimate of $232.87 million. However, the earnings per share (EPS) came in at a loss of $0.80, missing the estimated EPS of $0.03.

Company Overview

Methode Electronics Inc specializes in component and subsystem devices using electrical, radio remote control, electronic, wireless, and sensing technologies. The company operates through several segments: Automotive, Industrial, Interface, and Medical. The Automotive segment, which is the largest revenue generator, provides electronic and electro-mechanical devices to the automotive industry. The company derives most of its revenue from North America, with additional contributions from Europe, the Middle East & Africa (EMEA), and Asia.

Performance and Challenges

The fiscal fourth quarter saw Methode Electronics Inc facing significant challenges, including a pre-tax loss of $30.4 million, which included $15.2 million of unplanned inventory adjustments. The net loss for the quarter was $28.3 million, or $0.80 per diluted share, compared to a loss of $57.3 million, or $1.63 per diluted share, in the same quarter of fiscal 2024. The company attributed these losses to a decrease in automotive segment sales and inventory write-downs due to reduced demand from electric vehicle (EV) customers.

President and CEO Jon DeGaynor commented, “The Methode transformation journey made further progress in the quarter, as we focused on improving execution to drive long-term value. We have built a new management team and set records for the quarter and the year in data center power product sales, with the year finishing at over $80 million.”

Financial Achievements

Despite the challenges, Methode Electronics Inc achieved record sales for power distribution products for data centers, contributing significantly to the Industrial segment's growth. The company reported positive free cash flow of $26.3 million for the quarter, marking the highest quarter since fiscal 2023. This achievement is crucial for the hardware industry, where cash flow is vital for sustaining operations and funding future growth.

Key Financial Metrics

The company's net sales for the quarter were $257.1 million, a decrease from $277.3 million in the same quarter of fiscal 2024. The loss from operations improved to $23.6 million from a loss of $61.5 million in the prior year, primarily due to a $49.4 million goodwill impairment in the previous year. Adjusted EBITDA was negative $7.1 million, compared to positive $5.3 million in the same quarter of fiscal 2024.

| Metric | Q4 2025 | Q4 2024 |

|---|---|---|

| Net Sales | $257.1 million | $277.3 million |

| Net Loss | $(28.3) million | $(57.3) million |

| Adjusted EBITDA | $(7.1) million | $5.3 million |

Analysis and Outlook

Methode Electronics Inc's performance in the fourth quarter highlights the challenges faced by the company, particularly in the automotive segment. However, the growth in the Industrial segment, driven by data center power products, provides a positive outlook. The company's efforts to reduce debt and improve cash flow are commendable and essential for future stability. Looking ahead, the company expects to double its EBITDA in fiscal 2026, despite anticipating a decline in sales due to lower EV demand.

Overall, Methode Electronics Inc's strategic focus on operational improvements and leveraging growth opportunities in data centers positions it for potential success in the coming fiscal year. Value investors may find interest in the company's efforts to navigate current challenges while setting a foundation for future growth.

Explore the complete 8-K earnings release (here) from Methode Electronics Inc for further details.