Shares of Modine (MOD, Financial) have experienced a sharp decrease, dropping 8.3% to a price of $90.50. This decline translates to a reduction of $8.18 per share.

Wall Street Analysts Forecast

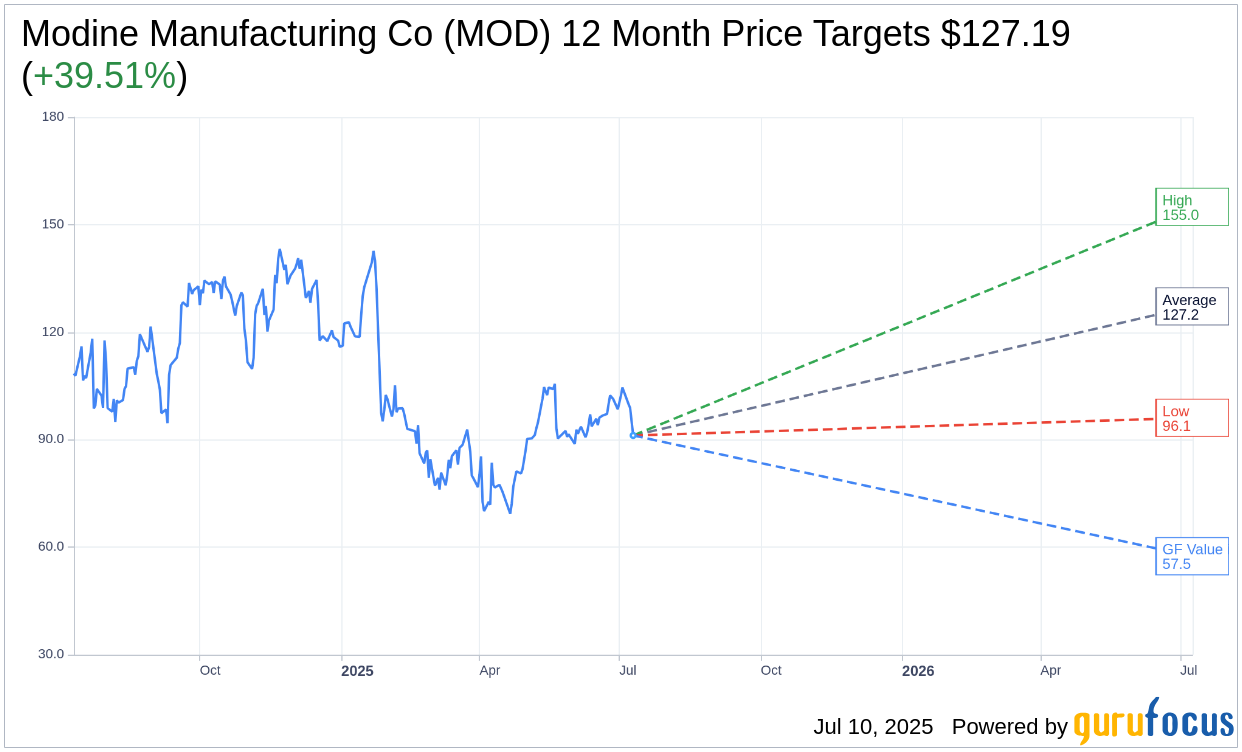

Based on the one-year price targets offered by 6 analysts, the average target price for Modine Manufacturing Co (MOD, Financial) is $127.19 with a high estimate of $155.00 and a low estimate of $96.11. The average target implies an upside of 39.51% from the current price of $91.17. More detailed estimate data can be found on the Modine Manufacturing Co (MOD) Forecast page.

Based on the consensus recommendation from 7 brokerage firms, Modine Manufacturing Co's (MOD, Financial) average brokerage recommendation is currently 1.9, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Modine Manufacturing Co (MOD, Financial) in one year is $57.46, suggesting a downside of 36.97% from the current price of $91.165. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Modine Manufacturing Co (MOD) Summary page.

MOD Key Business Developments

Release Date: May 21, 2025

- Revenue Growth: 7% increase in fourth quarter sales.

- Adjusted EBITDA: Up 32% or $25 million in Q4, with a margin of 16.1%.

- Climate Solutions Revenue: 30% increase for the fiscal year, with a 45% increase in adjusted EBITDA.

- Data Center Sales: Up 119% to $644 million, with significant growth in North America.

- Performance Technologies EBITDA Margin: 15% in Q4, 13.5% for the fiscal year, a 200 basis point improvement.

- Gross Margin: Improved by 330 basis points to 25.7% in Q4.

- Adjusted Earnings Per Share: $1.12, 45% higher than the prior year.

- Free Cash Flow: $27 million in Q4, $129 million for the fiscal year.

- Net Debt: Reduced by $92 million year-over-year to $279 million.

- Stock Buyback Program: $100 million announced, with $18 million completed.

- Fiscal 2026 Revenue Outlook: Total company sales growth expected between 2% to 10%.

- Fiscal 2026 Adjusted EBITDA Outlook: Expected to be between $420 million to $450 million.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Modine Manufacturing Co (MOD, Financial) reported its highest sales and profitability in history for the third consecutive year.

- The Climate Solutions segment achieved a 30% increase in revenues and a 45% increase in adjusted EBITDA, with a 220 basis point improvement in adjusted EBITDA margins to 21%.

- Data center sales grew by 119% to $644 million, with significant contributions from organic growth in North America.

- The company is expanding production capacity in North America to meet strong demand, particularly for chillers, and is launching a new modular data center cooling solution.

- Modine Manufacturing Co (MOD) achieved a 32% increase in adjusted EBITDA for the fourth quarter, marking the 13th consecutive quarter of year-over-year margin improvement.

Negative Points

- Performance Technologies segment faced challenging market conditions, with vehicular markets in an extended downturn and delays in electric vehicle program launches.

- The company is experiencing uncertainty in market recovery, particularly in the Performance Technologies segment, due to global trade concerns and tariffs.

- Foreign exchange rates negatively impacted sales by nearly $8 million in the fourth quarter.

- There is a cautious outlook for the coil products business, with expectations of flat to slightly declining sales.

- The company anticipates lower sales growth in the Performance Technologies segment, projecting a decline of 2% to 12% for fiscal '26.