Raymond James has adjusted its price target for Triple Flag Precious Metals Corp (TFPM, Financial), moving it up to C$35 from the previous C$34. The firm continues to assign an Outperform rating to the company's shares, indicating a positive outlook on its performance. The updated price target suggests optimism about Triple Flag's future prospects and performance in the market.

Wall Street Analysts Forecast

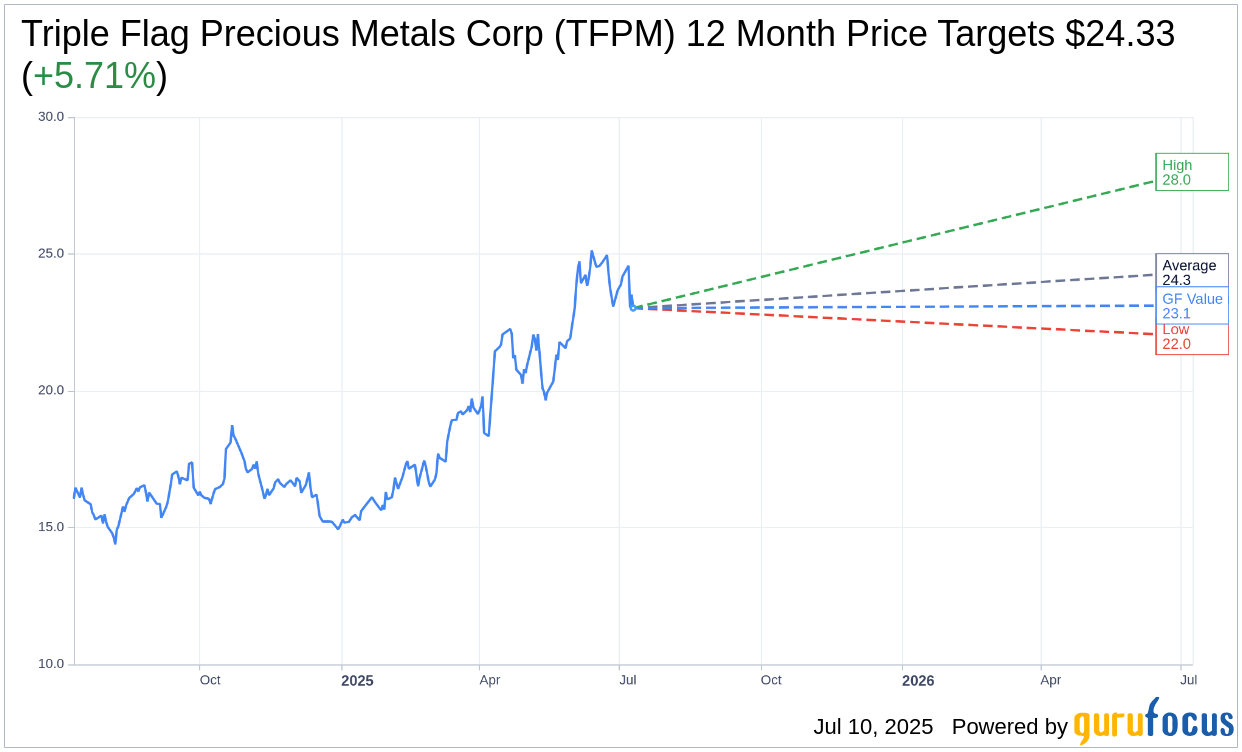

Based on the one-year price targets offered by 3 analysts, the average target price for Triple Flag Precious Metals Corp (TFPM, Financial) is $24.33 with a high estimate of $28.00 and a low estimate of $22.00. The average target implies an upside of 5.71% from the current price of $23.02. More detailed estimate data can be found on the Triple Flag Precious Metals Corp (TFPM) Forecast page.

Based on the consensus recommendation from 3 brokerage firms, Triple Flag Precious Metals Corp's (TFPM, Financial) average brokerage recommendation is currently 1.7, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Triple Flag Precious Metals Corp (TFPM, Financial) in one year is $23.12, suggesting a upside of 0.43% from the current price of $23.02. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Triple Flag Precious Metals Corp (TFPM) Summary page.

TFPM Key Business Developments

Release Date: May 07, 2025

- GEO Sales: Nearly 29,000 GEOs sold in Q1 2025.

- EBITDA: Record EBITDA of USD 71 million in Q1 2025.

- Operating Cash Flow: Record operating cash flow of USD 66 million in Q1 2025.

- Operating Cash Flow Per Share: Increased by 74% year over year.

- Dividend: Maintained at $0.21 on an annualized basis.

- Share Buybacks: Approximately 490,000 shares repurchased at CAD 23.55 per share.

- Debt: Exited Q1 2025 with zero debt.

- Credit Facility: USD 1 billion available under the credit facility.

- Revenue Composition: 100% derived from precious metals, with roughly three-quarters from gold.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Triple Flag Precious Metals Corp (TFPM, Financial) achieved record financial results with nearly 29,000 GEOs sold, resulting in record EBITDA of USD 71 million and operating cash flow of USD 66 million in Q1 2025.

- The company is on track to meet its 2025 GEO guidance of 105,000 to 115,000, demonstrating strong performance in a rising gold and silver price environment.

- TFPM announced a strategic acquisition of a 1% NSR royalty on the expanded Silicon Gold project in Nevada, a top-tier asset with significant exploration potential.

- The company maintained a strong pace of acquisitions, including the Tian acquisition of 5% silver and gold streams on the Arcata and Azuca mines in Peru, expected to deliver robust returns.

- TFPM has a debt-free balance sheet with robust operating cash flows and significant liquidity available under its credit facility, providing capital for future growth opportunities.

Negative Points

- The depletion of higher-grade open pit ore at the North Parks asset may impact future production levels, as the company transitions to processing stockpiled ore.

- The company is involved in a legal action to enforce payment for 650 ounces of gold owed by Stepy Gold, which could pose a risk to cash flow if not resolved favorably.

- While the company has been active in share buybacks, there is no stated policy, which may create uncertainty for shareholders regarding future buyback activities.

- The feasibility study for the Presco project is still under review, and the company requires it to meet certain conditions before proceeding, which could delay potential benefits.

- TFPM's reliance on precious metals, particularly gold, means its financial performance is heavily influenced by fluctuations in metal prices, which can be volatile.