Key Highlights:

- Wedbush maintains an Outperform rating for Palantir Technologies (PLTR, Financial), increasing its price target.

- Average analyst price target suggests a downside from current levels.

- GuruFocus GF Value indicates potential significant overvaluation.

Wedbush has reaffirmed its Outperform rating for Palantir Technologies (NYSE: PLTR) while raising the price target from $140 to a robust $160. This revision highlights the firm's strategic advancements in artificial intelligence (AI), which analysts believe could propel Palantir to a dominant position within the AI sector, augmenting its revenue potential.

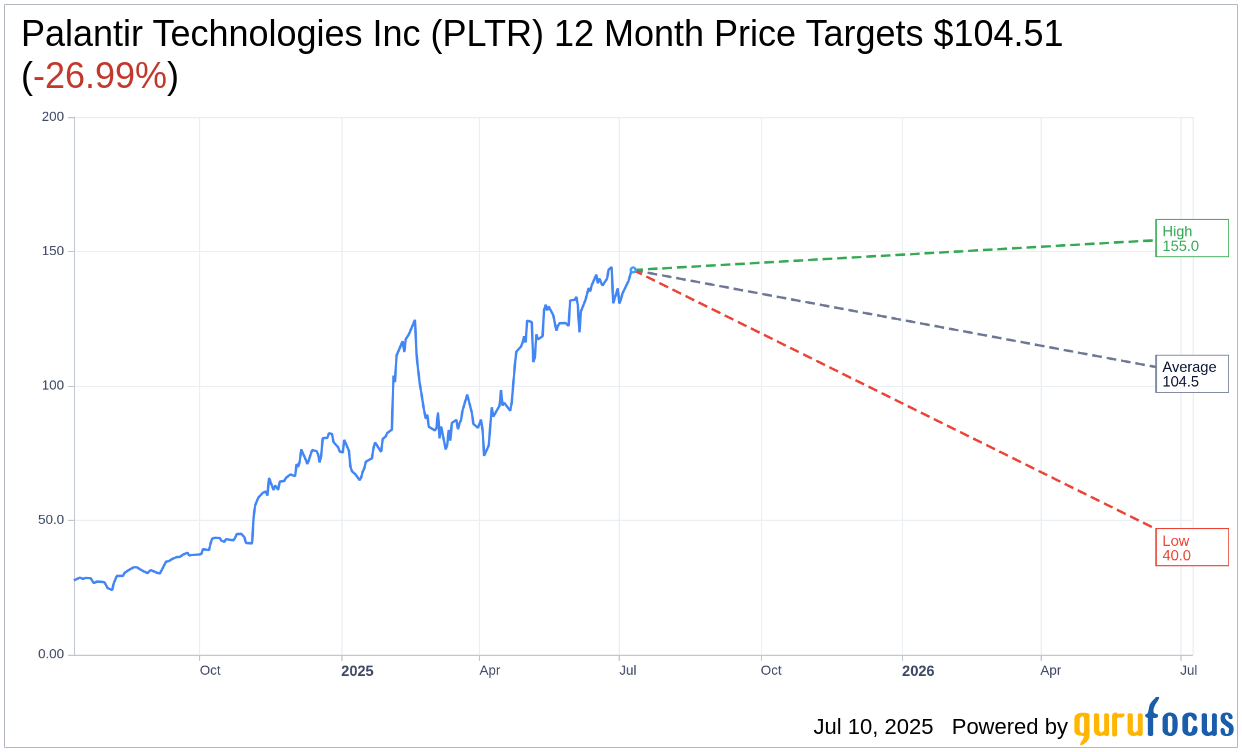

Wall Street Analysts Forecast

According to the latest insights from 20 analysts, Palantir Technologies Inc (PLTR, Financial) carries an average price target of $104.51 over the next year. Projections vary, with a high of $155.00 and a low of $40.00. These figures suggest an average downside of 26.99% from the recent trading price of $143.13. Investors seeking more granular data can explore our detailed forecasts on the Palantir Technologies Inc (PLTR) Forecast page.

An examination of brokerage sentiments reveals that, based on consensus from 24 firms, the average recommendation for Palantir Technologies stands at 2.9. This aligns with a "Hold" rating on a scale where 1 represents Strong Buy and 5 signifies Sell.

Intrinsic Value Evaluation: GF Value

GuruFocus's proprietary metrics place an estimated GF Value of Palantir Technologies at $31.92 over the next year. This suggests a significant downside of 77.7% from its current market price of $143.13. The GF Value is a critical measure, reflecting the stock's fair trading price by considering historical trading multiples, past business growth, and future business performance forecasts. For a comprehensive overview, visit the Palantir Technologies Inc (PLTR, Financial) Summary page.