Option traders are showing a cautious outlook on CrowdStrike Holdings (CRWD, Financial), with the stock experiencing a $23 drop, trading around $490.50. Trading activity in options is significantly higher than usual, with 58,000 contracts exchanged. Call options are outpacing puts, resulting in a put/call ratio of 0.64, which is below the average level of 0.74.

The stock's implied volatility (IV30) has increased by 1.2 points, reaching 36.87, which is still within the lower quartile of its range over the past year. This level of volatility corresponds to an anticipated daily price movement of $11.39. The put-call skew has intensified, reflecting greater interest in securing downside protection. This shift in sentiment follows a recent downgrade of the stock's rating to Neutral by Piper Sandler.

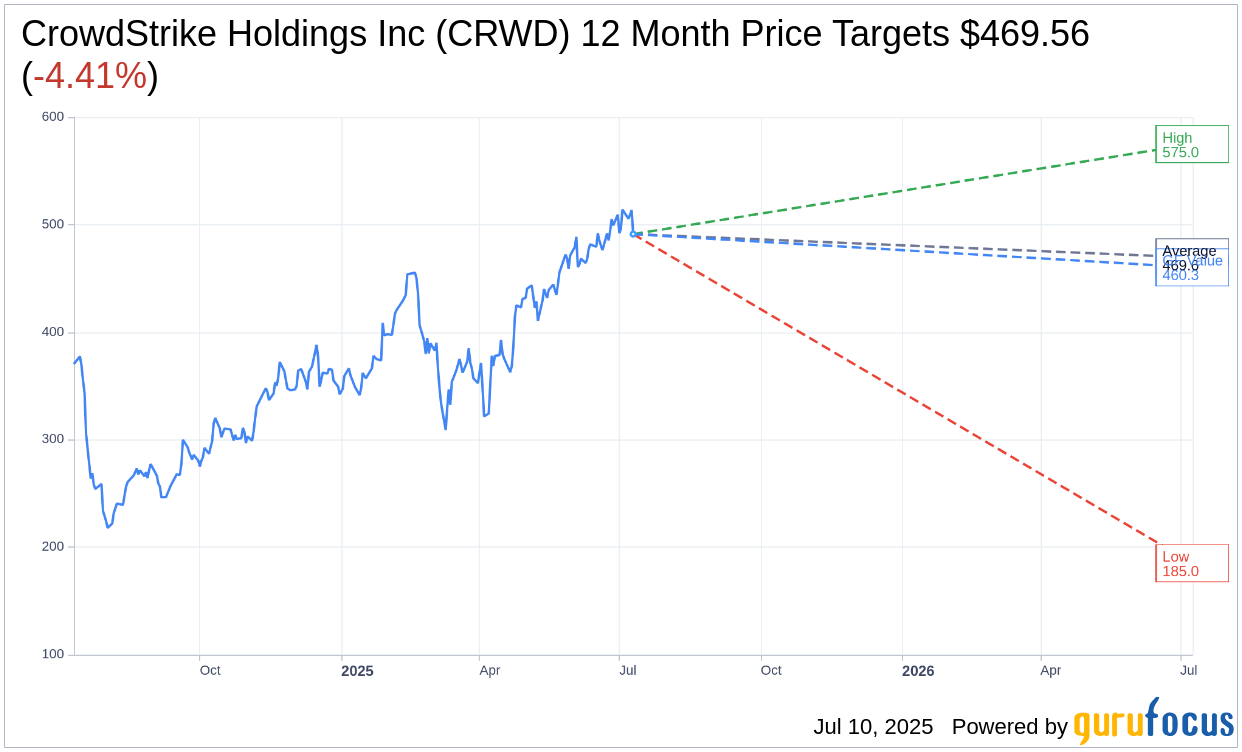

Wall Street Analysts Forecast

Based on the one-year price targets offered by 47 analysts, the average target price for CrowdStrike Holdings Inc (CRWD, Financial) is $469.56 with a high estimate of $575.00 and a low estimate of $185.00. The average target implies an downside of 4.41% from the current price of $491.20. More detailed estimate data can be found on the CrowdStrike Holdings Inc (CRWD) Forecast page.

Based on the consensus recommendation from 54 brokerage firms, CrowdStrike Holdings Inc's (CRWD, Financial) average brokerage recommendation is currently 2.2, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for CrowdStrike Holdings Inc (CRWD, Financial) in one year is $460.26, suggesting a downside of 6.3% from the current price of $491.2. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the CrowdStrike Holdings Inc (CRWD) Summary page.

CRWD Key Business Developments

Release Date: June 03, 2025

- Net New ARR: $194 million, surpassing expectations.

- Ending ARR: $4.44 billion, up 22% year-over-year.

- Subscription Gross Margin: 80%.

- Gross Retention Rate: 97%.

- Free Cash Flow: $279.4 million, 25% of revenue.

- Total Revenue: $1.10 billion, up 20% year-over-year.

- Subscription Revenue: $1.05 billion, up 20% year-over-year.

- Professional Service Revenue: $52.7 million.

- Total Gross Margin: 78%.

- Non-GAAP Operating Income: $201.1 million, 18% operating margin.

- Non-GAAP Net Income: $184.7 million, $0.73 per diluted share.

- Cash and Cash Equivalents: $4.61 billion.

- Q2 Revenue Guidance: $1,144.7 million to $1,151.6 million, 19% growth.

- FY26 Revenue Guidance: $4,743.5 million to $4,805.5 million, 20% to 22% growth.

- FY26 Non-GAAP Net Income Guidance: $878.7 million to $909.7 million.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- CrowdStrike Holdings Inc (CRWD, Financial) reported a strong start to fiscal year 2026 with net new ARR of $194 million, surpassing expectations.

- The company achieved a subscription gross margin of 80%, showcasing the efficiency of its AI platform.

- CrowdStrike Holdings Inc (CRWD) maintained a high gross retention rate of 97%, indicating strong customer loyalty.

- The Falcon Flex model has been a significant success, with $774 million added in total Falcon Flex account value, growing 31% sequentially.

- The company announced a $1 billion share repurchase authorization, reflecting confidence in its long-term strategy and growth prospects.

Negative Points

- CrowdStrike Holdings Inc (CRWD) reported a GAAP net loss of $110.2 million, which included $39.7 million of expenses related to outages.

- There is a temporary divergence between ARR and subscription revenue due to the CCP program, impacting revenue recognition.

- The company expects a near-term impact on subscription revenue due to CCP-related programs, with an estimated $10 million to $15 million impact per quarter.

- CrowdStrike Holdings Inc (CRWD) faces ongoing challenges in educating partners and sales force on the new go-to-market motion around demand planning.

- The company incurred $26 million in cash charges related to a strategic realignment plan, impacting Q2 financials.