Texas Capital has initiated coverage on Lucky Strike (LUCK, Financial) with a Buy recommendation and set a price target of $14. Over the past year, LUCK has significantly lagged behind the broader market, primarily due to concerns about softening consumer spending and negative same-store sales trends. However, the firm highlights that a return to positive same-store sales by fiscal year 2026 and the management's shift towards reducing debt could enhance the company's valuation in the coming year.

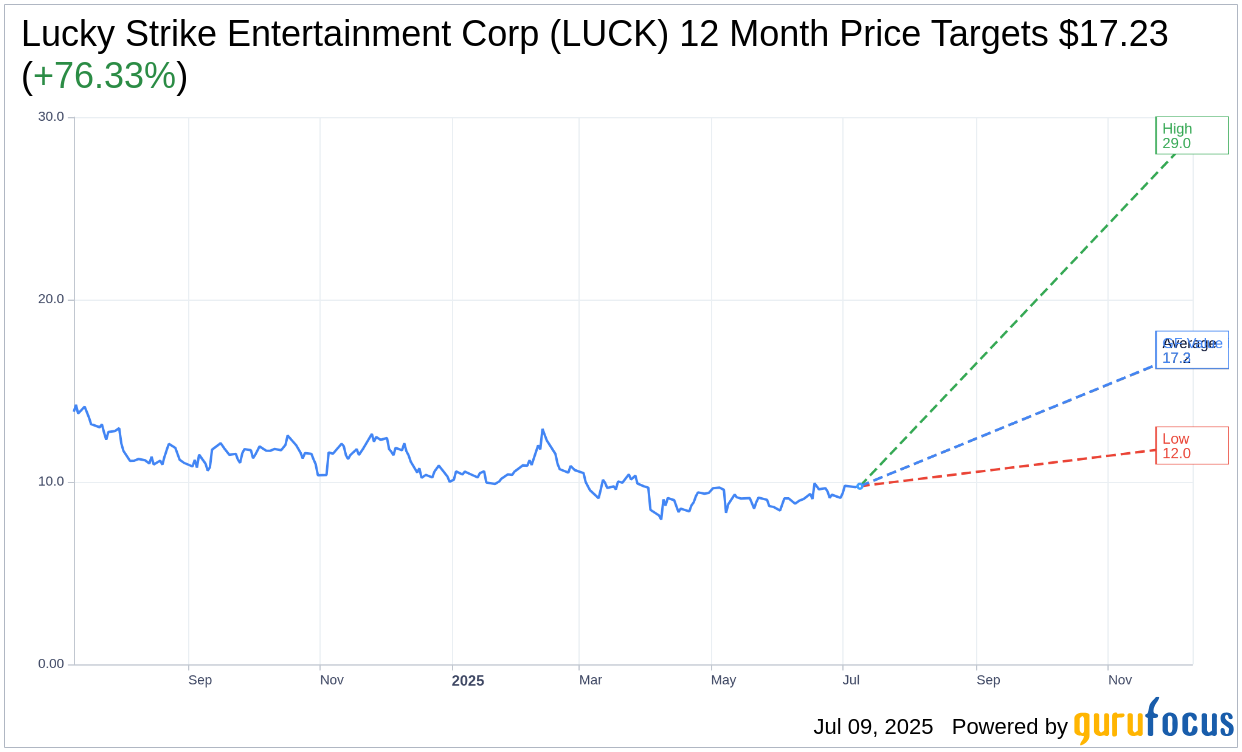

Wall Street Analysts Forecast

Based on the one-year price targets offered by 11 analysts, the average target price for Lucky Strike Entertainment Corp (LUCK, Financial) is $17.23 with a high estimate of $29.00 and a low estimate of $12.00. The average target implies an upside of 76.33% from the current price of $9.77. More detailed estimate data can be found on the Lucky Strike Entertainment Corp (LUCK) Forecast page.

Based on the consensus recommendation from 11 brokerage firms, Lucky Strike Entertainment Corp's (LUCK, Financial) average brokerage recommendation is currently 1.8, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Lucky Strike Entertainment Corp (LUCK, Financial) in one year is $17.25, suggesting a upside of 76.56% from the current price of $9.77. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Lucky Strike Entertainment Corp (LUCK) Summary page.

LUCK Key Business Developments

Release Date: May 08, 2025

- Total Revenue: $339.9 million, a 0.7% increase from the previous year.

- Adjusted EBITDA: $117.3 million, compared to $122.8 million in the previous year.

- Same Store Sales: Declined by 5.6%.

- League Operations Growth: Experienced low single-digit growth.

- Events Business Performance: Faced a high single-digit decline.

- Comparable Food Sales: Increased by 1%, with total food sales up 8% year over year.

- Capital Expenditures: $25 million, with $14 million for growth initiatives, $1 million for new builds, and $12 million for maintenance.

- Liquidity Position: $391 million, with $79 million in cash and no borrowing on the revolver.

- Net Debt: $1.2 billion, with a bank credit facility net leverage ratio of 2.9.

- Acquisition: Acquired Shipwreck Island in Panama City Beach, Florida for $30 million.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Lucky Strike Entertainment Corp (LUCK, Financial) reported a 0.7% increase in total revenue for the quarter, with significant gains in retail, online, and league segments.

- The company's league business is experiencing low single-digit growth and is described as sticky, high frequency, and high margin.

- Early sales of summer season passes are up over 200% year-over-year, indicating strong consumer interest in local entertainment options.

- New builds and properties launched between September and December 2024 exceeded expectations, generating nearly $8 million in revenue and $4 million in EBITDA.

- The company has a strong liquidity position with $391 million, including $79 million in cash and no borrowing on its revolver.

Negative Points

- Same store sales declined by 5.6%, with the events business facing a high single-digit decline.

- The corporate events segment, particularly in California, experienced double-digit declines due to macroeconomic uncertainty and layoffs in the tech sector.

- The lingering impact of January's fires in Southern California continues to weigh on business performance in that region.

- Adjusted EBITDA decreased compared to the previous year, with same store sales acting as a $19 million headwind for the bottom line.

- The company has removed guidance due to high volatility and uncertainty in the market, making it difficult to predict future performance.