Keefe Bruyette has downgraded MFA Financial (MFA, Financial) from an "Outperform" rating to "Market Perform," setting a price target of $10. This change comes ahead of the company's second-quarter earnings report for the mortgage real estate investment trust sector. The firm suggests that the downgrade is due to a lack of immediate growth drivers and anticipates that MFA's return on equity will remain in the single digits through 2025.

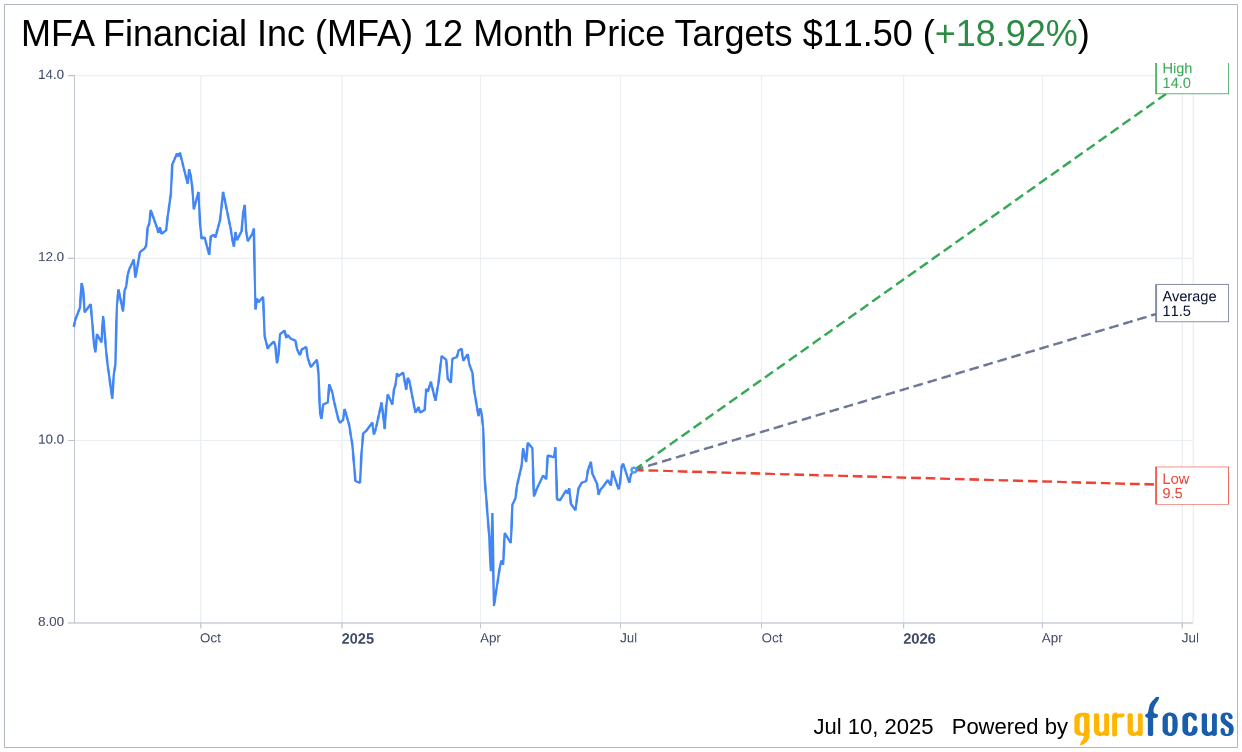

Wall Street Analysts Forecast

Based on the one-year price targets offered by 5 analysts, the average target price for MFA Financial Inc (MFA, Financial) is $11.50 with a high estimate of $14.00 and a low estimate of $9.50. The average target implies an upside of 18.92% from the current price of $9.67. More detailed estimate data can be found on the MFA Financial Inc (MFA) Forecast page.

Based on the consensus recommendation from 7 brokerage firms, MFA Financial Inc's (MFA, Financial) average brokerage recommendation is currently 2.4, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

MFA Key Business Developments

Release Date: May 06, 2025

- Total Economic Return: 1.9% for the first quarter, including a dividend increase to $0.36.

- Economic Book Value: Decreased by 0.6% in the first quarter.

- Loan and Securities Sourcing: $875 million sourced, including $383 million of non-QM loans, $268 million of agency MBS, and $223 million of business purpose loans.

- Leverage: Overall leverage at 5.1 times; recourse leverage at 1.8 times.

- GAAP Book Value: $13.28 per share at March 31.

- Economic Book Value: $13.84 per share at March 31.

- GAAP Earnings: $41.2 million or $0.32 per basic common share for the first quarter.

- Net Interest Income: $57.5 million for the first quarter.

- Lima One Mortgage Banking Income: $5.4 million for the quarter.

- Dividend: Increased to $0.36 per common share for the first quarter.

- Distributable Earnings: $30.5 million or $0.29 per basic common share for the first quarter.

- Investment Portfolio Growth: Increased to $10.7 billion from $10.5 billion at year-end.

- Non-QM Loans Sourced: $383 million with an average coupon of 7.8%.

- Agency MBS Portfolio: Grew to $1.6 billion.

- Lima One Business Purpose Loans: $213 million originated with an average coupon of 9.7%.

- 60-plus Day Delinquencies: Stable at 7.5% for the entire loan portfolio.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- MFA Financial Inc (MFA, Financial) delivered a total economic return of 1.9% for the first quarter, including an increased dividend of $0.36.

- The company sourced $875 million of loans and securities across target asset classes, demonstrating active portfolio management.

- MFA's leverage remained stable with overall leverage at 5.1 times and recourse leverage at 1.8 times, only slightly higher than year-end.

- 83% of loan financing and 70% of all liabilities were non-mark-to-market, providing stability during market volatility.

- The company continues to see strong demand in securitization markets, with deals being oversubscribed even during volatile trading sessions.

Negative Points

- Economic book value decreased modestly by 0.6% in the first quarter.

- Lima One's mortgage banking income declined from $8.5 million in Q4 to $5.4 million in Q1 due to lower origination volumes.

- Distributable earnings decreased to $0.29 per basic common share from $0.39 in the previous quarter.

- The company expects short-term increases in realized credit losses as they resolve challenged assets in the transitional loan portfolio.

- Subsequent to quarter-end, economic book value is estimated to be down approximately 2% to 4% due to wider spreads.

Become a Premium Member to See This: (Free Trial):