Key Highlights:

- Byrna Technologies (BYRN, Financial) has announced a record revenue of $28.5 million in Q2 2025.

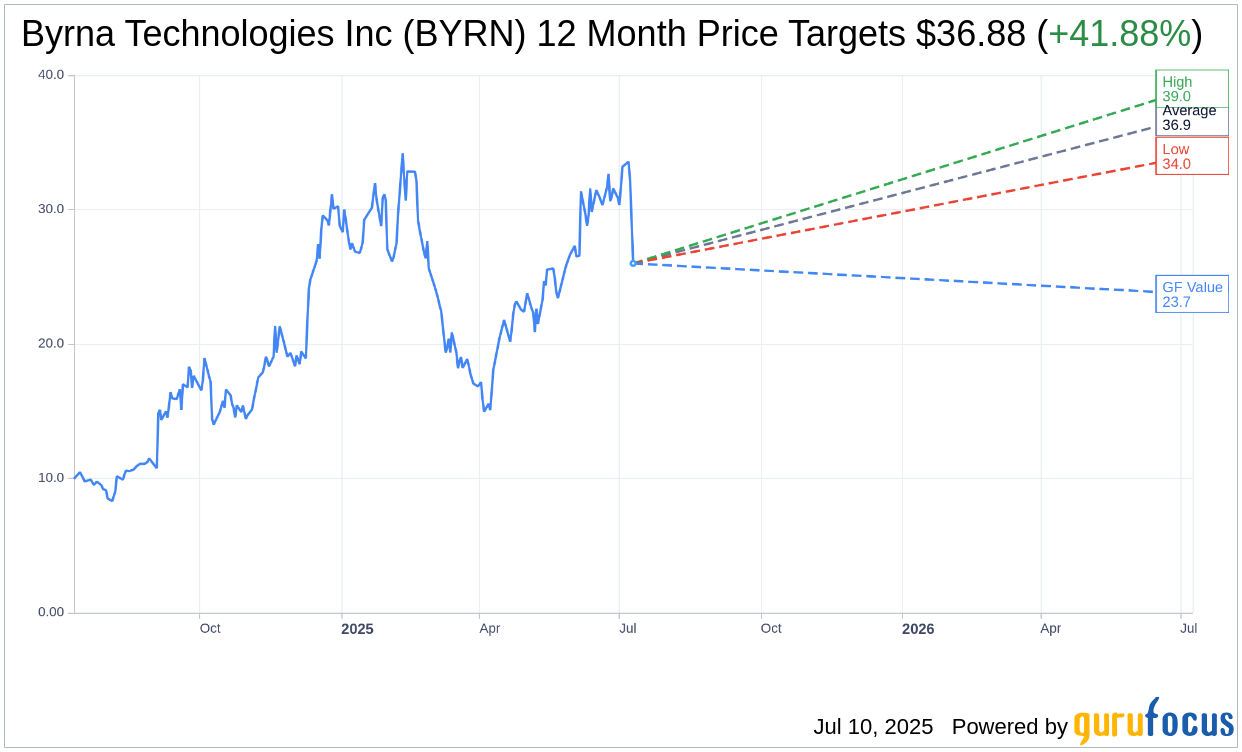

- Analysts predict a potential 41.88% stock price increase based on the current price.

- The company is labeled as "Outperform" with ongoing expansion plans.

Byrna Technologies Inc. (BYRN) is making headlines with its stunning Q2 2025 financial performance. Let's delve deeper into the details and analyze what these results could mean for investors.

Record-Setting Financial Performance

The second quarter of 2025 has proven to be a milestone for Byrna Technologies, as the company reported an impressive revenue of $28.5 million. This figure marks a significant 41% increase compared to the previous year, propelled by the booming success of their Compact Launcher. With plans to expand product availability to 140 stores by the end of the year, Byrna Technologies is capturing notable retail interest, potentially supporting future growth trajectories.

What Do Wall Street Analysts Predict?

Wall Street analysts have provided their insights, suggesting a promising outlook for Byrna Technologies. According to the one-year price targets from 4 analysts, the stock's average target price is projected to reach $36.88, with expectations stretching from a low of $34.00 to a high of $39.00. This forecast indicates a substantial upside potential of 41.88% from the current stock price of $25.99. Further, in-depth analysis is available on the Byrna Technologies Inc (BYRN, Financial) Forecast page.

Brokerage Recommendation and GF Value

The consensus recommendation from 4 brokerage firms classifies Byrna Technologies as an "Outperform" investment, boasting an average brokerage rating of 1.8. This rating is derived from a scale where 1 indicates a Strong Buy and 5 signifies a Sell, highlighting the positive sentiment surrounding the stock.

In contrast, GuruFocus estimates suggest a slight downside risk with a projected GF Value of $23.72 for Byrna Technologies in the next year. This estimate places the potential downside at 8.73% from the existing stock price of $25.99. The GF Value calculation incorporates historical trading multiples, past business growth, and future business performance estimates. For a comprehensive analysis, visit the Byrna Technologies Inc (BYRN, Financial) Summary page.

In summary, while Byrna Technologies appears poised for growth with its robust financial performance and strategic market positioning, investors should consider both the optimistic analyst forecasts and the GF Value estimates when making investment decisions.