Baird has started its analysis of James Hardie (JHX, Financial), assigning the stock an Outperform rating. The firm has set a price target of $32, indicating a positive outlook for the company's future performance. This rating suggests that Baird expects the stock to perform better than the overall market and peers.

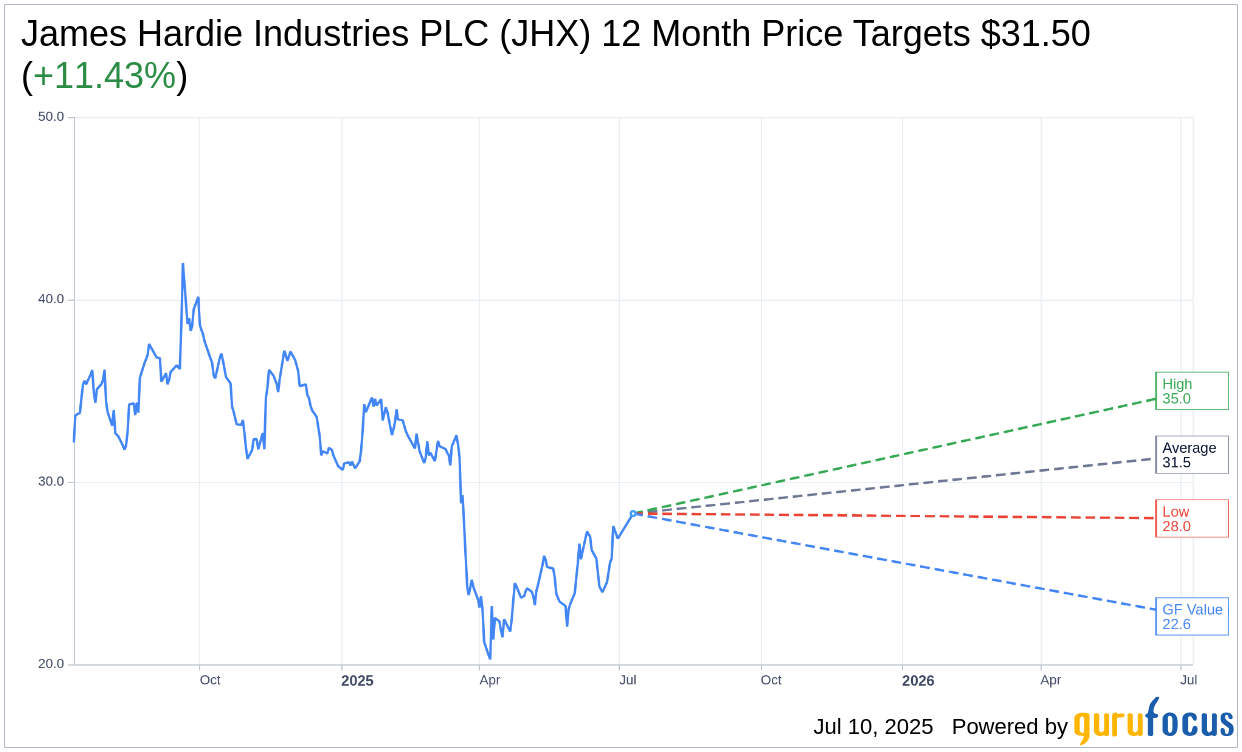

Wall Street Analysts Forecast

Based on the one-year price targets offered by 2 analysts, the average target price for James Hardie Industries PLC (JHX, Financial) is $31.50 with a high estimate of $35.00 and a low estimate of $28.00. The average target implies an upside of 11.43% from the current price of $28.27. More detailed estimate data can be found on the James Hardie Industries PLC (JHX) Forecast page.

Based on the consensus recommendation from 3 brokerage firms, James Hardie Industries PLC's (JHX, Financial) average brokerage recommendation is currently 1.3, indicating "Buy" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for James Hardie Industries PLC (JHX, Financial) in one year is $22.63, suggesting a downside of 19.95% from the current price of $28.27. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the James Hardie Industries PLC (JHX) Summary page.

JHX Key Business Developments

Release Date: May 20, 2025

- North America Sales: $2.9 billion in FY25.

- North America EBIT Margin: 29.4% in FY25.

- North America EBITDA: $1 billion, with a 35% EBITDA margin.

- Adjusted Net Income: $644 million in FY25.

- Q4 Total Net Sales: $972 million, a 3% decrease year-over-year.

- Q4 Adjusted EBITDA: $269 million, with a 27.6% margin.

- Q4 Adjusted Net Income: $156 million.

- Q4 Adjusted Diluted EPS: $0.36 per share.

- Asia Pacific Q4 Net Sales: Declined 17% in USD, 13% in AUD.

- Europe Q4 Net Sales: $135 million, a 5% increase in USD.

- FY26 Free Cash Flow Guidance: At least $500 million, up over 30% from FY25.

- FY26 Capital Expenditures: Expected to decline by nearly $100 million to approximately $325 million.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- James Hardie Industries PLC (JHX, Financial) delivered solid business and financial results in the fourth quarter, reflecting a commitment to invest and grow profitably even in challenging market conditions.

- The company achieved a North America EBIT margin of 29.4%, exceeding initial profitability commitments.

- James Hardie Industries PLC (JHX) announced a strategic combination with the AZEK Company, creating a leading growth platform in building products.

- The company has secured multiyear national hard siding and trim exclusivity agreements with several major homebuilders, enhancing its market position.

- James Hardie Industries PLC (JHX) expects to generate robust annual free cash flow of greater than $1 billion post-synergies from the AZEK merger.

Negative Points

- The North American market is expected to face a mid-single-digit decline in volumes due to macroeconomic uncertainties and a challenging demand environment.

- The company's interior products and multifamily segments experienced significant volume declines, impacting overall performance.

- James Hardie Industries PLC (JHX) faced raw material headwinds, particularly in cement and pulp, which weighed on margins.

- The Asia Pacific segment saw a 31% decrease in volume, primarily due to the closure of operations in the Philippines.

- The European market remains challenged, with a gradual path to recovery expected, particularly in Germany, the largest European market for the company.