On July 10, 2025, Delta Air Lines Inc (DAL, Financial) released its 8-K filing for the June quarter, showcasing a strong financial performance that exceeded analyst expectations. The Atlanta-based airline, known for its extensive network of over 300 destinations across more than 50 countries, reported significant achievements in revenue and earnings, driven by diverse revenue streams and strategic operational management.

Performance Highlights and Challenges

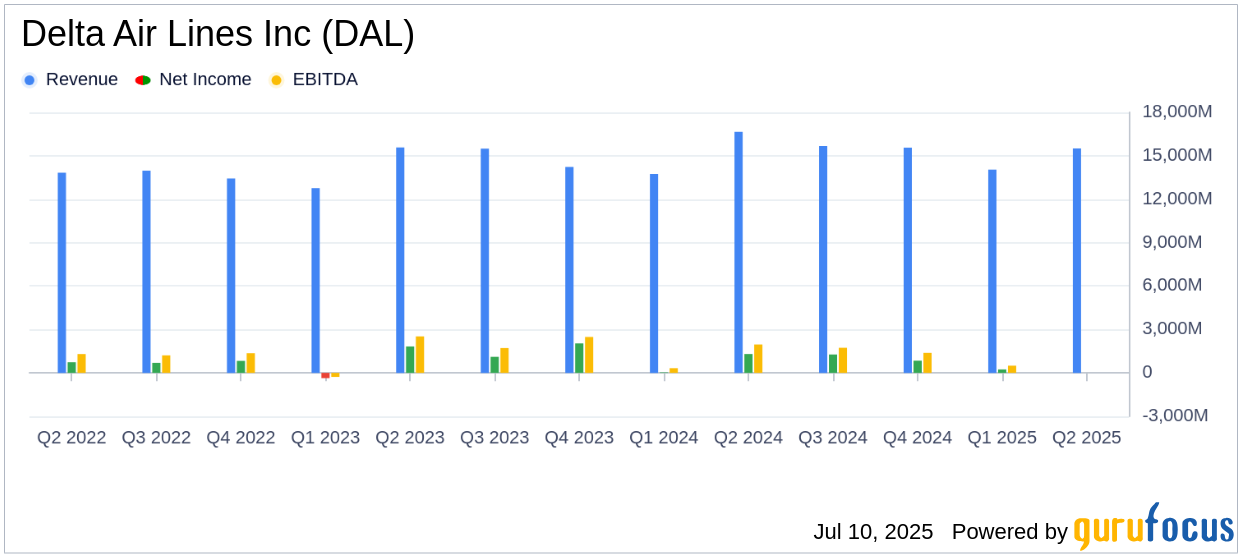

Delta Air Lines Inc (DAL, Financial) reported a GAAP operating revenue of $16.6 billion, surpassing the estimated revenue of $15,448.48 million. The company's GAAP earnings per share (EPS) stood at $3.27, significantly higher than the estimated EPS of $1.98. This robust performance is attributed to a 13% operating margin and a pre-tax profit of $1.8 billion, positioning Delta ahead of its network peers in key operational metrics.

Despite these achievements, Delta faces challenges such as stabilizing demand trends and managing non-fuel unit costs. The airline's ability to navigate these challenges is crucial for maintaining its competitive edge and ensuring sustainable growth.

Financial Achievements and Industry Impact

Delta's financial achievements are noteworthy, with a record operating revenue of $15.5 billion on a non-GAAP basis, marking a 1% increase from the previous year. The company's diversified revenue streams, including premium and loyalty revenues, contributed significantly to its financial success. Premium revenue grew by 5%, while loyalty revenue increased by 8%, driven by co-brand spend growth and card acquisitions.

These achievements underscore Delta's strategic focus on leveraging its structural advantages to optimize performance, which is vital in the highly competitive transportation industry.

Key Financial Metrics

Delta's financial statements reveal important metrics that highlight its operational efficiency and financial health:

| Metric | GAAP | Non-GAAP |

|---|---|---|

| Operating Revenue | $16.6 billion | $15.5 billion |

| Operating Income | $2.1 billion | $2.0 billion |

| Pre-tax Income | $2.6 billion | $1.8 billion |

| Earnings Per Share | $3.27 | $2.10 |

These metrics are crucial for assessing Delta's profitability and operational efficiency, providing insights into its ability to generate revenue and manage costs effectively.

Analysis and Outlook

Delta's strong financial performance in the June quarter reflects its strategic focus on executing priorities and managing controllable factors to deliver robust earnings and cash flow. The company's outlook for the September quarter includes an expected EPS of $1.25 to $1.75 and an operating margin of 9% to 11%, indicating continued confidence in its business model.

Delta's strategic initiatives, including a 25% increase in dividend payments and a focus on cost management, position it well for future growth. As the airline industry continues to evolve, Delta's ability to adapt and innovate will be key to maintaining its leadership position.

Explore the complete 8-K earnings release (here) from Delta Air Lines Inc for further details.