On July 10, 2025, Columbia Banking System (COLB, Financial) experienced a notable change in its stock rating and price target by the financial experts at Wells Fargo. The analyst Timur Braziler made a strategic shift in the stock's outlook, altering its status from an "Overweight" rating to an "Equal-Weight" rating.

Accompanying this rating adjustment, Wells Fargo also revised its price target for Columbia Banking System (COLB, Financial). The new price target has been set at USD 27.00, down from the previous target of USD 29.00. This adjustment represents a 6.90% decrease in the projected stock value.

Columbia Banking System (COLB, Financial) is a key player on the NASDAQ exchange, and this recent update from Wells Fargo is a crucial data point for investors and market analysts, reflecting changing expectations and valuations within the banking sector.

Wall Street Analysts Forecast

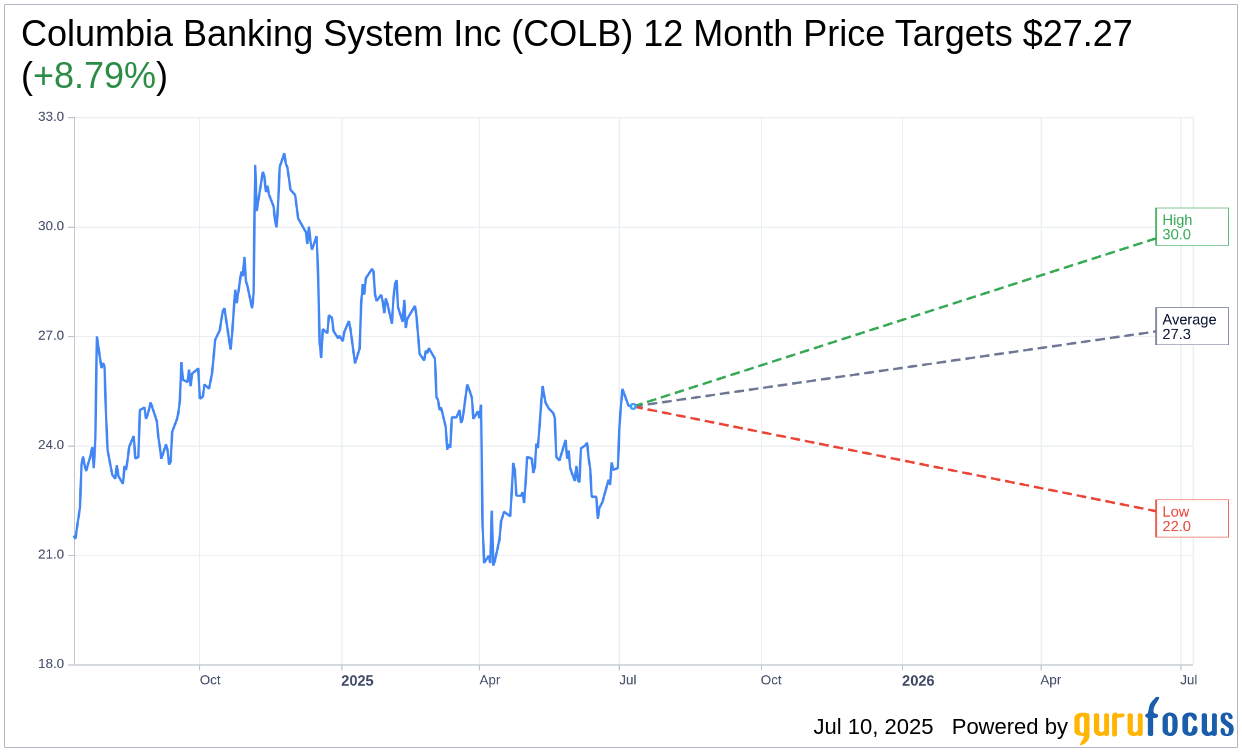

Based on the one-year price targets offered by 11 analysts, the average target price for Columbia Banking System Inc (COLB, Financial) is $27.27 with a high estimate of $30.00 and a low estimate of $22.00. The average target implies an upside of 8.79% from the current price of $25.07. More detailed estimate data can be found on the Columbia Banking System Inc (COLB) Forecast page.

Based on the consensus recommendation from 12 brokerage firms, Columbia Banking System Inc's (COLB, Financial) average brokerage recommendation is currently 2.8, indicating "Hold" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.