- CME Group (CME, Financial) sets a new record with international average daily volume reaching 9.2 million contracts in Q2 2025, an 18% increase year-over-year.

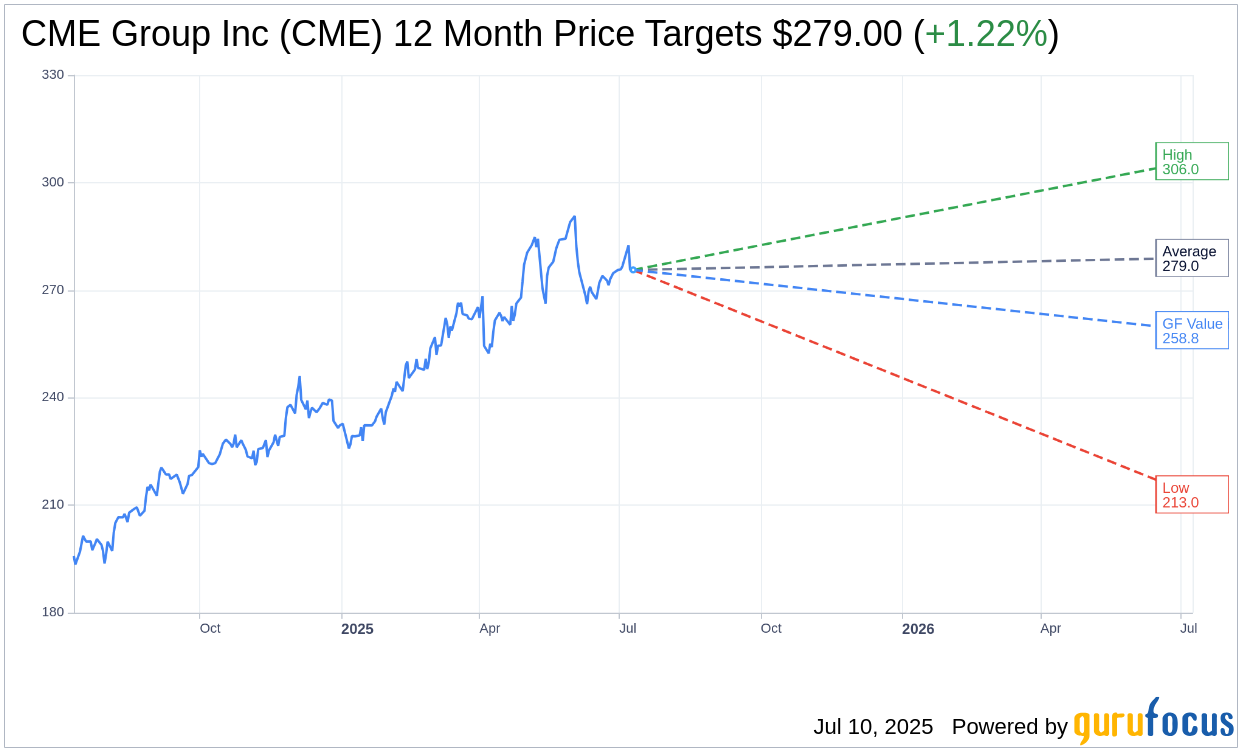

- Analysts forecast an average price target of $279.00 for CME, with potential upside of 1.22% based on current valuations.

- GuruFocus estimates a GF Value of $258.83 for CME, indicating a possible downside of 6.1% from the current stock price.

CME Group (CME) has surpassed expectations as it reached a historic milestone, with its international average daily volume hitting 9.2 million contracts in the second quarter of 2025. This impressive feat marks an 18% year-over-year increase, driven primarily by robust growth in the EMEA and APAC regions. These burgeoning markets have propelled CME Group's volumes across a diverse array of product categories, underscoring the company's expanding global footprint.

Analyst Price Targets and Market Projections

In terms of stock performance, CME Group Inc (CME, Financial) is being closely watched by 15 Wall Street analysts, who have set a one-year average price target of $279.00. This figure encompasses a high estimate of $306.00 and a low of $213.00, suggesting a modest upside potential of 1.22% from the current trading price of $275.64. For more granular insights, investors can explore further details on the CME Group Inc (CME) Forecast page.

Brokerage Recommendations

The sentiment among 18 brokerages positions CME Group Inc (CME, Financial) at an average recommendation of 2.6, which indicates a "Hold" position. This rating operates on a scale from 1 to 5, where 1 denotes a Strong Buy and 5 signifies Sell.

Understanding GF Value Considerations

From an intrinsic value perspective, GuruFocus estimates suggest that the GF Value for CME Group Inc (CME, Financial) stands at $258.83 over the coming year, indicating a potential downside risk of 6.1% from its current price of $275.64. The GF Value is a crucial metric, representing the fair value at which the stock ought to be traded. This valuation is derived from historical trading multiples, past business growth trajectories, and projected future performance figures. Investors seeking more details can visit the CME Group Inc (CME) Summary page.