Simply Good Foods (SMPL, Financial) reported Q3 revenue of $381 million, aligning closely with market expectations of $381.21 million. The company saw a notable 14% increase in net sales, driven by a 4% rise in organic sales. Strong consumer demand for Quest and OWYN products, which together comprise about 70% of current net sales, contributed significantly to this growth, while Atkins faced challenges as anticipated.

Looking at the year's overall performance and early Q4 trends, Simply Good Foods has fine-tuned its full-year forecast. The company expects to achieve roughly 3% organic net sales growth and mid-single-digit growth in Adjusted EBITDA. CEO Geoff Tanner highlighted the company's strategy to enhance its position in the Nutritional Snacking sector by introducing innovative products, expanding market reach, and leveraging effective marketing strategies to boost brand awareness.

Amidst inflation and tariff challenges, Simply Good Foods is increasing productivity measures to maintain its growth momentum while continuing to invest in growth-oriented initiatives. Tanner praised the company's teams for their resilience in a dynamic business environment and their role in integrating OWYN successfully.

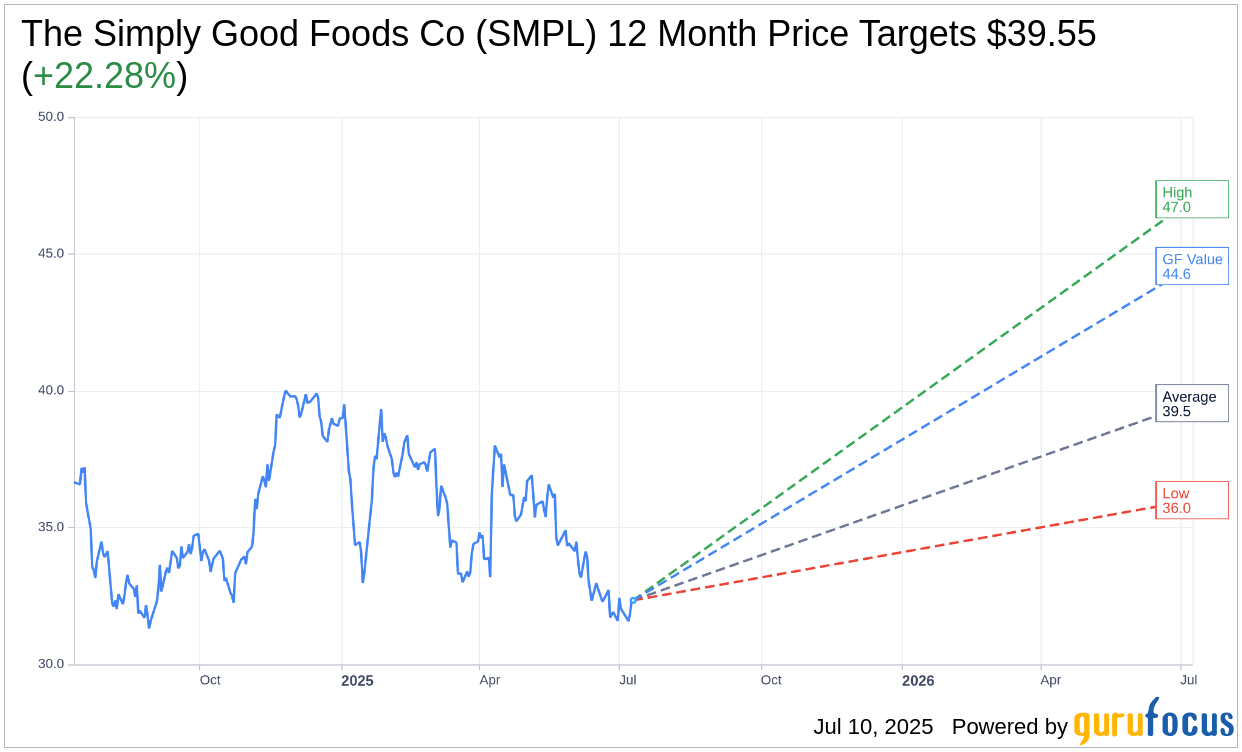

Wall Street Analysts Forecast

Based on the one-year price targets offered by 11 analysts, the average target price for The Simply Good Foods Co (SMPL, Financial) is $39.55 with a high estimate of $47.00 and a low estimate of $36.00. The average target implies an upside of 22.28% from the current price of $32.34. More detailed estimate data can be found on the The Simply Good Foods Co (SMPL) Forecast page.

Based on the consensus recommendation from 12 brokerage firms, The Simply Good Foods Co's (SMPL, Financial) average brokerage recommendation is currently 2.2, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for The Simply Good Foods Co (SMPL, Financial) in one year is $44.56, suggesting a upside of 37.79% from the current price of $32.34. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the The Simply Good Foods Co (SMPL) Summary page.