GameSquare Holdings (GAME, Financial) has strategically invested $5 million in Ethereum, acquiring roughly 1,818.84 ETH at an average rate of $2,749 per token. This acquisition marks the initial phase of the company’s ambitious $100 million Ethereum treasury management strategy designed to establish a distinctive approach in their crypto treasury operations.

Additionally, GameSquare has successfully concluded its recent public offering, managed by Lucid Capital Markets. Lucid has fully exercised its option to purchase an extra 1,263,157 shares at the public offering price, excluding underwriting discounts and commissions. This move has boosted the total gross proceeds from the offering to about $9.2 million, which includes $1.2 million from the over-allotment, before deducting expenses related to the offering.

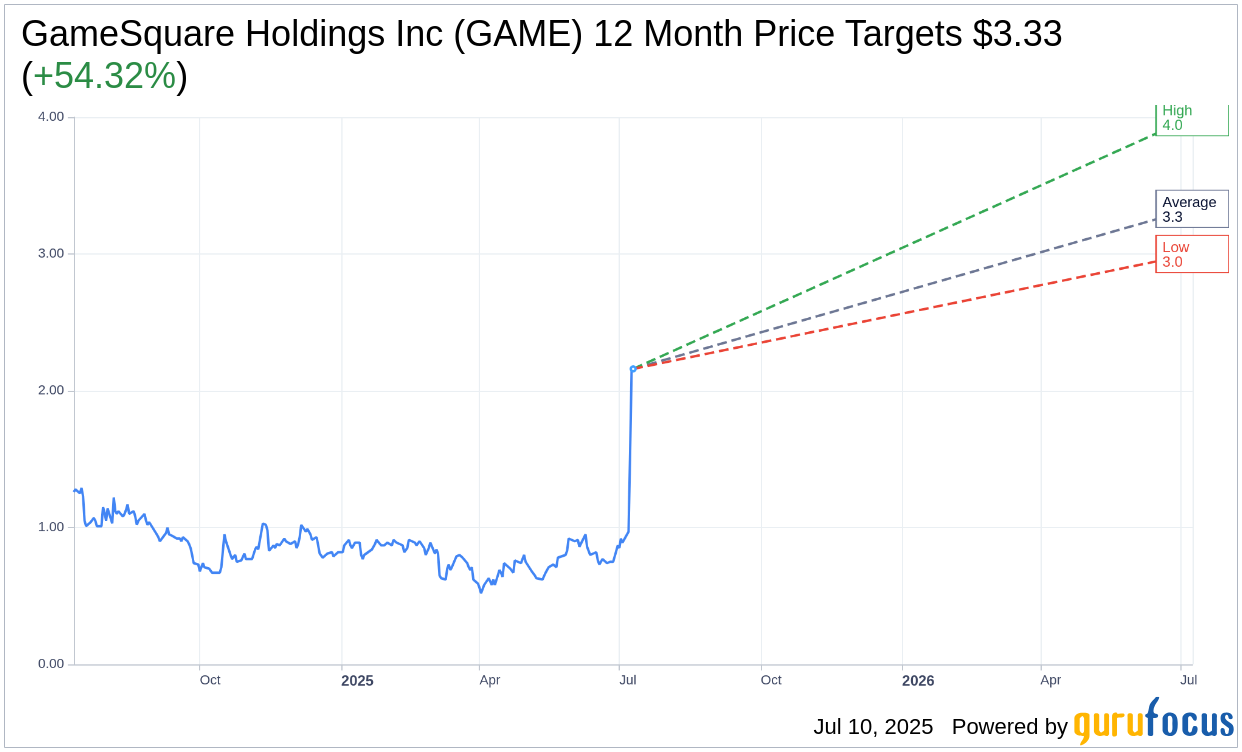

Wall Street Analysts Forecast

Based on the one-year price targets offered by 3 analysts, the average target price for GameSquare Holdings Inc (GAME, Financial) is $3.33 with a high estimate of $4.00 and a low estimate of $3.00. The average target implies an upside of 54.32% from the current price of $2.16. More detailed estimate data can be found on the GameSquare Holdings Inc (GAME) Forecast page.

Based on the consensus recommendation from 2 brokerage firms, GameSquare Holdings Inc's (GAME, Financial) average brokerage recommendation is currently 2.0, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for GameSquare Holdings Inc (GAME, Financial) in one year is $0.83, suggesting a downside of 61.57% from the current price of $2.16. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the GameSquare Holdings Inc (GAME) Summary page.