CME Group (CME, Financial) reported a groundbreaking increase in its international average daily volume for the second quarter, hitting 9.2 million contracts. This marks an 18% rise compared to the previous year. The surge was largely fueled by substantial growth in regions such as EMEA and APAC. Specifically, record-breaking numbers were seen across several product areas: Interest Rate products climbed 14%, Equity Index products surged 38%, Energy products rose 23%, Agricultural products increased 3%, and Metals products advanced 14%.

According to Julie Winkler, the company's Senior Managing Director and Chief Commercial Officer, the heightened market volatility led diverse investors to turn to CME Group for risk management and seizing opportunities across multiple asset classes. CME Group's robust global benchmarks and continuous liquidity have proven essential for clients who need to swiftly react to market changes no matter their location or the time zone.

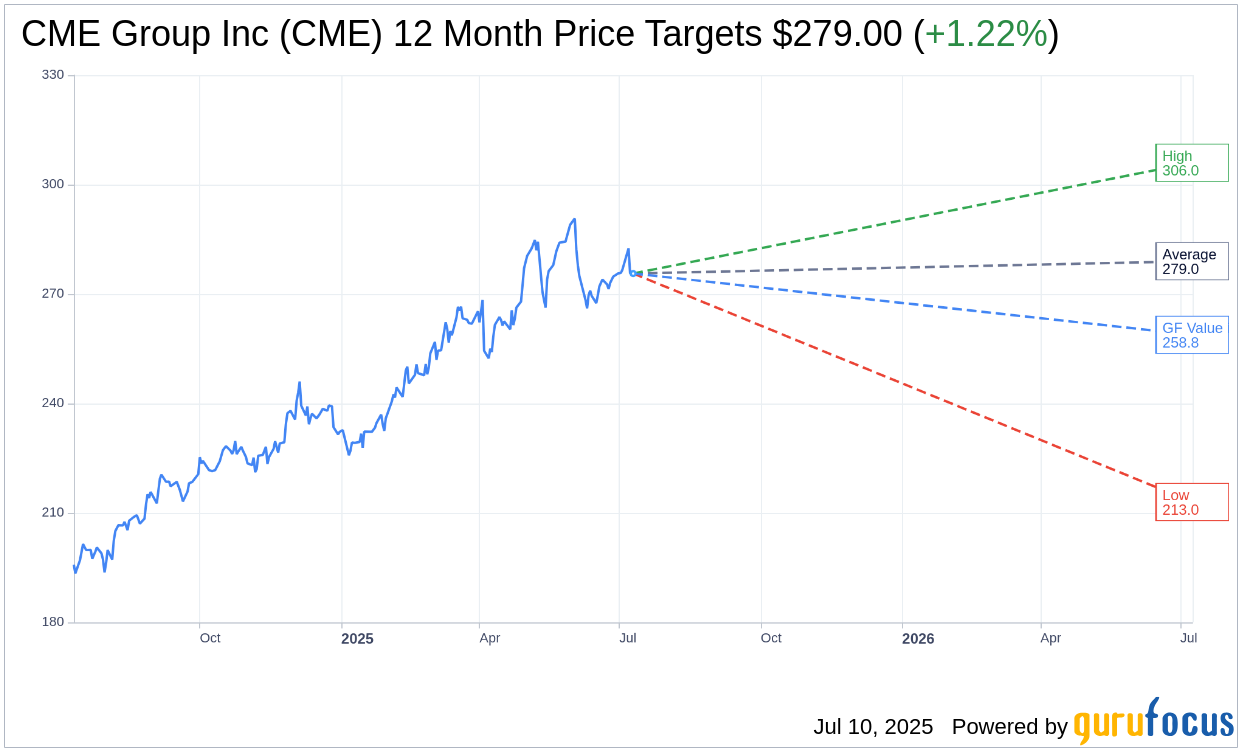

Wall Street Analysts Forecast

Based on the one-year price targets offered by 15 analysts, the average target price for CME Group Inc (CME, Financial) is $279.00 with a high estimate of $306.00 and a low estimate of $213.00. The average target implies an upside of 1.22% from the current price of $275.64. More detailed estimate data can be found on the CME Group Inc (CME) Forecast page.

Based on the consensus recommendation from 18 brokerage firms, CME Group Inc's (CME, Financial) average brokerage recommendation is currently 2.6, indicating "Hold" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for CME Group Inc (CME, Financial) in one year is $258.83, suggesting a downside of 6.1% from the current price of $275.64. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the CME Group Inc (CME) Summary page.

CME Key Business Developments

Release Date: April 23, 2025

- Revenue: Over $1.6 billion, up 10% from Q1 2024.

- Average Daily Volume (ADV): 29.8 million contracts, highest in CME Group's history, up 13% year-over-year.

- Adjusted Net Income: Exceeded $1 billion, up 12% from Q1 2024.

- Adjusted Diluted Earnings Per Share: $2.80, up 12% year-over-year.

- Clearing and Transaction Fees: $1.3 billion, up 11% year-over-year.

- Market Data Revenue: $195 million, up 11% year-over-year.

- Adjusted Operating Income: $1.2 billion, up 14% year-over-year.

- Adjusted Operating Margin: 71.1%, up from 68.9% in Q1 2024.

- Adjusted Effective Tax Rate: 23.1%.

- Capital Expenditures: Approximately $12 million.

- Cash: $1.6 billion at the end of the quarter.

- Dividends Paid: Approximately $2.6 billion during the quarter.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- CME Group Inc (CME, Financial) reported record quarterly revenue of over $1.6 billion, marking the highest volume revenue, operating income, and diluted earnings per share in the company's history.

- The first quarter saw a 13% increase in average daily volume (ADV) to 29.8 million contracts, with growth across all six asset classes, including record volumes in interest rates, equities, agricultural commodities, and foreign exchange.

- International business achieved a record average of 8.8 million contracts per day, up 19% from the previous year, with strong growth in EMEA and APAC regions.

- CME Group Inc (CME) continues to innovate with new product offerings, such as BrokerTec Chicago and FX Spot Plus, enhancing links between cash and futures markets.

- The company maintained strong cost discipline, resulting in an adjusted operating margin of 71.1%, up from 68.9% in the same period last year.

Negative Points

- Despite the strong performance, the average rate per contract decreased by 1% from the prior year, indicating potential pricing pressure.

- There are concerns about potential deleveraging in certain pockets, such as agricultural futures, despite overall open interest growth.

- The company faces challenges in maintaining momentum in the face of geopolitical uncertainties and market volatility.

- CME Group Inc (CME) is cautious about the regulatory approval timeline for the sale of its OSTTRA joint venture, which could impact capital allocation plans.

- The company anticipates increased expenses related to technology and professional fees as it continues to invest in cloud migration and other projects.