- Vertiv Holdings experiences an 8% stock drop after AWS unveils a new data center cooling system.

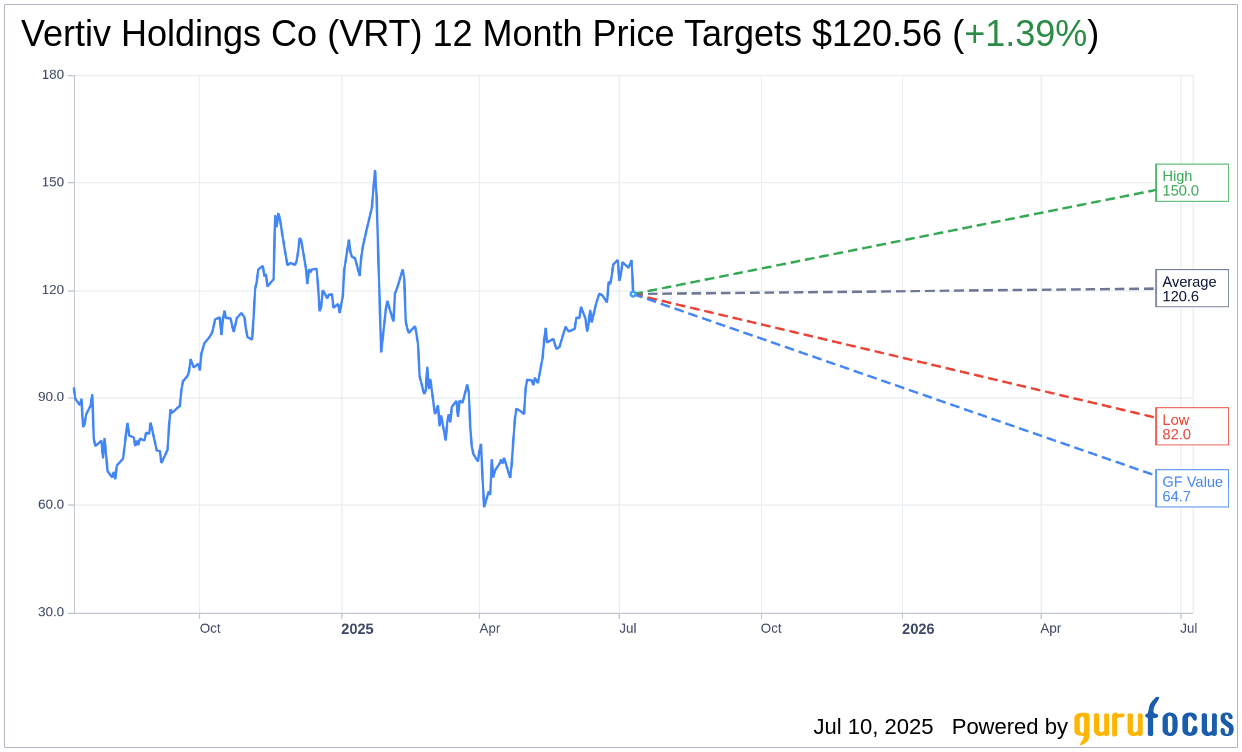

- Analysts project a slight upside for VRT with an average price target of $120.56.

- Despite a current "Outperform" rating, GF Value suggests a potential downside for VRT.

Vertiv Holdings (NYSE: VRT) recently witnessed an 8% dip in its stock price, sparked by Amazon Web Services’ (AWS) announcement of an innovative in-house data center cooling system. This development is specifically designed for Nvidia-powered servers and signifies a pivotal competitive movement within the data center cooling sector, a market where Vertiv is actively engaged.

Wall Street Analysts' Perspective

According to the insights from 20 financial analysts, the average target price set for Vertiv Holdings Co (VRT, Financial) over the coming year stands at $120.56. This target encompasses a high estimate of $150.00 and a low estimate of $82.00. Presently, this projection suggests a modest potential upside of 1.39% from the current price of $118.91. For an in-depth examination of these estimates, visit the Vertiv Holdings Co (VRT) Forecast page.

Analyst Recommendations

The consensus recommendation from 25 brokerage firms positions Vertiv Holdings Co (VRT, Financial) with an average brokerage recommendation of 1.9. This rating translates to an "Outperform" status. The scale utilized ranges from 1, indicating a Strong Buy, to 5, representing a Sell.

GF Value and Potential Downside

According to GuruFocus' proprietary estimates, the anticipated GF Value for Vertiv Holdings Co (VRT, Financial) in the span of one year is $64.67. This figure implies a potential downside of 45.62% from the current trading price of $118.91. The GF Value is an estimation of the fair market value of a stock, derived from historical trading multiples, past business growth trajectories, and future performance projections. For more comprehensive data, please refer to the Vertiv Holdings Co (VRT) Summary page.