On July 10, 2025, Levi Strauss & Co (LEVI, Financial) released its 8-K filing detailing the financial results for the second quarter of 2025. The company, known for its iconic denim and apparel products, reported a significant increase in net revenues and earnings per share, surpassing analyst estimates.

Company Overview

Levi Strauss & Co is a global leader in the apparel industry, designing, marketing, and selling a wide range of products including jeans, casual wear, and accessories under brands such as Levi's, Dockers, and Denizen. The company operates through three regional segments: the Americas, Europe, and Asia, with the Americas being the primary revenue driver.

Performance and Challenges

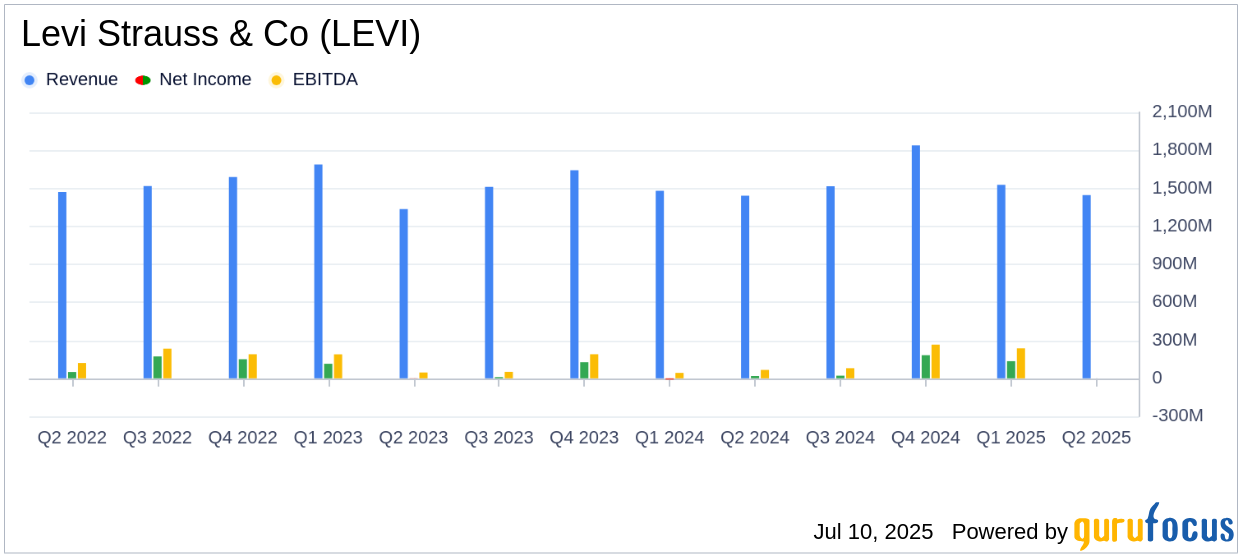

Levi Strauss & Co reported net revenues of $1.4 billion for Q2 2025, a 6% increase on a reported basis and a 9% increase on an organic basis compared to Q2 2024. This growth was driven by a 9% increase in the Levi’s brand globally on an organic basis. The company's performance is crucial as it reflects the effectiveness of its strategic initiatives and its ability to navigate challenges such as higher tariffs.

Financial Achievements

The company achieved a gross margin of 62.6%, up 140 basis points from the previous year, marking a record high. The operating margin improved to 7.5%, with an adjusted EBIT margin of 8.3%, up 190 basis points year-over-year. These achievements highlight Levi Strauss & Co's ability to enhance profitability through cost management and strategic focus on its core brand and direct-to-consumer (DTC) strategy.

Income Statement Highlights

The company reported a net income from continuing operations of $80 million, a substantial increase from $17 million in Q2 2024. Adjusted net income rose to $89 million from $65 million in the previous year. Diluted earnings per share from continuing operations were $0.20, exceeding the analyst estimate of $0.14. Adjusted diluted EPS was $0.22, up 37% year-over-year.

Balance Sheet and Cash Flow

As of June 1, 2025, Levi Strauss & Co had cash and cash equivalents of $654 million, with total liquidity of approximately $1.5 billion. Total inventories increased by 15%, reflecting strategic inventory management to support growth. The company returned approximately $51 million to shareholders through dividends, an 8% increase over the prior year.

Analysis and Outlook

Levi Strauss & Co's strong financial performance in Q2 2025 underscores its successful execution of strategic initiatives, particularly its focus on the Levi’s brand and DTC strategy. The company's ability to expand margins and increase shareholder returns positions it well for future growth. Despite challenges such as tariffs, Levi Strauss & Co has raised its full-year revenue and EPS outlook, indicating confidence in its ongoing momentum.

“We delivered another strong quarter, reflecting broad-based strength across the board—clear evidence that our strategic agenda is gaining traction,” said Michelle Gass, President and CEO of Levi Strauss & Co.

“The continued inflection of our financial performance is a direct result of our laser focus on the core Levi’s® brand and our DTC-first strategy,” said Harmit Singh, Chief Financial and Growth Officer of Levi Strauss & Co.

Levi Strauss & Co's Q2 2025 results demonstrate its resilience and strategic prowess in the competitive apparel industry, making it a company to watch for value investors seeking growth and profitability.

Explore the complete 8-K earnings release (here) from Levi Strauss & Co for further details.