MP Materials (MP, Financial) has partnered with the U.S. Department of Defense to boost domestic production of rare earth magnets and diminish reliance on foreign sources. This collaboration involves significant investments aimed at establishing a new magnet manufacturing facility in the U.S., expected to begin operations in 2028. The facility will enhance MP's production capacity to approximately 10,000 metric tons annually.

Additionally, MP plans to advance its heavy rare earth separation processes at its Mountain Pass site in California, reinforcing its role as a vital national asset. The agreement includes convertible preferred equity, warrants, loans, and long-term purchase commitments, securing MP a stable revenue stream with protective price measures. The Department of Defense has committed to a $110 per kilogram price floor for MP's NdPr products over a decade.

JPMorgan Chase and Goldman Sachs are set to provide $1 billion in financing for the new facility's construction, while a $150 million loan from the Department of Defense will support the expansion of Mountain Pass operations. Furthermore, the Department will acquire $400 million in preferred stock convertible into MP common shares, potentially becoming the company's largest stakeholder with a 15% shareholding.

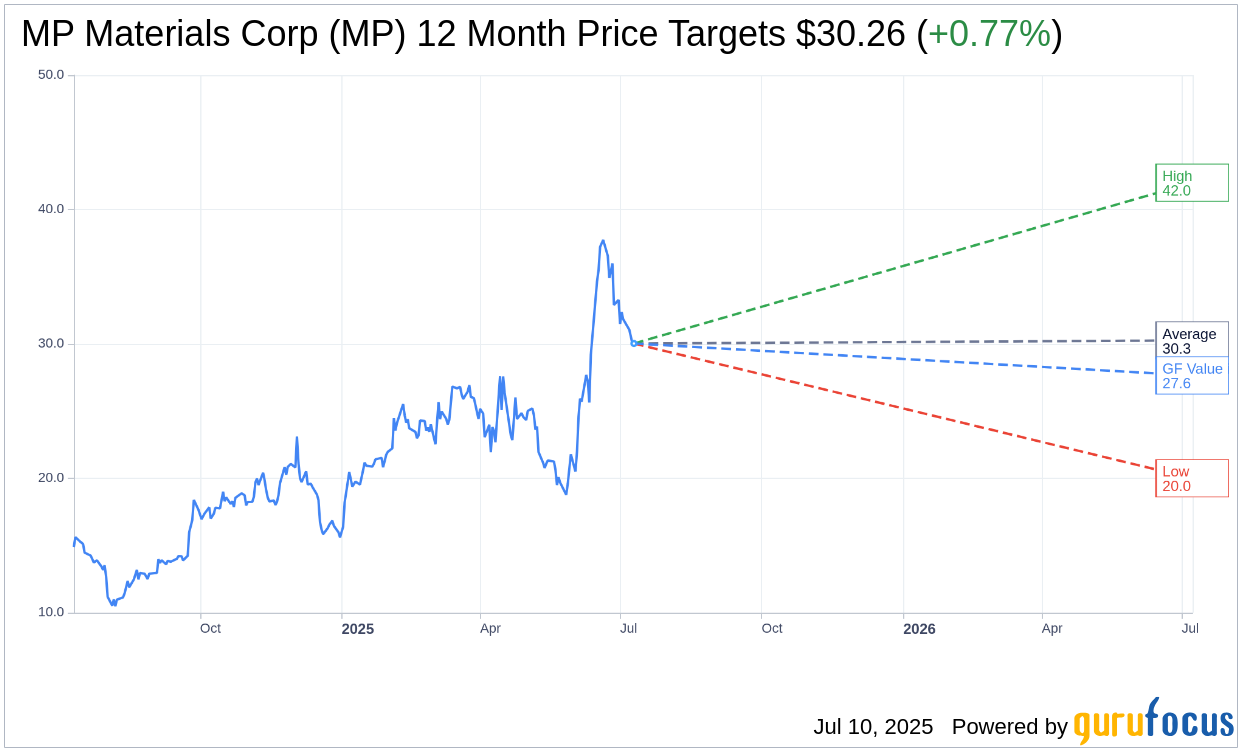

Wall Street Analysts Forecast

Based on the one-year price targets offered by 10 analysts, the average target price for MP Materials Corp (MP, Financial) is $30.26 with a high estimate of $42.00 and a low estimate of $20.00. The average target implies an upside of 0.77% from the current price of $30.03. More detailed estimate data can be found on the MP Materials Corp (MP) Forecast page.

Based on the consensus recommendation from 12 brokerage firms, MP Materials Corp's (MP, Financial) average brokerage recommendation is currently 1.8, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for MP Materials Corp (MP, Financial) in one year is $27.65, suggesting a downside of 7.93% from the current price of $30.03. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the MP Materials Corp (MP) Summary page.