Texas Capital has initiated coverage on Dave & Buster’s, assigning a "Buy" rating and setting a price target of $48. Over the past two years, Dave & Buster's (PLAY, Financial) has faced challenges due to dwindling store-level attendance and sales. These difficulties were compounded by a consumer economy focused on value and ineffective strategic moves by the previous management team that did not manage to halt the decline in same-store sales.

Despite still being in the early phases of its turnaround efforts, optimism surrounds the company's prospects. The newly established management team is emphasizing a "back to basics" approach, which is anticipated to resonate well with the entertainment-seeking audience. This strategic direction aims to attract a broader customer base as Dave & Buster’s expands its operations in a financially sustainable way.

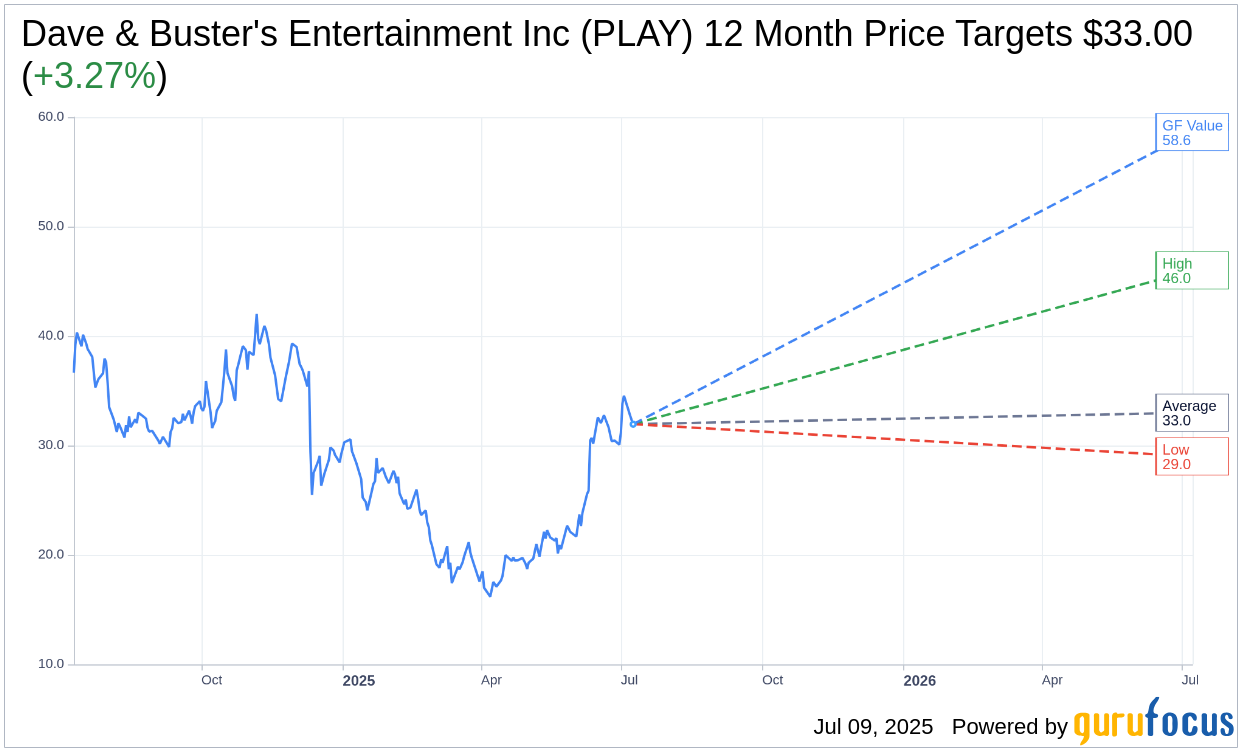

Wall Street Analysts Forecast

Based on the one-year price targets offered by 7 analysts, the average target price for Dave & Buster's Entertainment Inc (PLAY, Financial) is $33.00 with a high estimate of $46.00 and a low estimate of $29.00. The average target implies an upside of 3.27% from the current price of $31.96. More detailed estimate data can be found on the Dave & Buster's Entertainment Inc (PLAY) Forecast page.

Based on the consensus recommendation from 10 brokerage firms, Dave & Buster's Entertainment Inc's (PLAY, Financial) average brokerage recommendation is currently 2.6, indicating "Hold" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Dave & Buster's Entertainment Inc (PLAY, Financial) in one year is $58.64, suggesting a upside of 83.51% from the current price of $31.955. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Dave & Buster's Entertainment Inc (PLAY) Summary page.

PLAY Key Business Developments

Release Date: June 10, 2025

- Revenue: $568 million for the first quarter of fiscal 2025.

- Net Income: $22 million or $0.62 per diluted share.

- Adjusted Net Income: $27 million or $0.76 per diluted share.

- Adjusted EBITDA: $136 million with an adjusted EBITDA margin of 24%.

- Comp Store Sales: Decreased 8.3% versus the prior year period.

- Operating Cash Flow: $96 million generated during the first quarter.

- Cash and Credit Availability: $12 million in cash and $411 million available under the revolving credit facility.

- Capital Expenditures: $115 million in capital additions on a gross basis, $110 million on a net basis.

- Preopening Expenses: $2.7 million increase versus the prior year.

- New Store Openings: Two new stores opened in Calin, Texas, and Lansing, Michigan, with two additional openings in Freehold, New Jersey, and Wilmington, North Carolina.

- Store Relocation: Successful relocation of the Honolulu, Hawaii store.

- International Expansion: First international franchise location opened in India, with at least seven more expected over the next year.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Dave & Buster's Entertainment Inc (PLAY, Financial) reported significant improvement in operating results over the first quarter, driven by a back-to-basics strategy.

- The company successfully reintroduced the Eat and Play Combo, which has shown positive early results and a double-digit opt-in rate.

- Remodeled stores have outperformed the system by over 700 basis points in the last three months, indicating the success of the remodel strategy.

- The introduction of new games and attractions, such as the Summer of Games and the human crane, is expected to enhance customer engagement and drive sales.

- Dave & Buster's opened new stores in strategic locations, including international expansion, which is expected to drive incremental growth with minimal investment and risk.

Negative Points

- Comp store sales decreased by 8.3% in the first quarter compared to the prior year, with a particularly soft February.

- The company incurred a $2.7 million increase in preopening expenses due to new store openings and relocations.

- There was a significant front-end loading of capital expenditures, with $115 million spent in the first quarter, impacting cash flow.

- The company is still in the early stages of implementing its back-to-basics strategy, indicating that full recovery may take time.

- Marketing and R&M expenses increased, which may continue to pressure margins if not managed effectively.