Sterling Infrastructure, identified by the ticker STRL, has expanded its Board of Directors by appointing two new members, B. Andrew Rose and David Schulz. The appointments will take effect on July 10, 2025. Rose has been selected to join both the Compensation and Talent Development Committee and the Corporate Governance and Nominating Committee. Meanwhile, Schulz will contribute his expertise to the Compensation and Talent Development Committee as well as the Audit Committee. These strategic appointments aim to strengthen Sterling Infrastructure's leadership and governance.

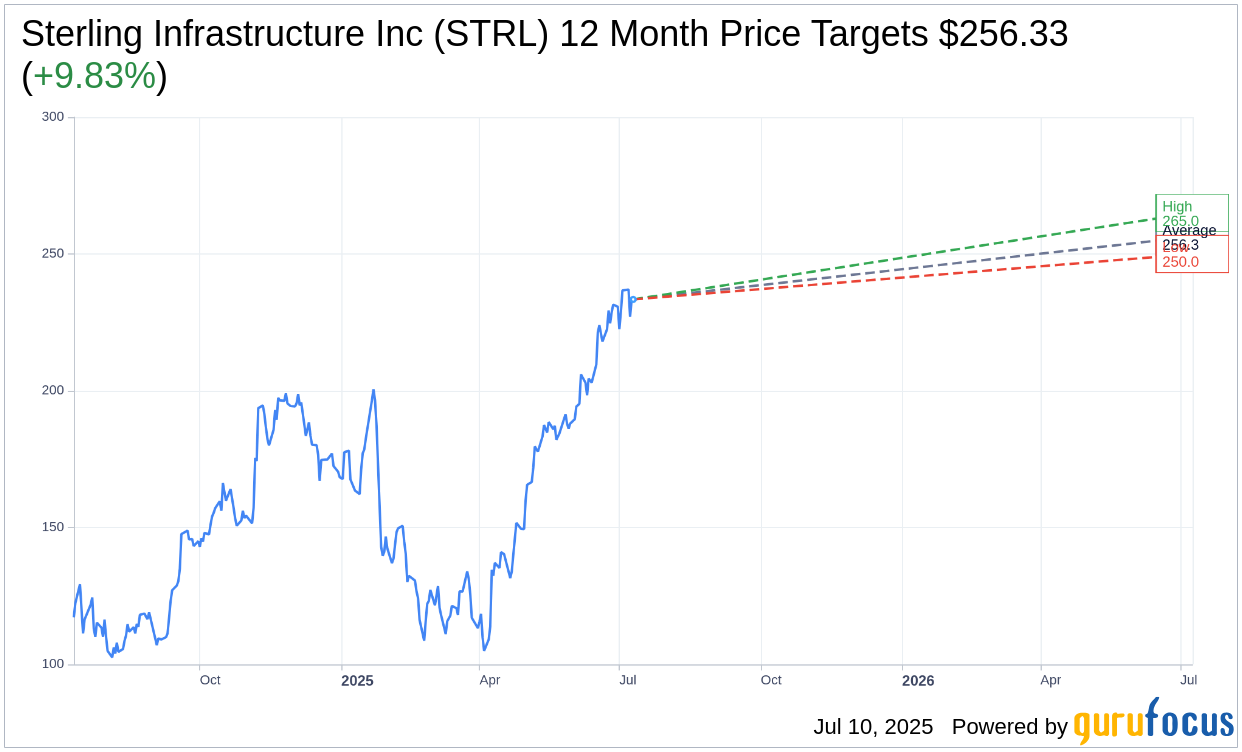

Wall Street Analysts Forecast

Based on the one-year price targets offered by 3 analysts, the average target price for Sterling Infrastructure Inc (STRL, Financial) is $256.33 with a high estimate of $265.00 and a low estimate of $250.00. The average target implies an upside of 9.83% from the current price of $233.39. More detailed estimate data can be found on the Sterling Infrastructure Inc (STRL) Forecast page.

Based on the consensus recommendation from 3 brokerage firms, Sterling Infrastructure Inc's (STRL, Financial) average brokerage recommendation is currently 1.3, indicating "Buy" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Sterling Infrastructure Inc (STRL, Financial) in one year is $90.61, suggesting a downside of 61.18% from the current price of $233.39. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Sterling Infrastructure Inc (STRL) Summary page.

STRL Key Business Developments

Release Date: May 06, 2025

- Adjusted Earnings Per Share (EPS): Increased by 29% to $1.63.

- Adjusted EBITDA: $80 million, a 31% increase.

- Revenue: Grew 7% to $430.9 million on a pro forma basis.

- Gross Profit Margin: Expanded by more than 400 basis points to 22%.

- Operating Cash Flow: Strong at $85 million.

- Backlog: Totaled $2.1 billion, a 17% year-over-year increase on a pro forma basis.

- E-Infrastructure Solutions Revenue Growth: 18% increase.

- Transportation Solutions Revenue Growth: 9% increase on a pro forma basis.

- Building Solutions Revenue Decline: 14% decrease.

- Net Income: Adjusted net income of $50.2 million.

- Cash Flow from Operating Activities: $84.9 million, up from $49.6 million in the prior year.

- Cash and Debt Position: $638.6 million in cash and $310 million in debt, resulting in a net cash position of $328.6 million.

- 2025 Revenue Guidance: $2.05 billion to $2.15 billion.

- 2025 Adjusted EPS Guidance: $8.40 to $8.90.

- 2025 Adjusted EBITDA Guidance: $410 million to $432 million.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Sterling Infrastructure Inc (STRL, Financial) reported a 29% increase in adjusted earnings per share to $1.63 and a 31% rise in adjusted EBITDA to $80 million for the first quarter.

- Revenue grew by 7% on a pro forma basis, with significant contributions from the E-Infrastructure Solutions segment, which saw an 18% increase, and Transportation Solutions, which grew by 9%.

- The company's gross profit margins expanded by over 400 basis points to reach 22%, indicating improved operational efficiency.

- Sterling Infrastructure Inc (STRL) closed the acquisition of Drake Concrete, enhancing its geographic footprint in the Dallas-Fort Worth area and expanding its customer base.

- The company's backlog increased by 17% year-over-year to $2.1 billion, with a book-to-burn ratio above 2 times, providing strong visibility into future revenue streams.

Negative Points

- Building Solutions segment experienced a 14% decline in revenue and an 18% drop in adjusted operating income due to softness in the housing market and severe weather conditions.

- General and administrative expenses increased by $7.3 million, partly due to one-time separation expenses and performance-based compensation.

- The residential business faced a 19% revenue decline, impacted by affordability challenges for potential home buyers.

- The company is exposed to potential risks from tariffs and material cost fluctuations, although measures are in place to mitigate these impacts.

- The market for residential construction remains soft, with potential headwinds expected to continue affecting the segment's performance.